- BlackRock pulled nearly $100M in Bitcoin and Ethereum off Coinbase Prime, hinting at major accumulation.

- Grayscale deposited $138M worth of BTC and ETH back onto the exchange, likely signaling liquidation or rebalancing.

- Data shows investors rotating capital from Grayscale’s older ETFs into BlackRock’s newer crypto funds.

Things are getting interesting again in the ETF world. BlackRock just pulled nearly $100 million worth of Bitcoin and Ethereum off Coinbase Prime, while Grayscale did the opposite — depositing over $138 million back onto the exchange. On-chain analysts are calling it what looks like a major capital rotation between the two asset managers, hinting that big money might be quietly shifting sides in the crypto ETF battle.

BlackRock Loads Up, Grayscale Cashes Out

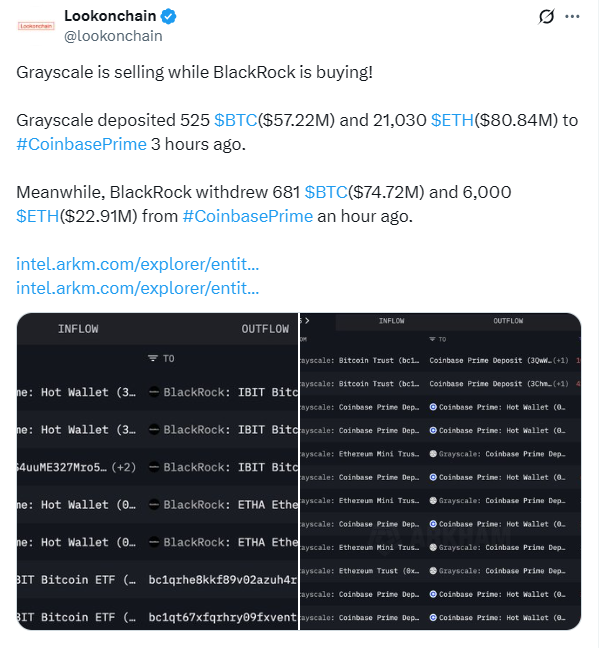

According to Lookonchain, BlackRock withdrew 681 BTC and 6,000 ETH from Coinbase Prime on Oct. 23 — worth about $74.7 million in Bitcoin and $22.9 million in Ether. Pulling assets off an exchange typically means one thing: they bought. Those coins are now likely being moved into secure custody wallets, potentially tied to their ETF reserves. Meanwhile, Grayscale moved in the opposite direction — depositing 525 BTC and 21,030 ETH (roughly $138 million total) to Coinbase Prime, suggesting they’re prepping to sell or rebalance some positions.

ETF Flows Tell the Same Story

CoinGlass data from Oct. 22 backs it up — investors appear to be rotating capital out of Grayscale’s funds and into BlackRock’s newer products. Grayscale’s GBTC saw an outflow of 522 BTC, while BlackRock’s IBIT took in about 680 BTC over the same period. For Ethereum, Grayscale’s ETHE saw around 20,000 ETH move out, and BlackRock’s ETHA absorbed almost 28,000 ETH in inflows. It’s a mirror image — one’s losing assets, the other’s gaining. That’s usually how capital flow looks when confidence starts to shift from an older product to a newer, more efficient one.

Big Picture: Market Signals and Speculation

Grayscale has offloaded over 1 million ETH from its funds since launch, including 145,000 ETH since Oct. 10, while BlackRock’s ETHA ETF has seen massive inflows since going live. The timing is interesting, too — the broader market recently faced a brutal $19 billion liquidation wave, and yet BlackRock’s buying through it. All this comes as sentiment starts to recover, especially after former President Donald Trump pardoned Binance’s CZ, who boldly claimed Bitcoin could one day surpass gold’s market cap. Whether that’s optimism or overconfidence is anyone’s guess — but one thing’s for sure: whales and institutions are positioning early.