- T. Rowe Price, managing $1.8T, filed for its first actively managed crypto ETF covering 5–15 major cryptocurrencies.

- The ETF will use a flexible, actively managed strategy to outperform traditional crypto indexes.

- The move highlights traditional finance’s deepening commitment to digital assets amid growing ETF competition.

T. Rowe Price, the 87-year-old giant managing over $1.8 trillion in assets, just made a bold move into crypto. The firm filed an S-1 with the SEC to launch its first actively managed crypto ETF — the T. Rowe Price Active Crypto ETF. It’s a major step for a traditional asset manager known for its conservative approach. The ETF aims to track a mix of 5 to 15 major cryptocurrencies like Bitcoin, Ethereum, Solana, Dogecoin, and Shiba Inu, but with an active strategy rather than a passive one.

A Hands-On Approach to Crypto Investing

Unlike spot ETFs that merely mirror an index, T. Rowe’s new product will be actively managed — meaning portfolio managers will adjust holdings based on changing market conditions. They’ll blend fundamentals, valuations, and momentum signals to decide which coins to hold and how much. This flexible approach could help them ride crypto volatility more effectively, potentially outperforming static index funds. As ETF analyst Bryan Armour put it, it’s rare to see such an active, multi-coin strategy in this space — a sign that traditional finance is still trying to find its unique angle in digital assets.

Building Digital Infrastructure for the Long Game

This isn’t T. Rowe’s first flirtation with crypto. Back in 2022, they brought on Blue Macellari, a former crypto hedge fund exec, to lead digital asset strategy. Now, with this ETF filing, it’s clear they’re building out a full infrastructure to handle crypto trading, custody, and ETF operations. Nate Geraci of NovaDius Wealth Management noted that the move signals something bigger — that crypto is no longer a niche play but an integral piece of modern finance.

ETF Boom and Regulatory Hurdles

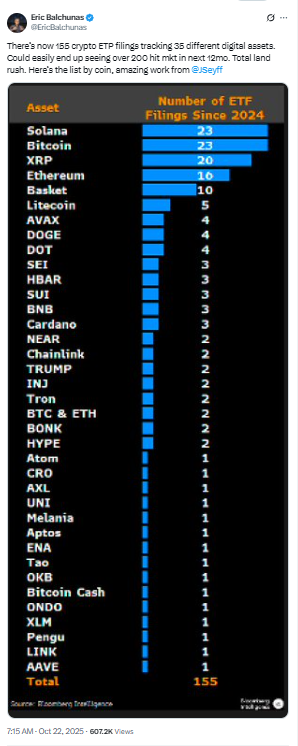

The timing of T. Rowe’s filing lands amid a flood of ETF applications — over 150 are waiting for SEC approval from heavyweights like BlackRock, VanEck, and Fidelity. The process, though, has been slow. With the U.S. government shutdown dragging on into its third week, the SEC’s capacity to review filings has been limited. Still, regulatory progress has been moving faster overall, especially after the SEC approved listing standards for commodity-based ETFs, clearing some hurdles for crypto products. For T. Rowe Price, entering now — even late — could be strategic, as it lets them learn from early entrants while crafting a distinct, active approach.