- Binance’s stablecoin-to-Bitcoin ratio hit its lowest level in two years, hinting at strong buying potential.

- Tether and Circle minted $7B in new stablecoins, with Tether reaching 500M real users worldwide.

- Citi projects the stablecoin market could grow to $1.9T by 2030, reshaping global liquidity.

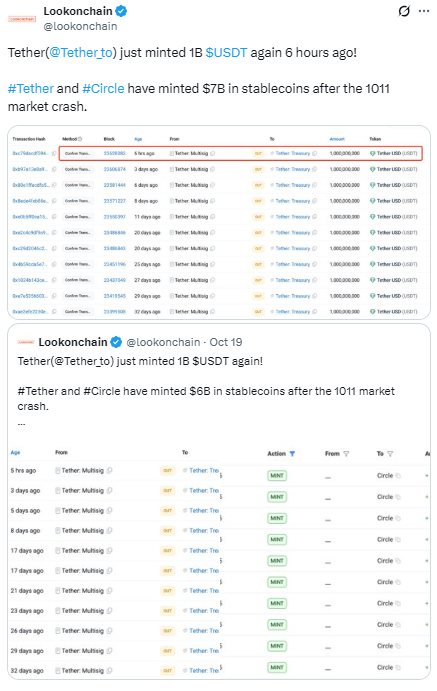

The stablecoin-to-Bitcoin ratio on Binance has dropped to its lowest level in two years, even as Tether and Circle collectively minted $7 billion worth of new tokens. It’s a strange mix — less stablecoin activity on exchanges, but way more being created — and it’s hinting at something building under the surface. According to data from Lookonchain, Bitcoin climbed past $108,000 right as this new liquidity entered the market, suggesting investors are gearing up for something bigger.

CryptoQuant’s data shows Binance’s stablecoin ratio now sits at just 0.8149, a level not seen since 2023. That means traders are holding more stablecoins relative to Bitcoin — basically waiting, watching, and ready to pounce when prices look right. Historically, when this ratio dips this low, it often precedes a wave of accumulation. We saw the same thing back in 2023 and 2024 before major rallies. If Bitcoin holds above the $108K–$110K range, this could be one of those quiet moments before everything moves fast.

Billions minted as Tether hits adoption milestone

Tether just printed another $1 billion USDT, pushing the combined total of new issuance from Tether and Circle to $7 billion since the last market pullback. It’s a sign that demand for dollar-pegged assets remains strong, especially as global markets wobble. Tether also hit an eye-popping milestone of 500 million users — and according to them, those aren’t just wallet addresses but real people. That’s roughly 6% of the global population that has used or held USDT at some point.

The growth is most visible in emerging economies like Kenya and parts of Latin America, where people are using stablecoins as shields against inflation and shaky national currencies. With Tether now commanding a market cap of $182 billion (around 58% of all stablecoins) and Circle trailing with $76 billion, it’s clear who’s dominating the digital dollar game.

Citi sees a $1.9 trillion stablecoin future

Even traditional banks are paying attention. Citi analysts recently projected that the stablecoin market could reach $1.9 trillion by 2030, representing as much as 10% of total crypto value. They compared this phase of stablecoin adoption to the rise of money market funds in the 1980s — something that reshaped liquidity without destabilizing traditional finance.

While the ratio drop looks bearish on paper, the massive minting spree and global user growth suggest the opposite: a ton of dry powder waiting for the right moment to enter the market. Whether it’s next week or next quarter, the setup feels eerily similar to those pre-rally moments that crypto veterans know all too we