- Peter Brandt believes Bitcoin could reach $250K, but says it’s a possibility, not a guaranteed outcome.

- He also warned BTC could drop to $60K, depending on broader market conditions.

- Brandt stays neutral, ready to trade either long or short based on Bitcoin’s next move.

Even as Bitcoin struggles to stay above $108K, veteran trader Peter Brandt is back with one of his boldest takes yet. He says Bitcoin could soar to $250,000 — but before you start dreaming about yachts, there’s a twist. Brandt clarified that his prediction isn’t a matter of certainty or even probability… it’s a possibility. In true Bayesian fashion, he reminded his followers that both sides of the market remain very real — meaning BTC could just as easily slide the other way, maybe even toward $60K.

A $250,000 Bitcoin — not a promise, but a possibility

In his October 22 post on X, Brandt explained that his view stems from macroeconomic trends and the shifting landscape of digital assets. He doesn’t claim to know when Bitcoin will move — only that, under the right conditions, the flagship crypto could eventually climb to a quarter of a million dollars. With Bitcoin trading around $108,300 at the time, it’s quite a leap. Still, optimism from figures like Brandt keeps sentiment from falling completely flat, especially as BTC continues to test key resistance zones.

Interestingly, Brandt’s vision aligns with one made months ago by Cardano founder Charles Hoskinson, who pointed to rising corporate interest from giants like Apple and Microsoft. That kind of mainstream attention, Hoskinson argued, could be the fuel Bitcoin needs for another historic rally.

The twist — a possible plunge to $60,000

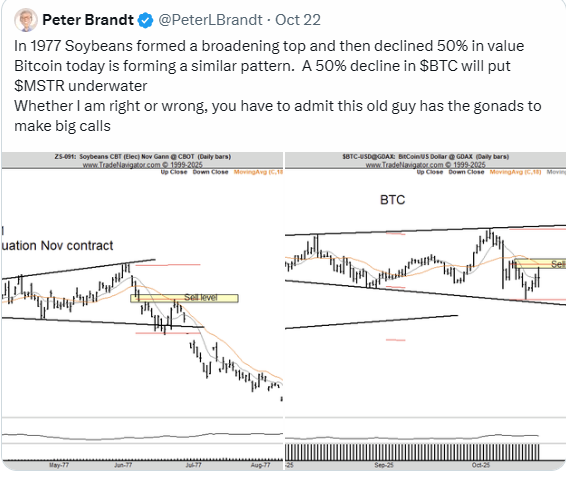

But Brandt didn’t stop there. Alongside his bullish scenario, he also mentioned a potential drop — all the way down to $60,000 — depending on how market sentiment shifts. He framed it as an asymmetrical bet: strong upside if things break right, steep downside if macro conditions worsen. True to his style, Brandt doesn’t lean on predictions alone; he trades the market as it moves. He even responded to another trader’s post about Bitcoin’s descending pattern, saying he’s ready to go long or short depending on what the charts show next.

It’s the kind of pragmatic view that’s made Brandt one of the most respected names in trading circles — bullish enough to see the long-term potential, but grounded enough to know that Bitcoin doesn’t care about anyone’s predictions.