- Bitcoin whale “BitcoinOG(1011)” adds $140M in new short positions after accurately calling the October 10–11 crash.

- Another trader, the “Trump Insider Whale,” made $1B from perfectly timed Bitcoin and Ethereum shorts, sparking insider trading rumors.

- Bitcoin hovers near $108K with weak short-term momentum, though long-term bulls like CZ still expect BTC to eventually surpass gold.

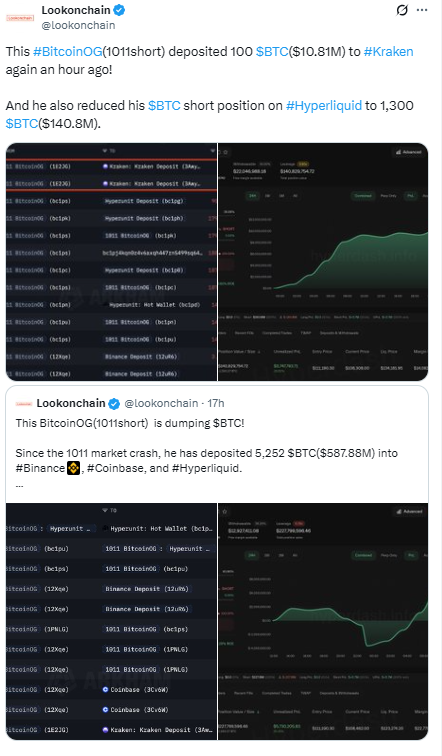

A well-known Bitcoin whale who perfectly predicted the October 10–11 crash is back at it again, placing huge short bets against BTC. The address, tagged as BitcoinOG(1011) by on-chain analysts, recently sent another 100 BTC—worth around $10.8 million—to Kraken, keeping up a staggering $140 million in open short positions on Hyperliquid. This move follows weeks of heavy exchange activity, with the whale having already moved over 5,352 BTC (roughly $600 million) to major platforms since mid-October.

The timing has caught everyone’s attention. According to Lookonchain, this whale’s short exposure was actually trimmed from $227 million earlier, suggesting a bit of profit-taking or risk adjustment. Still, the bearish tone remains. During the last market crash, their liquidation point sat near $123,000 per BTC—well above current prices—indicating they’re still comfortably in the green. Traders are now watching this address closely, wondering if another drop might be brewing.

Insider moves and the mysterious “Trump Whale”

But BitcoinOG isn’t the only one stirring the pot. Another trader, known by the nickname “Trump Insider Whale,” also made headlines after allegedly opening over $1 billion in shorts on Bitcoin and Ethereum right before the October crash that wiped out $19 billion in market positions. The timing was… let’s just say suspicious. Arkham Intelligence flagged the account, sparking speculation about insider access or privileged info behind these trades.

When traders like these act in unison—or when the crowd starts copying them—their moves can actually influence the market itself. If enough investors mimic their shorts, Bitcoin’s price could dip further just from the pressure alone. Some call it smart trading, others see manipulation. Either way, the whales’ fingerprints are all over the market right now.

Bitcoin stalls near $108K as sentiment turns cautious

At the time of writing, Bitcoin sits around $108,079, down roughly 2.16% over the past week. Trading volume remains heavy at about $94 billion in the last 24 hours, hinting at increased volatility and investor caution. BTC has struggled to push beyond recent resistance levels, and the market feels a bit uneasy—like everyone’s waiting for the next shoe to drop.

Despite all this, optimism hasn’t completely faded. Binance founder CZ, for example, remains bullish long term, saying Bitcoin will eventually surpass gold’s market cap. Even with gold rallying hard last week, many in the crypto community still see Bitcoin as the future of hard money—just caught in one of its usual growing pains.