- XRP shows signs of fading sell pressure and forming higher lows near $2.45.

- Open Interest remains stable while Funding Rates turn negative, signaling possible reversal conditions.

- A push above $2.45 with RSI over 45 could drive XRP toward the $2.7–$3 range soon.

Is XRP finally setting up for a breakout? It’s starting to look that way. The coin’s sell pressure seems to be softening, higher lows are forming, and open interest isn’t falling apart — all of which hint at a slow but steady shift in market sentiment.

Selling Pressure Loses Steam

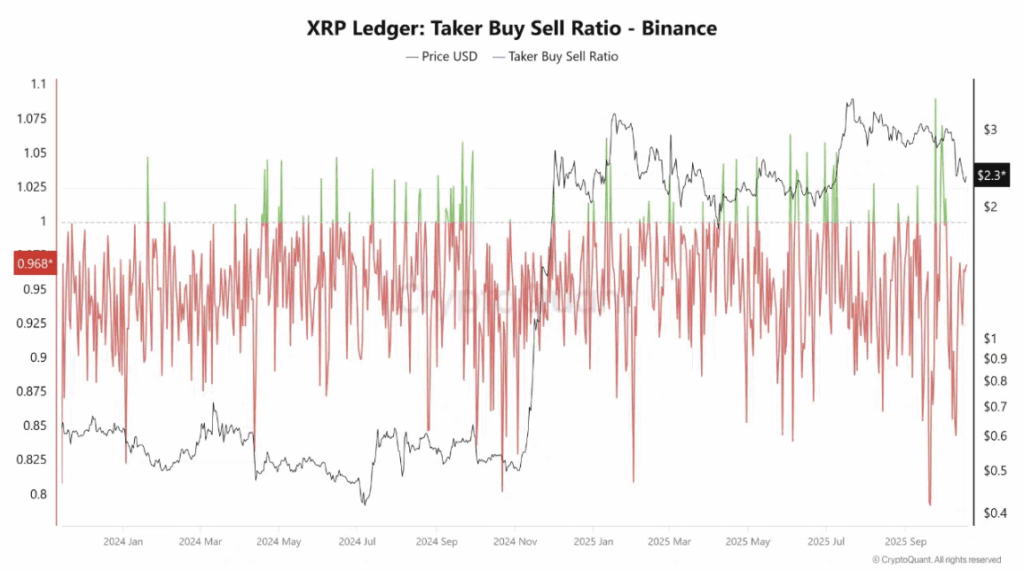

Right now, the Taker Buy/Sell Ratio sits near 0.96, which means sellers still have a slight edge. But here’s the thing — every time it dips below 0.9, it quickly rebounds. That’s a good sign. It shows that the selling pressure, while still there, is losing its grip little by little.

In simple terms, the bears are getting tired. The push down isn’t as strong anymore, and each drop seems to get bought up faster than before. It’s not explosive bullish action yet, but it’s a subtle shift that often happens right before a breakout move starts brewing.

Open Interest Holds, Funding Turns Negative

Over the past week, XRP’s aggregated Open Interest (OI) has stayed steady around $1.26 billion, showing that traders aren’t rushing to open new positions — or close their old ones. It’s that quiet zone where the market kind of takes a breath.

The Funding Rate flipped slightly negative to -0.048%, which means short traders are paying longs to hold their positions. That’s usually a hint that sentiment’s leaning a bit too bearish. When everyone expects a drop, the opposite often happens.

This setup — steady OI, negative funding, and fading sell momentum — often signals consolidation before an upside move. Traders are cautious, sure, but they’re not running for the exits.

The Signs of a Cautious Rebound

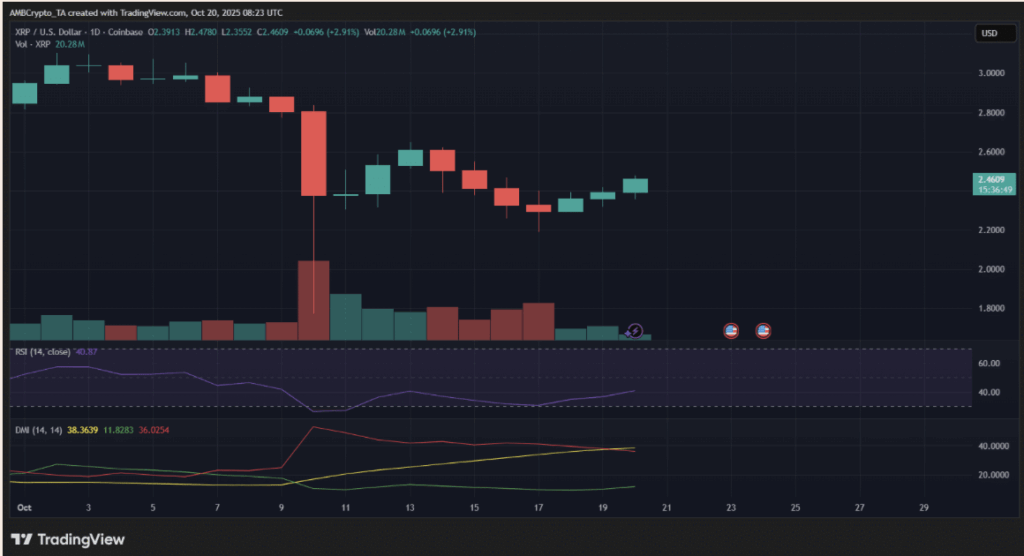

Price-wise, XRP is holding near $2.46, forming a higher low that shows buyers are defending their ground. The RSI has climbed up to 40.8, showing weaker bearish pressure, though it’s still not fully bullish territory. Meanwhile, the DMI lines are narrowing, meaning the gap between buying and selling strength is getting smaller — another hint that momentum could soon flip.

If XRP keeps steady above $2.45, and the RSI can break past 45, we might see the next leg up form toward the $2.7–$2.8 range. It’s not a guaranteed breakout yet, but all the early signs are stacking up. And if that happens, traders eyeing the $3 mark might finally get their wish.