- Elon Musk’s post of his dog Floki as “CEO of X” sent FLOKI up 29%.

- FLOKI price spiked from $0.00006572 to $0.00008469 before cooling off.

- The memecoin market remains volatile despite Musk’s short-term boost.

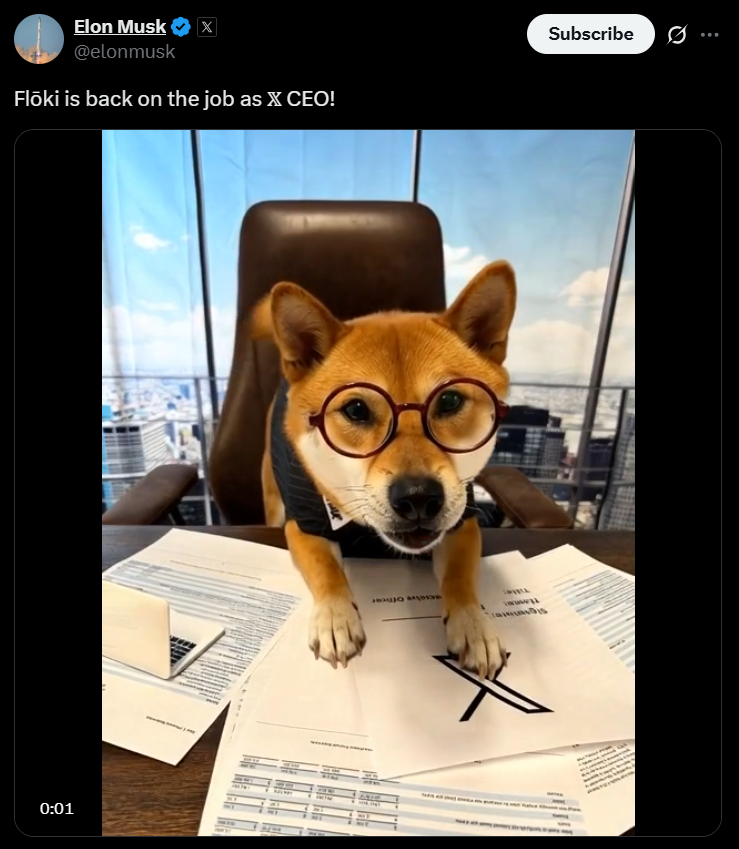

Elon Musk once again stirred up the crypto scene after posting a video of his Shiba Inu, Floki, on X — and within hours, the Floki memecoin shot up nearly 29%. Musk’s playful clip showed his dog dressed as the “CEO” of X, sitting at a desk in glasses and a tie while jokingly saying, “Numbers, numbers, numbers? Is this working? Yay.” The post immediately reignited speculative energy in the memecoin market, proving Musk’s social media influence remains as powerful as ever.

Market Reacts in Real Time

According to CoinGecko, FLOKI’s price jumped from $0.00006572 to a high of $0.00008469 shortly after the video went live. At press time, it had slightly corrected to around $0.00007998 — but still held strong gains on the day. The spike came amid an otherwise shaky week for crypto markets, underlining how quickly hype can move capital when a major personality like Musk is involved.

Musk’s Long History With Memecoins

This isn’t Musk’s first dance with meme-driven rallies. His tweets, jokes, and even logo swaps have repeatedly sent Dogecoin surging in the past. The billionaire’s offhand remarks have often created short-term volatility in tokens like DOGE and FLOKI, giving rise to an entire subculture of traders who monitor his posts in real time. A class-action lawsuit accusing Musk of manipulating Dogecoin’s price was dropped in late 2024, but the phenomenon of “Elon-induced pumps” remains alive and well.

Memecoins in a Volatile Market

Despite the rally, the broader memecoin market remains under pressure after back-to-back selloffs earlier this month. CoinMarketCap data shows the sector’s value dropped nearly 40% during the October 10–11 crash, from $72 billion to $44 billion, before another 9–11% pullback last Friday. With fear sentiment high across crypto, Musk’s playful Floki post offered a brief moment of excitement — and a reminder of just how fast narrative-driven trading can flip the mood.