- Over $60 billion has flowed into Bitcoin ETFs, with BlackRock’s IBIT leading the charge and reshaping market structure.

- Traditional indicators like halving cycles, miner activity, and exchange inflows are losing relevance as institutions dominate.

- Bitcoin’s new bear market floor is estimated between $75K and $80K, supported by ETF demand and global liquidity trends.

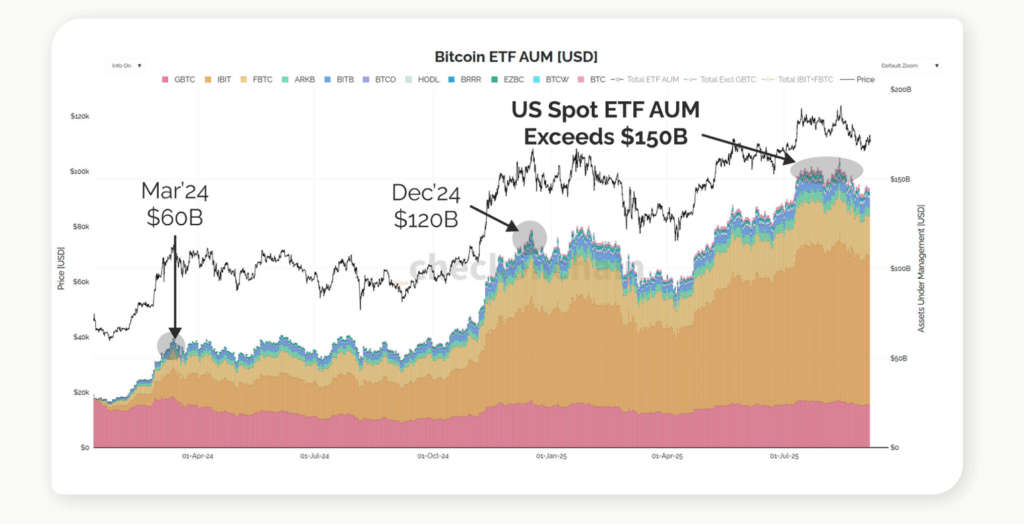

Bitcoin’s legendary halving cycle—the one that used to define every bull and bear market—is starting to lose its grip. With over $60 billion pouring into spot Bitcoin ETFs, led mostly by BlackRock’s IBIT, the game has changed. Institutional demand, global liquidity, and derivatives are now pulling the strings. The old rules of “wait for the halving, then buy” might not mean much heading into 2026.

ETFs Are Rewriting Bitcoin’s Price Story

For years, miners were at the center of Bitcoin’s market rhythm. Every four years, their rewards halved, and prices soared soon after. But now, ETFs are the ones driving price formation. Since the US greenlit Bitcoin spot ETFs, money has flooded in—over $60 billion worth. BlackRock’s IBIT sits at the top, not just with the largest assets under management but also leading in ETF-linked options trading. The U.S. alone now accounts for around 90% of all global spot Bitcoin ETF holdings.

James Check, co-founder of Checkonchain Analytics, summed it up perfectly: “Some holders are moving from on-chain to ETFs… but demand’s been massive.” It’s a subtle shift that’s actually huge—Bitcoin’s pricing power is now more about institutional flows than miner rewards.

Old Metrics Are Losing Their Edge

Exchange inflows used to be a go-to signal for market trends, but not anymore. Even as Bitcoin hits new all-time highs, exchange inflows are sitting at record lows. Analysts say much of that data is flawed anyway since so many exchange wallets remain unidentified. “You won’t see me use exchange data often—it’s just not a great tool,” James admitted.

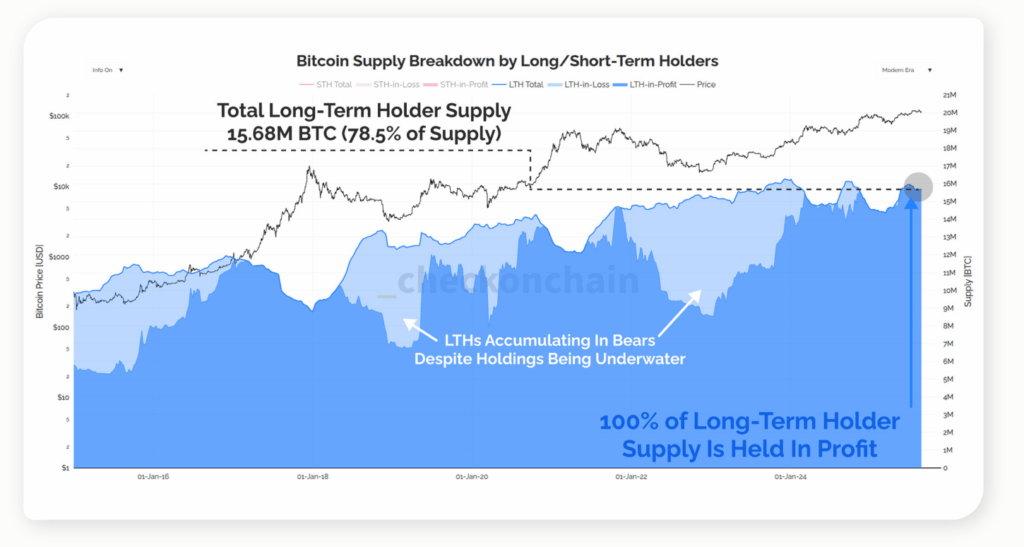

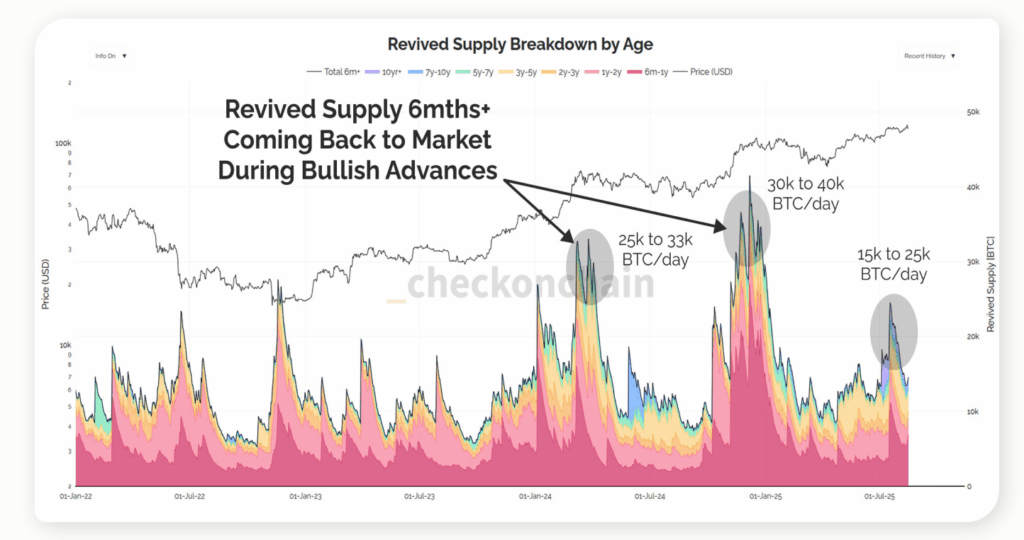

Miner selling? Barely noticeable. With daily issuance down to around 450 BTC, it’s nothing compared to long-term holders who can offload tens of thousands at once. On-chain charts barely even register miner activity anymore. It’s clear: the market’s direction isn’t being set by miners or exchanges—it’s driven by institutions, ETFs, and the slow churn of long-term holders.

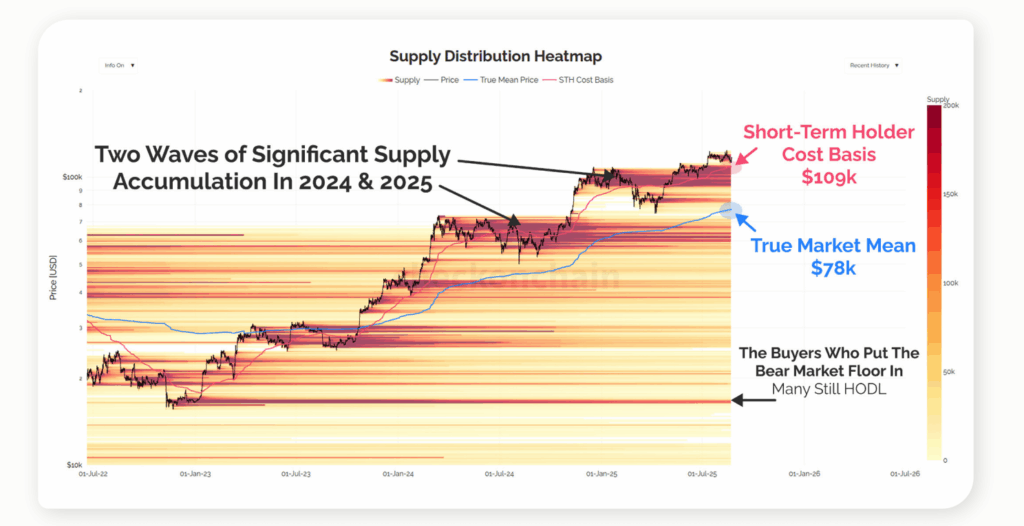

Realized Price and Market Floors Are Evolving

Traditionally, investors looked to metrics like Realized Price to spot market bottoms. But that number includes ancient wallets—some probably lost forever, like Satoshi’s. Today, the Realized Price sits around $52K, but no one really thinks Bitcoin will drop that low again. James believes a “bear market” floor now sits closer to $75K–$80K, supported by ETF inflows and corporate treasuries buying at those levels.

Even popular metrics like MVRV Z-Score aren’t hitting the same. They still matter, but analysts say thresholds need tweaking to reflect how deep and institutionalized Bitcoin’s market has become. The real signals now come from liquidity trends, derivatives volume, and how large entities position their portfolios.

Bitcoin Follows Liquidity, Not Just Halvings

Global liquidity has become Bitcoin’s new pulse. As ETFs mature, options and derivatives built on top of them are becoming the real engines of price discovery. Vanguard is reportedly preparing its own ETF next, which could push this even further. “The ETFs are big,” said James, “but the options market around them—that’s where the real action is.”

Even sovereign funds and pensions are dipping their toes in. While still early, their presence marks a turning point. Most of these ETFs are held through Coinbase, raising questions about centralization, though the network’s proof-of-work model still ensures security and decentralization at the protocol level.

At this stage, Bitcoin isn’t just reacting to crypto-specific events—it’s moving with global liquidity, interest rates, and institutional sentiment. The old halving cycle? It’s still there, but it’s not in charge anymore. As 2026 approaches, Bitcoin’s story will be written by ETFs, derivatives, and Wall Street money—not block rewards.