- Bitcoin dipped below $110K as gold captured safe-haven flows.

- U.S.–China tensions reignited global risk-off sentiment.

- Over $500M in liquidations and heavy put buying amplified the selloff.

Bitcoin’s sharp dip today wasn’t triggered by one catastrophic headline, but by several forces converging at the same time. Gold stole crypto’s safe-haven spotlight, the U.S.–China trade feud reignited, and leveraged positioning cracked under stress. Here’s the breakdown behind the move — and what traders should watch next.

Gold Takes the Safe-Haven Crown

When fear floods the market, capital hunts for safety — and this week, that crown went to gold. Spot gold hit $4,240/oz intraday, marking a new record before settling slightly lower. The largest gold ETF just logged its biggest holdings since 2022, as institutions shifted cash toward metals instead of Bitcoin.

Major banks raised their 2025–26 gold targets, citing rising central-bank demand and macro instability. That flow rotation hurts BTC because when allocators can meet their “risk-off” mandate with gold, they don’t need digital gold. Bitcoin temporarily loses its hedge narrative and trades like a high-beta tech asset instead.

Trump–China Tensions Ignite Global Risk-Off

Geopolitical friction returned in full force. The U.S.–China trade standoff escalated with new export-control measures, rare-earth restrictions, and port fees — and neither side looks ready to back down. Markets immediately repriced global growth risk, and investors dumped volatile assets first.

BTC fell roughly 2–3% to around $107.6K, now about 14% below its early-October peak. Ethereum dropped 3–4%, Solana shed 6–7%, and XRP slid around 5%. That’s a broad, correlated sell-off typical of risk-off phases, not a protocol-specific issue. The crypto market is once again behaving like a macro asset class.

Liquidations and Options Skew Amplify the Damage

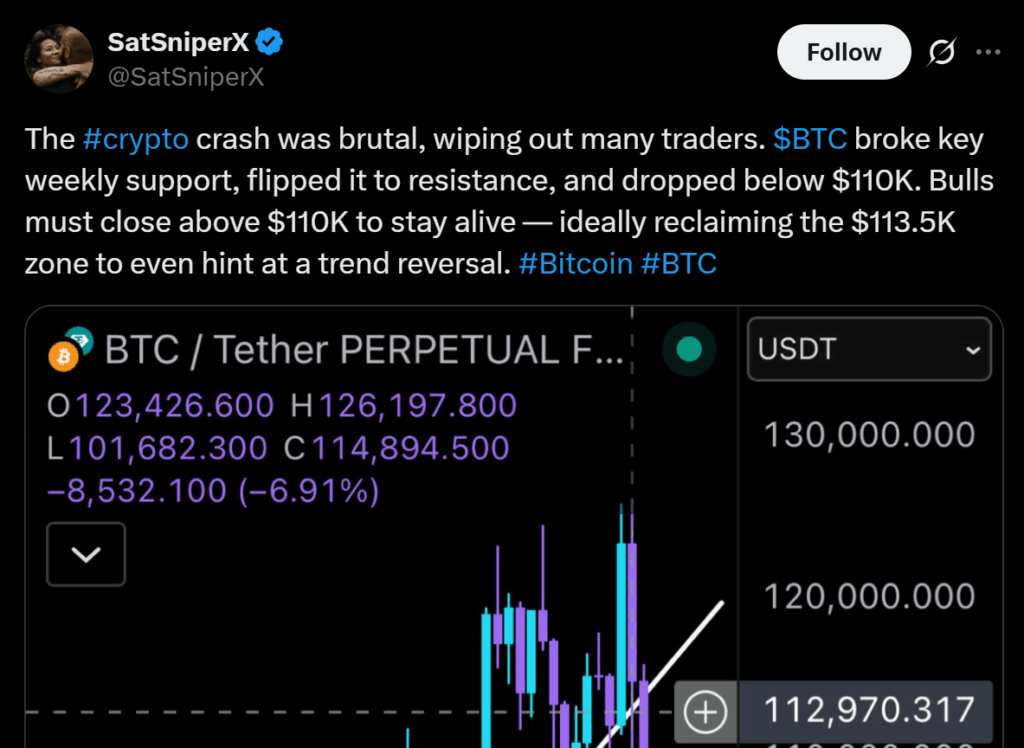

Once Bitcoin broke below $110K, algorithms and leveraged traders took over. Around $415M–$540M in liquidations hit across major exchanges in the last 24 hours, with CoinGlass reporting a single-day total near $524M. BTC and ETH were hit hardest as stop cascades triggered forced unwinds.

Options data also showed heavy put buying between $104K–$108K, suggesting traders are paying up for downside protection. That kind of setup creates a reflexive loop — the more puts purchased, the more dealers hedge short, keeping rallies capped. Until the pace of liquidations cools off, rebounds will likely stay fragile.

Bottom Line

Bitcoin’s current drop is a perfect storm of gold stealing defensive inflows, trade-war tension driving risk aversion, and leverage unwinds magnifying volatility. Add in choppy ETF flows and no fresh CPI data to stabilize sentiment, and you’ve got a market running on nerves.

If gold cools, ETF inflows turn positive, and BTC holds above $107K–$110K, the market could rebuild a base. But until then, smart traders are keeping positions small, stops wide, and eyes on flows — not vibes.