- Bitcoin slipped below $110K, sparking $524M in liquidations across the market.

- Options traders hedge downside, with heavy put activity around $104K–$108K.

- Trade tensions and fading liquidity continue to pressure risk assets.

The crypto market took another hit Thursday morning as Bitcoin briefly slipped under $110,000, triggering a wave of forced liquidations across major exchanges. The move erased roughly $524 million in leveraged positions and pushed the total crypto market cap down 3.1% to $3.85 trillion, according to CoinGecko and CoinGlass data.

Broad Market Sell-Off Grips Majors

Bitcoin has since clawed back to around $110,400, still down about 1.3% on the day. The weakness wasn’t limited to BTC — Ethereum fell 1.8% to hover near $4,000, XRP dropped around 4% to $2.40, and Solana, Cardano, and Dogecoin all posted losses between 3.5% and 5%. The lone bright spot among the top ten was Tron, which managed to stay green with a modest 1.2% gain.

“Liquidity continues to rotate back into Bitcoin and stablecoins,” said Wenny Cai, COO of SynFutures, explaining that the move reflects a wider risk-off shift. This rotation underscores how traders are seeking safety amid macro uncertainty and thinning liquidity conditions.

Options Data Shows Heavy Bearish Positioning

Options traders are bracing for more pain. Data from GreeksLive showed that over $1.15 billion—roughly 28% of total options volume—flowed into deep out-of-the-money puts expiring this week and month, primarily in the $104K–$108K strike range. That concentration signals that large traders and liquidity providers are aggressively hedging against further downside.

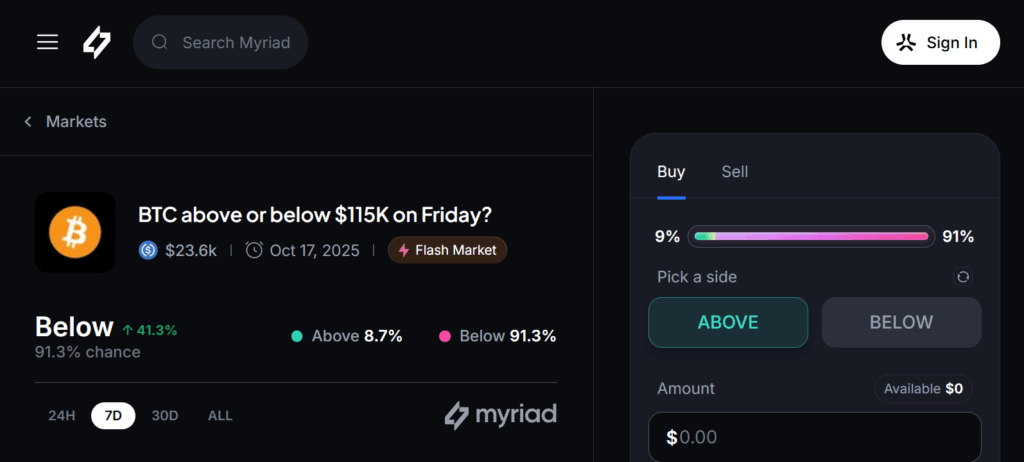

The options skew has turned sharply negative, a sign that sentiment is nearing the same fear levels seen after last week’s $19 billion liquidation event. Prediction markets echo that caution: users on Myriad now assign only a 10–15% probability that Bitcoin, Ethereum, or Solana will close the week above $115K, $4,200, and $210, respectively.

U.S.–China Trade Tension Fuels De-Risking

This downturn traces back to rising U.S.–China trade tensions, which reignited market anxiety and triggered a historic leverage wipeout last week. The renewed tariff threats and export control headlines have kept traders cautious, prompting widespread de-risking and reduced exposure to high-volatility assets like crypto.

“Caution is warranted,” said Max Shannon of Bitwise Europe, noting that the trade war remains on uneven footing and could keep price action range-bound until clarity returns.

What’s Next: Waiting for Calm After the Shakeout

Analysts expect continued choppy price action as leverage resets and capital consolidates around Bitcoin and large-cap alts. “Some weaker names will likely keep bleeding, while higher-quality assets stabilize,” Cai added.

Ultimately, any meaningful recovery hinges on two things: a cooldown in trade rhetoric and a return of institutional inflows. Until then, traders should brace for volatility — and perhaps a few more painful liquidation candles before the dust settles.