- China vows to “fight to the end” after Trump announces 100% tariffs on Chinese goods.

- Beijing condemns US “coercive diplomacy” but leaves the door open for negotiation.

- The escalating trade war could disrupt global supply chains and dominate IMF talks this week.

Tensions between the United States and China are once again boiling over after President Donald Trump announced an additional 100% tariff on all Chinese goods, triggering Beijing’s fiercest response yet. On October 14, a Chinese Commerce Ministry spokesperson declared that the country was “ready to fight to the end” in the escalating trade war, vowing that China would defend its economic interests at all costs.

The move follows Trump’s October 10 post outlining new trade restrictions, including sweeping export controls on critical software starting November 1. These measures were a direct response to China’s new export controls on rare earth metals, a critical component in semiconductors and green technology — sectors where Beijing dominates global supply chains.

China Responds with Firm Rhetoric

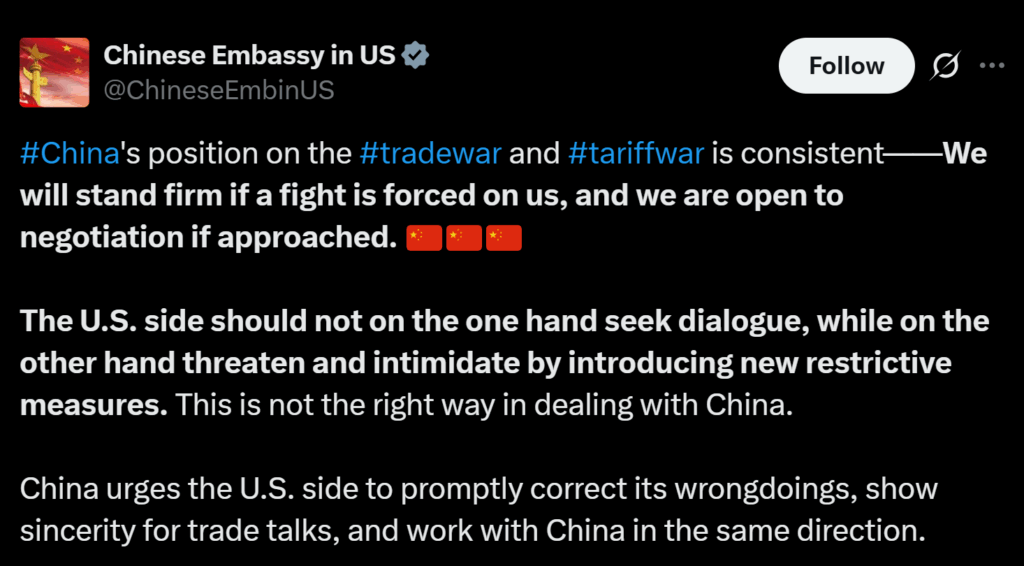

In a sharp statement, the Commerce Ministry warned Washington that it “cannot simultaneously seek dialogue while threatening restrictive measures.” The message emphasized that while China remains open to negotiations, it will not tolerate what it calls “coercive diplomacy.”

Trump appeared to slightly ease his tone two days later, writing in a follow-up post that “it will all be fine” and that the US wants to “help” China. However, analysts say the damage may already be done, with Beijing viewing the new tariffs as a direct provocation ahead of a potential meeting with President Xi Jinping in South Korea.

Economic Ripples and Global Fallout

Markets reacted sharply to the escalating rhetoric. The S&P 500 fell 1.3%, while Asian equities tumbled amid fears of renewed supply chain disruptions. Meanwhile, exports from China actually showed resilience, jumping 8.3% year over year in September, marking their fastest growth since March.

Shipments to the United States surged to $34.3 billion, despite existing US tariffs of at least 30%. China’s retaliatory tariffs currently sit at 10%, but economists predict that Beijing could raise them in the coming weeks.

The trade conflict is expected to dominate discussions at this week’s IMF and World Bank meetings in Washington, where global leaders will assess the economic ripple effects of Trump’s tariff onslaught.

What’s Next for the Global Economy

While the White House insists the tariffs will have a “positive long-term effect,” experts warn that the confrontation could destabilize global trade networks just as markets begin to recover from recent turmoil. If China follows through with countermeasures, industries reliant on rare earths, electronics, and battery materials could see severe supply shortages.

For now, both nations appear locked in a game of economic brinkmanship — with Beijing pledging to resist and retaliate, and Washington doubling down on its “America First” trade agenda.