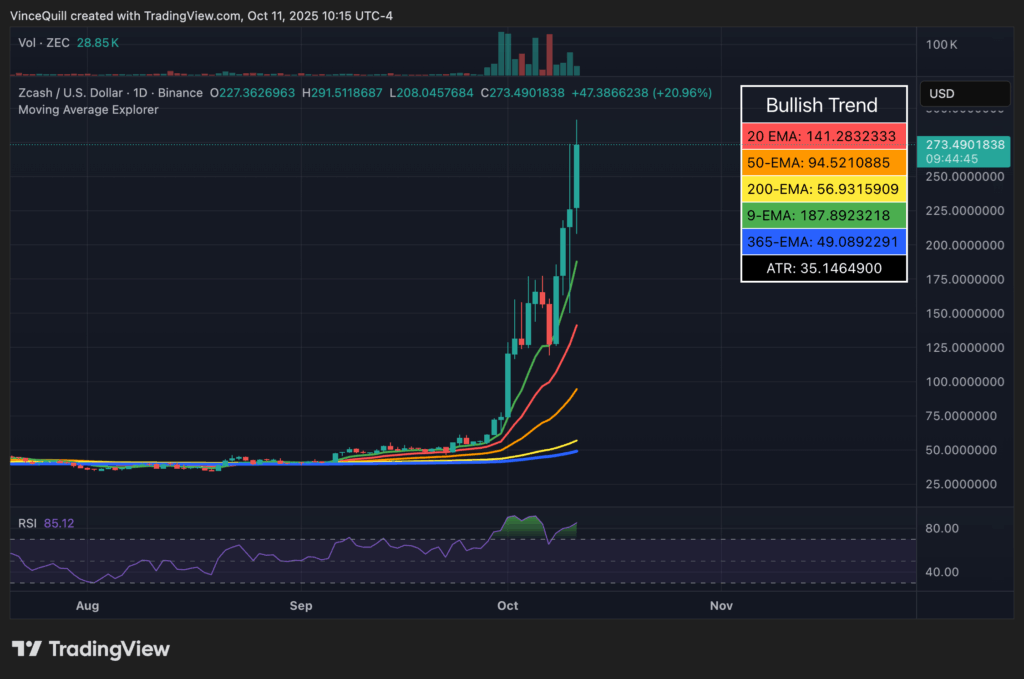

- Zcash plunged 45% after Trump’s tariff announcement but bounced back to $291 before stabilizing near $270.

- The crypto market saw over $20 billion in liquidations, making it one of the worst single-day crashes in crypto history.

- Despite the chaos, ZEC became one of the few coins to fully recover, showcasing strong resilience amid market turmoil.

Zcash’s recovery has been nothing short of wild. After the crypto market nosedived on Friday, the privacy-focused coin, ZEC, pulled off a full comeback—touching $291 before cooling down around the $270 range. For a coin that was in freefall just a day earlier, that’s a serious flex.

From Collapse to Comeback

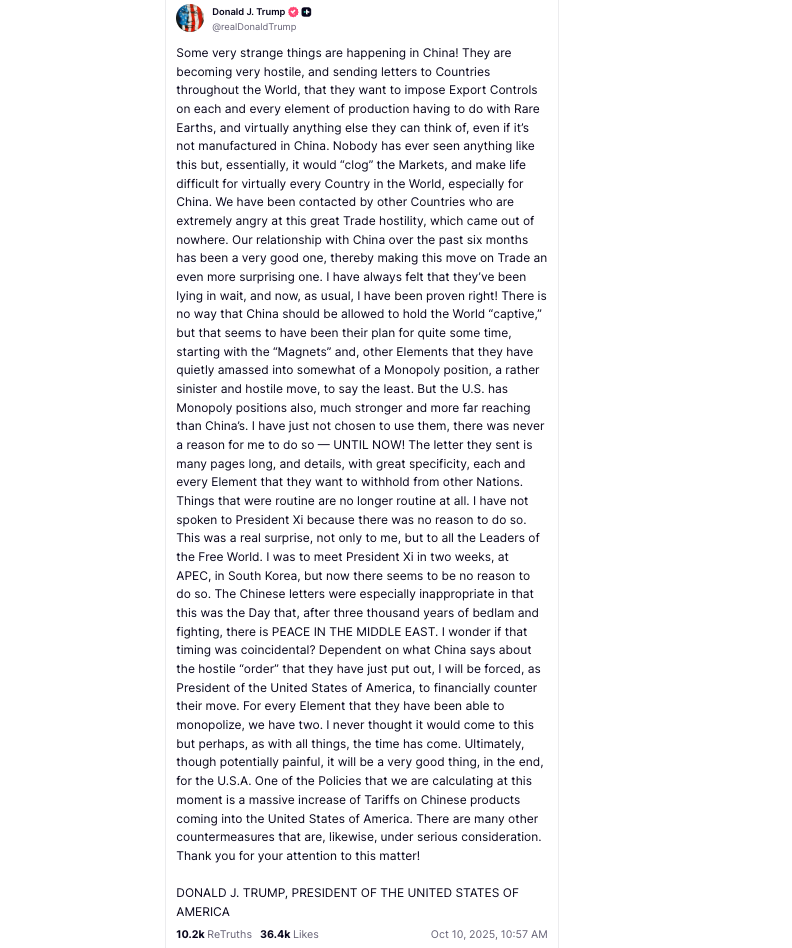

On Friday, Zcash plunged nearly 45%, crashing from roughly $273 to $150 in a matter of hours. The cause? A pair of fiery posts from U.S. President Donald Trump, announcing a whopping 100% tariff on all Chinese goods. That single announcement sent shockwaves through global markets, dragging the entire crypto space down with it.

But by Saturday, ZEC had clawed its way back up. At one point, it hit a high of $291 before slightly retracing. As of now, it’s only down about 5.5% from that local peak—pretty impressive when compared to heavyweights like Ether, which is still sitting around 22% below its recent all-time high of $4,957.

A Rocket Ride Before the Fall

Before all the chaos, Zcash had already been on a tear. From just $74 at the start of October to nearly $291 in under two weeks, it was one of the market’s most explosive rallies. Even after the crash, ZEC is holding its ground around pre-crash levels, making it one of the few coins to recover this quickly. Most others are still limping along, waiting for the next wave of green candles.

The broader crypto market, however, took a brutal hit. Friday’s meltdown turned into one of the largest liquidation events in crypto history—over $20 billion wiped out in mere hours. Traders across the board watched their positions vanish, some blaming Trump’s posts for “nuking” the charts.

When Tweets Move Markets

It’s wild how much power two social media posts can have. In his first message, Trump blasted China’s new export limits on rare earth minerals—materials essential for batteries, semiconductors, and military tech—calling them “hostile” and warning they’d “clog” global trade. Over 90% of those minerals come from China, according to Reuters, so that message alone rattled investors worldwide.

A few hours later, he followed up with the real bombshell: a 100% tariff on all Chinese imports, set to kick in by November 1, 2025. Within minutes, stocks and cryptos tanked across the board. By the end of the day, billions were gone, and chaos ruled the markets once again.

Still, in the middle of all that noise, Zcash stood out as the comeback kid—rising from the ashes like it had something to prove. Maybe that’s what makes privacy coins so interesting… they move differently, sometimes even defiantly.