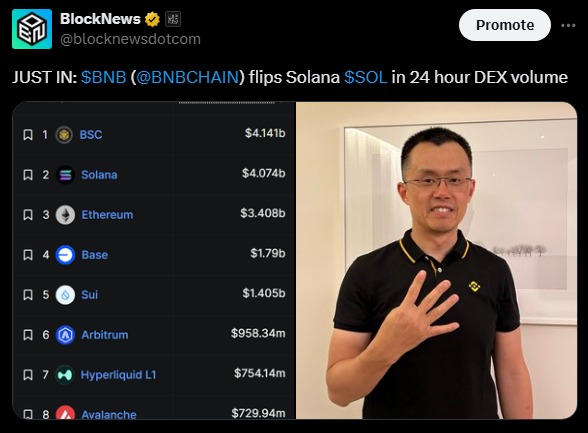

- BNB Chain recorded ~$178B in 24-hour DEX volume, surpassing Solana’s ~$143B.

- Growth driven by record perpetuals trading, meme coin activity, and RWA tokenization.

- Strong ecosystem metrics: $17.1B TVL, 4.2M daily users, and a new BNB all-time high at $1,295.

BNB Chain (BSC) has officially overtaken Solana in 24-hour decentralized exchange (DEX) volume, marking a major milestone in the Layer-1 race. According to DeFiLlama and ecosystem trackers, BNB Chain logged roughly $178 billion in 24-hour DEX activity, compared to Solana’s $143 billion. The surge cements BNB’s leadership in on-chain trading, backed by record perpetual futures volume exceeding $100 billion, dominant chain fees, and the highest liquidity across key decentralized markets.

BNB’s ecosystem has expanded rapidly in October, with Total Value Locked (TVL) climbing to $17.1 billion and daily active users surpassing 4.2 million. The BNB token itself recently set a new all-time high of $1,295, rising over 113% year-to-date.

Why BNB is Winning the Volume Battle

BNB’s dominance is fueled by low fees, fast finality (1.875s via the Maxwell upgrade), and explosive activity across meme coins, DeFi, and real-world assets (RWA). Key platforms like PancakeSwap alone drove over $165 billion in monthly volume. Incentive programs, including a $100 million liquidity campaign and zero-fee stablecoin transfers, have also drawn traders. Meanwhile, Binance’s deep ecosystem influence and community momentum—boosted by its 5-year anniversary—continue to amplify activity.

In contrast, Solana remains strong in NFTs and overall chain activity, but trails BNB in DEX-specific liquidity and trading incentives.

Market Impact and Sentiment

BNB’s social sentiment hit 87% positive, with traders celebrating the flip as a bullish signal. Analysts suggest BNB’s strength in DeFi and perpetuals positions it for further gains, potentially pushing the token beyond $1,500 if Bitcoin sustains its rally above $125K. For traders, the message is clear: BNB Chain is now the busiest arena for on-chain trading.