- SunSwap transactions topped 30,000 in September, showing strong network demand.

- Exchange outflows of nearly $5M suggest accumulation and reduced sell pressure.

- TRX needs to clear $0.37 resistance to confirm a breakout toward $0.40.

September turned out to be a big month for TRON, with on-chain activity showing steady growth. SunSwap transactions alone jumped past 30,000 — the highest figure this year — proving there’s real demand for stablecoin settlement and cross-border remittances on the network. Even with market volatility hanging around, TRON managed to keep transaction volumes consistently above 15,000, which suggests users aren’t just speculating, they’re actually using the chain. That’s been helping TRON shake off its old “secondary platform” tag and position itself more like a core settlement layer in crypto.

TRX Price Holding the Trendline

At press time, TRX was trading around $0.33, sitting comfortably above its ascending trendline. This line has been tested during pullbacks before and keeps acting as a pivot for the bullish setup. Still, the Directional Movement Index (DMI) flashed a warning with a bearish signal, which could mean a short-term retest of support before another rebound attempt. On the upside, resistance levels at $0.3526 and $0.37 are the immediate hurdles. If TRX clears those, the $0.40 mark would quickly come into view.

Exchange Outflows Back Bullish Case

Data from CoinGlass showed consistent outflows from exchanges in September, including a $4.79 million move on the 29th. These outflows usually suggest holders are pulling coins into private wallets instead of keeping them on exchanges — often a sign of accumulation. With less supply floating around on liquid venues, the chances of strong price dips shrink, especially when paired with demand that’s been climbing steadily. This type of behavior from holders hints at confidence in TRX’s longer-term outlook, even when short-term charts wobble.

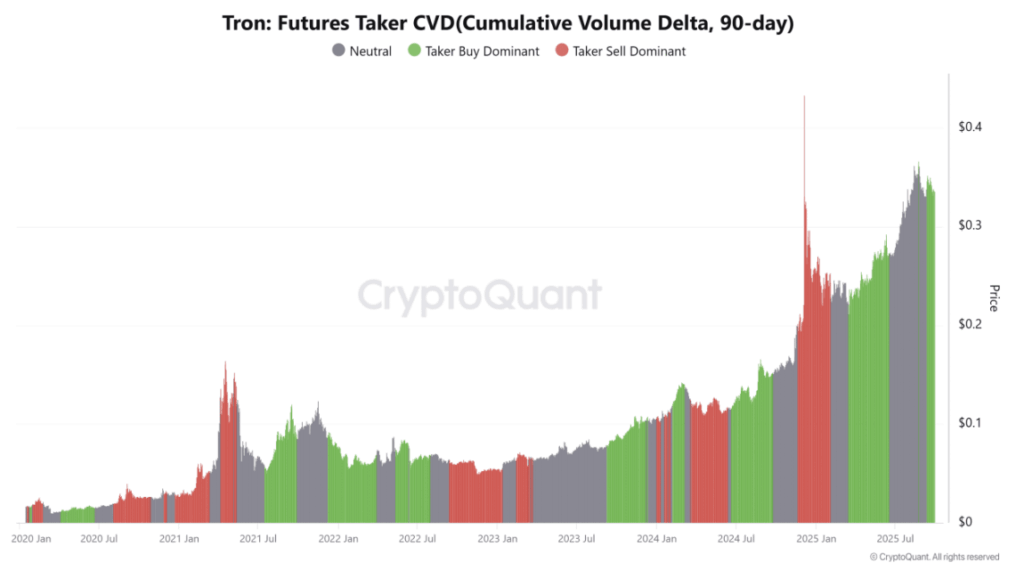

Futures Market Adds More Fuel

The derivatives side is also leaning bullish. Futures Taker CVD revealed buy-side dominance, meaning leveraged traders are leaning toward long exposure. Historically, when buyers outweigh sellers in futures markets, it often signals expectations of higher spot prices. This, combined with SunSwap’s record transaction growth and the steady drip of exchange outflows, builds a cluster of signals pointing to potential upside. If TRX can keep trendline support intact, leveraged sentiment might help push momentum higher.

Can TRX Push Through $0.37?

The big test remains the $0.37 resistance level. Clearing it with conviction could unlock a path toward $0.40 and beyond, while failure to do so risks another pullback toward the trendline. With network fundamentals improving, exchange balances dropping, and futures positioning tilted bullish, the setup leans positive. For now, TRON’s September strength may be the fuel it needs for its next rally attempt.