- Cardano broke below its ascending channel support on Sept. 23, hinting at more downside pressure.

- Key support sits at $0.69, with deeper risk down to $0.53 if selling persists.

- A bounce back into the old channel could flip sentiment bullish, but $1 remains the real level to reclaim.

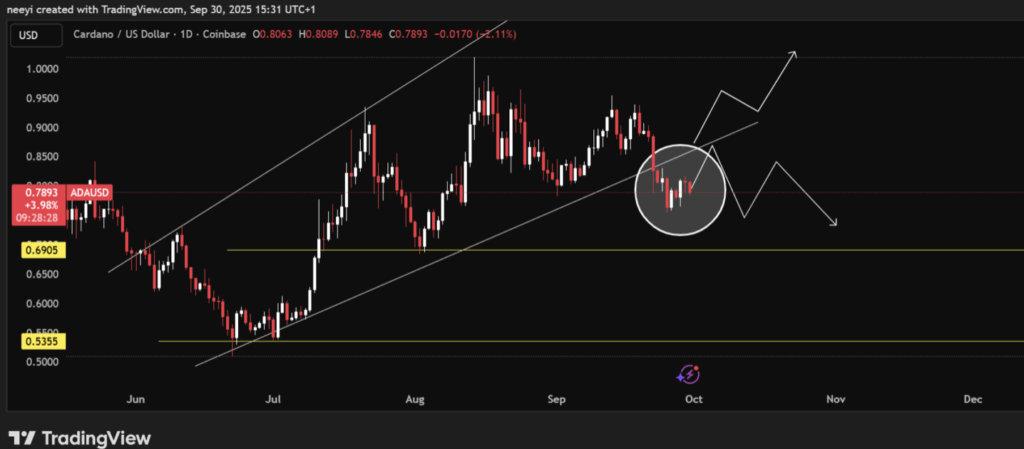

Markets never really sit still, and Cardano (ADA) is proving that once again. For months, from June through late September, ADA was moving inside an ascending broadening channel — a structure that usually points to rising volatility and steady higher highs. That setup came undone on September 23, when ADA finally slipped under the channel’s support, breaking a trendline that had held the price up for nearly the whole summer. With October now in play, the question is pretty straightforward: does ADA recover from here or sink even lower?

The first clues lean bearish. That break below support signals that sellers still have the upper hand, at least for now. If pressure builds, ADA could drift toward its next key base around $0.69. A deeper move could even revisit $0.53, a level that acted as strong support earlier this year. Such a slide would echo a cautious market, one where buyers keep hesitating to step in with conviction.

Where Buyers Might Try to Step Back In

Still, it’s not all doom and gloom. Bulls will be watching closely to see how ADA behaves around current levels. If price can climb back into that broken channel, even briefly, it might be treated as a short-term buying window. That could reopen the path toward the upper side of the old pattern, sitting near $1. But unless ADA can break above $1 with force, the overall picture on the charts stays weak and shaky.

CoinAnk Indicators Show a Bearish Tilt

Looking under the hood, CoinAnk data paints an interesting picture. Open interest in ADA futures sits around $280 million — steady, but not extreme. Net short positions come in heavier at $4.17 billion, while net longs trail slightly lower at $3.93 billion. That tilt tells us more traders are leaning bearish than bullish right now, which lines up with what the charts are showing.

Still, the imbalance isn’t massive. It leaves room for things to flip fast if a wave of buying momentum appears. In crypto, sentiment has a way of turning on a dime, and ADA isn’t immune to that kind of swing.

October Outlook: Patience Will Be Tested

Heading into October, ADA finds itself in a crossroads. The technical breakdown below long-term support is a red flag, but any recovery that forces price back into the channel could catch traders off guard. For now, ADA is hovering close to $0.78, with $0.69 standing out as critical support and $1 marking the level bulls must reclaim for a meaningful rebound.

October looks set to be a patience test for Cardano holders — a month where the battle between sellers and buyers decides whether ADA starts building strength again or keeps sliding deeper.