- Institutional adoption and DeFi infrastructure gave Ethereum the edge.

- Tron cut fees to defend its stablecoin lead, with TRX showing relative strength.

- Despite price weakness, Ethereum saw record $164B inflows in four weeks.

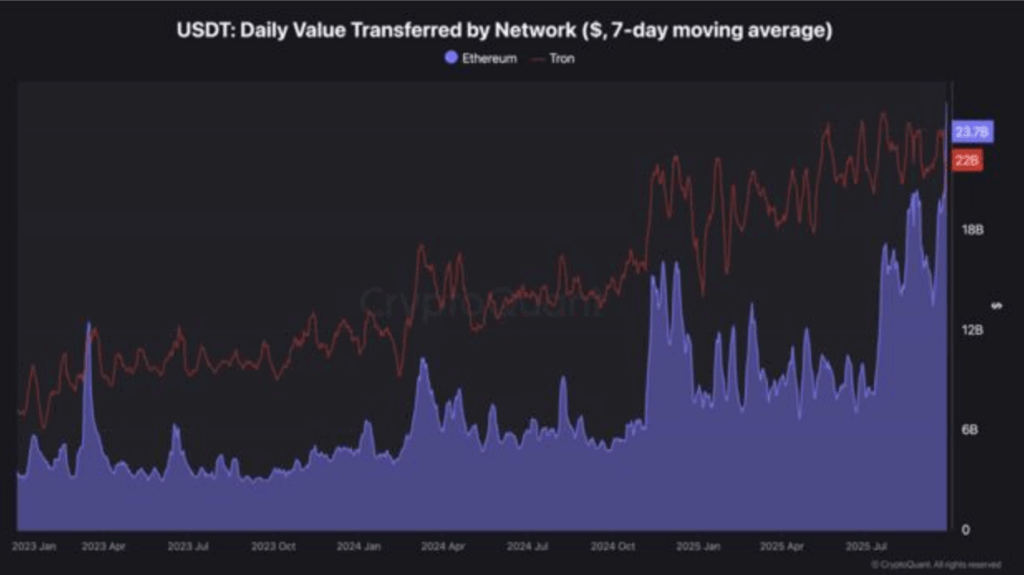

The crypto market may have cooled off last week, leaning bearish, but DeFi stayed hot. Ethereum and Tron found themselves in a head-to-head clash, battling for stablecoin dominance. For years Tron wore the crown in USDT transfers, but that changed recently. Ethereum finally pulled ahead, overtaking Tron in USDT activity for the first time in more than two years—a milestone many in the space had been waiting for.

Fresh data showed Ethereum’s weekly USDT transfers reached $23.7 billion, while Tron managed about $22 billion. At first glance, the numbers look close, but they mark a shift in momentum. According to DeFiLlama, Ethereum now holds roughly 77.76 billion USDT, equal to 44.48% of supply. Tron sits just behind with 76.23 billion USDT, about 43.77%. The margin is slim, but Ethereum’s edge is clear.

Why Ethereum Is Outpacing Tron in USDT Transfers

Tron built its dominance on speed and low costs, making stablecoins easy to move for everyday users. But Ethereum’s latest strength comes from somewhere else entirely: institutions. Banks and traditional finance players have turned to Ethereum to deploy stablecoin solutions and experiment with tokenized assets. Add that to Ethereum’s powerful DeFi ecosystem—where liquidity constantly rotates in times of volatility—and the momentum shift makes sense. Tron, while strong in stablecoins, hasn’t captured the DeFi-driven flows with the same intensity.

Still, Tron isn’t standing still. It cut fees by 60% in a push to attract more adoption, and its token TRX has shown resilience, holding a long-term uptrend. In September, TRX fell less than 2%, while ETH dropped more than 8%. Tron’s stablecoin-first strategy might keep it relevant, but Ethereum’s blend of DeFi infrastructure and institutional backing is hard to beat.

Ethereum DeFi Performance: TVL Outflows and Record Inflows

Looking closer at Ethereum’s DeFi performance, the last four weeks were a mix of highs and lows. Its total value locked (TVL) fell by around $10 billion, reflecting shaky investor confidence in a volatile month. ETH’s price followed suit, slipping more than 8% over the same stretch. Yet activity on the chain held strong. Active addresses reached 14.2 million—slightly down from August, but still elevated compared to previous months.

Transaction levels told the same story: steady and robust despite the market’s dips. But the real headline was inflows. Ethereum saw $164 billion in net inflows over the last four weeks—the highest in its history. That surge in capital suggests that while prices corrected, serious money was still flowing into Ethereum, positioning it for long-term strength in DeFi and stablecoins.