- Litecoin is testing $103 as critical support, with $108 marked as near-term resistance.

- Indicators show oversold signals but bearish momentum still dominates.

- Derivatives market activity and leverage remain muted, reflecting cautious sentiment.

Litecoin is trading near $103.17, slipping around 1.5% in the last 24 hours. The coin holds a market cap close to $7.9 billion, with daily trading volume sitting at $1.73 billion — that’s roughly 0.21% of the overall crypto market right now.

Traders have been buzzing about LTC, with mentions climbing even though the price action hasn’t been too kind. On the short-term chart, Litecoin is drifting lower, stuck beneath its 5, 10, and 20-period moving averages. That setup isn’t ideal — it reflects the ongoing downward pressure dragging the token’s short-term outlook.

Technical Outlook: Rebound or More Downside?

Indicators give a mixed read. The Relative Strength Index (RSI) shows oversold conditions, hinting that a rebound could be in play if enough buyers step back in. But the MACD isn’t supportive yet, sitting below its signal line, which suggests that bearish momentum still has the upper hand for now.

Market watchers see $103 as the key floor. If Litecoin can defend this level, it may avoid deeper losses. Resistance is visible up at $108, and a clean breakout above could restore short-term stability. But if $103 breaks down, traders are bracing for another corrective leg lower.

Despite this pullback, Litecoin hasn’t lost its shine completely. It’s still one of the most established names in crypto, and the next few days could decide whether it bounces or bleeds further.

Derivatives Market Points to Caution

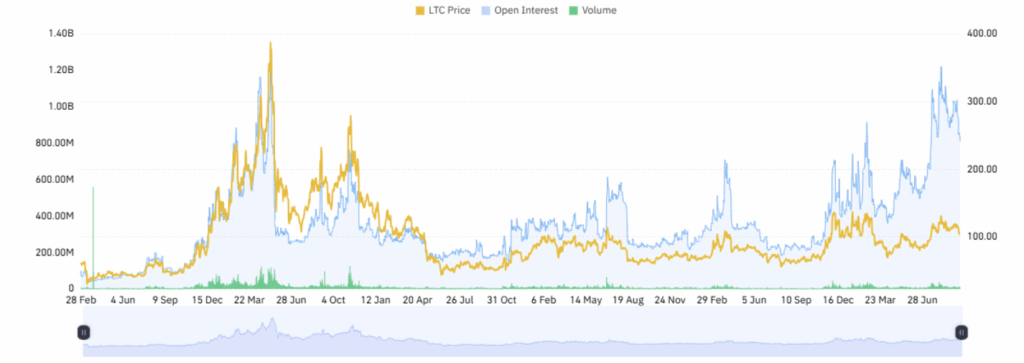

Litecoin’s derivatives market has been cooling off too. Open interest fell 4.2% to around $800 million, showing that traders may be closing positions to take profits — or simply stepping aside due to sluggish expectations in the near term. Trading volume also slipped 2.7% to $1.02 billion, a signal that overall activity is tapering.

Sentiment metrics back this up. Weighted Open Interest sits at a tiny 0.0064%, suggesting very little leverage in play. That’s not outright bearish, but it does tell us that traders aren’t willing to bet big right now. Most are holding back, waiting for a clearer direction before piling in again.

Final Take

Litecoin sits at a crossroads. Defend $103, and it could climb back toward $108 and maybe beyond. Lose that level, and the market may drag it toward another correction. For now, it’s a waiting game — the market feels cautious, patient, and not yet ready to commit.