- CleanSpark secured a new $100M Bitcoin-backed credit line with Two Prime, raising its total lending capacity to $400M.

- The company is leveraging its 12,000+ BTC treasury to fund data center expansion and HPC initiatives without diluting shareholders.

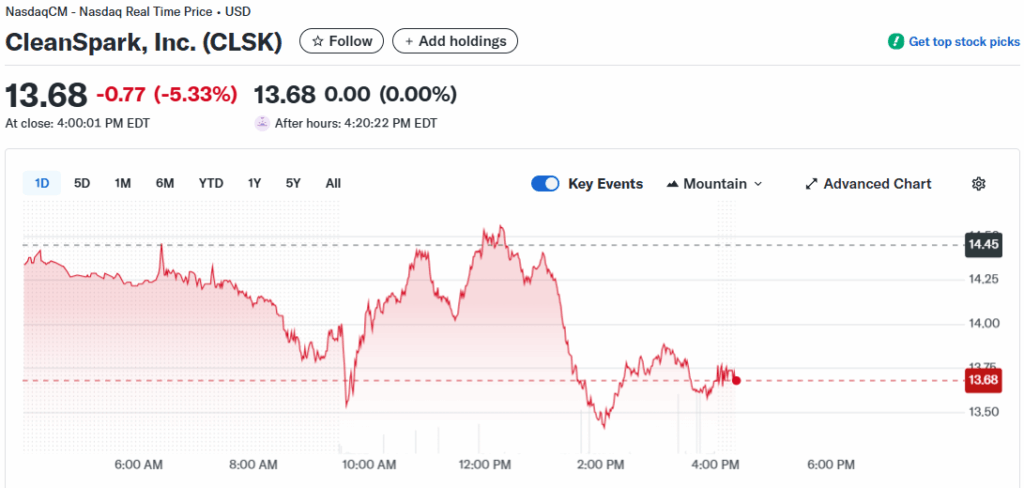

- Despite the major financing news, CLSK shares stayed stable at $13.68, though trading volume surged above 36M.

CleanSpark, one of the biggest US-based Bitcoin mining firms, has locked in a new $100 million Bitcoin-backed credit line with institutional lender Two Prime. This deal, announced Sept. 25, pushes its total collateralized lending capacity to $400 million, giving the company more flexibility to scale operations. Backed by a treasury of more than 12,000 BTC, CleanSpark is using its crypto holdings to secure non-dilutive financing, which allows expansion without issuing new stock.

Bitcoin-Backed Lending Gains Momentum

The new facility with Two Prime follows another $100 million line of credit announced earlier this week with Coinbase Prime. This trend highlights a growing strategy among miners—leveraging their Bitcoin reserves to raise capital at favorable rates rather than tapping equity markets. Two Prime’s CEO called the move a sign of growing institutional confidence in Bitcoin as reliable collateral. Other miners, including Riot Platforms, are adopting similar approaches, signaling that Bitcoin-backed lending is becoming a mainstream funding model in the industry.

Market Reaction Remains Subdued

Despite the major credit announcements, CleanSpark’s stock (CLSK) barely moved, closing at $13.68 on Sept. 25 after dipping from highs earlier in the week. Trading volumes surged, but price action suggests investors had already priced in growth expectations. Still, CLSK has gained more than 50% over the past month, supported by optimism that the company can expand its hashrate and infrastructure while protecting shareholder value. With its market cap near $3.9 billion, CleanSpark’s financial strategy places it firmly in the spotlight among Bitcoin miners navigating competitive markets.