- Hedera now processes over 10,000 TPS, making large-scale tokenization technically and economically viable.

- Governance, auditability, and compliance tools in Hedera’s Token Service (HTS) are designed to win institutional trust.

- ETF progress and new governing council members strengthen Hedera’s position as a credible platform for enterprise adoption.

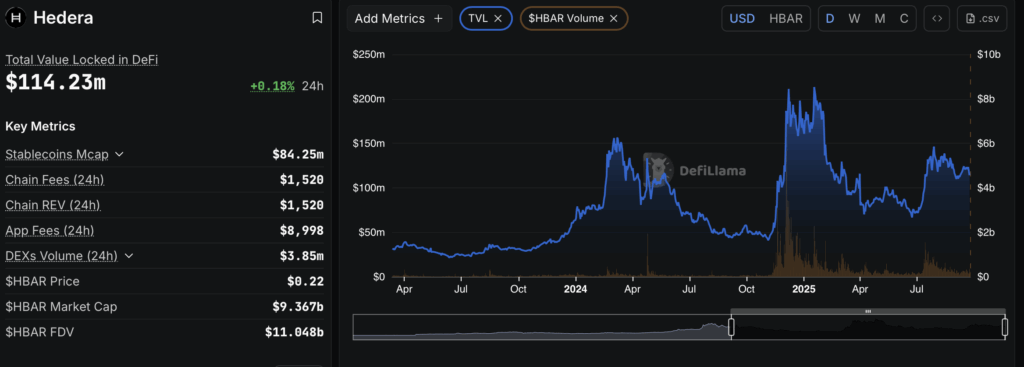

Hedera’s been making noise lately. The network is now pushing through more than 10,000 transactions every single second. On paper, that’s massive, but it’s not just about bragging rights or a speed record. What matters here is what builders and institutions can actually do with that kind of throughput—especially when it comes to tokenization.

Ben Sheppard, an entrepreneur who’s been knee-deep in AI and Web3 projects, explained that speed alone isn’t enough. Governance, auditability, and the ability for institutions to plug into existing processes… that’s where the real battle lies. Hedera is trying to hit all these notes, and that’s why people are paying attention.

Hedera Token Service Explained

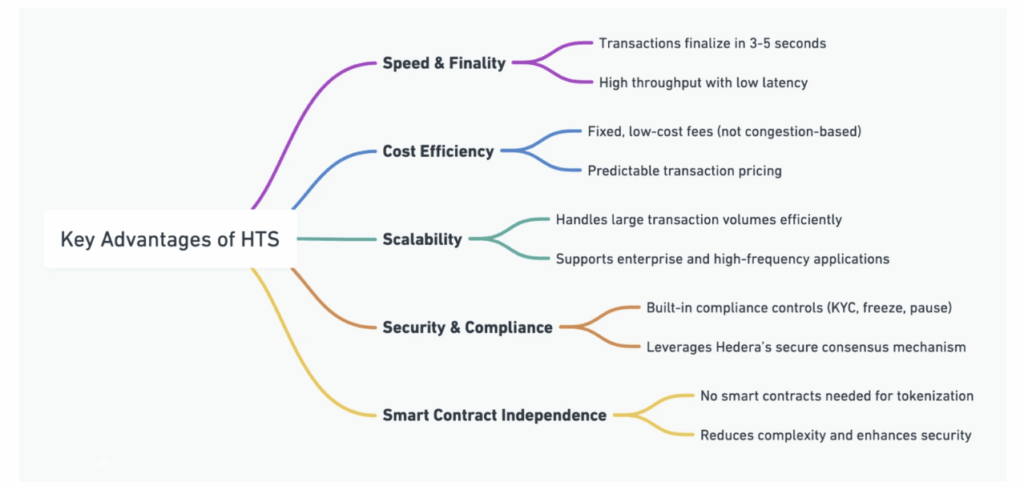

The Hedera Token Service (HTS) gives users the ability to mint, move, and manage tokens right on the network without writing custom smart contracts. That’s a big deal because it reduces costs, risk, and complexity. It supports both fungible tokens (like stablecoins) and NFTs, all with finality in just 3–5 seconds. Fees? Practically pocket change—often a fraction of a cent.

Key takeaways from HTS:

- Tokens without the overhead of Solidity or external contracts

- Predictable transaction costs under $0.01

- Scalability beyond 10,000 TPS, even under heavy load

- Compliance tools baked in, like KYC, freezes, custom fees, and supply controls

For enterprises, that means fewer headaches and a system that looks a lot more like traditional finance infrastructure—just faster and cheaper.

Why Throughput Actually Changes the Economics

High throughput doesn’t just sound cool, it changes the math. Sheppard pointed out that tokenizing large asset portfolios on Ethereum was always bottlenecked by fees and speed. Private chains helped, but they’re expensive and clunky. Hedera’s model lowers those barriers. Suddenly, tokenizing real estate portfolios or bond markets starts looking less like a whitepaper dream and more like a working product.

Still, speed by itself isn’t enough to win over Wall Street. Institutions want to know the rules, the guardrails, and who’s steering the ship. That’s where governance and regulatory clarity step in.

Trust, Governance, and the ETF Effect

Sheppard put it bluntly: “Tokenizing billion-dollar assets isn’t just about TPS—it’s about trust.” Institutions want governance models that make sense, audit trails regulators can accept, and assurance that networks can slot into existing systems. Hedera’s council model, which now includes groups like Arrow Electronics and Blockchain for Energy, is designed to do just that.

That trust narrative got another boost with the DTCC adding Fidelity and Canary Capital’s HBAR ETFs to its eligibility register. Add in speculation over a U.S. spot HBAR ETF, and suddenly Hedera looks a lot more like a serious institutional play than a fringe blockchain.

Regulation and Political Balance

Governments don’t like losing control—plain and simple. Sheppard argued that while SMEs and startups may experiment with public blockchains, regulators need frameworks that keep their levers of oversight intact. That means disclosure standards, AML protections, regulated custodians, and consistent cross-border rules.

He went as far as saying regulators might only fully embrace public blockchains once they come wrapped in international or multilateral backing—something like a UN stamp of approval. Until then, hybrid and permissioned setups may act as stepping stones.

Looking Ahead: Setting the Standards

The next few years won’t be about one platform “winning.” Instead, Sheppard expects a convergence—networks, regulators, and institutions coming together to establish shared standards. What sticks long-term are frameworks regulators can live with and institutions can trust.

Hedera, with its speed, governance model, and growing council, might help shape those standards. But the bigger story is whether tokenization evolves from small pilots into global, regulated financial products that can be traded just as easily as stocks or bonds today.

Conclusion

Hedera has shown it can deliver the raw performance—10,000 TPS and beyond. But the bigger picture is about marrying that scale with governance and regulatory confidence. Tokenization won’t scale just because it’s fast. It’ll scale when enterprises, regulators, and institutions all see it as trustworthy. That’s the real race Hedera is running.