- Linea is a zkEVM Layer 2 from ConsenSys, designed for Ethereum scaling with full EVM equivalence and zk-SNARK security.

- Over $1B in TVL, 100+ dApps integrated, and major backers like Microsoft and Coinbase Ventures put it among top scaling contenders.

- With no VC token allocation and an aggressive roadmap toward decentralization, Linea could be a breakout Layer 2 in the 2025 bull run.

Linea, the zero-knowledge Layer 2 network built by ConsenSys, has emerged as one of the most aggressive and technically refined attempts to scale Ethereum without compromising its soul. And with over a billion dollars in total value locked, a massive airdrop campaign, and a roadmap that reads like a manifesto, Linea is not here to play nice. It is here to dominate. So, let us take a closer look at what makes Linea stand out.

What Is Linea?

Linea is a zkEVM Layer 2 blockchain designed to scale Ethereum by executing transactions off-chain and verifying them on-chain using zero-knowledge proofs. Developed by ConsenSys, the same company behind MetaMask and Infura, Linea offers full Ethereum equivalence, meaning developers can deploy smart contracts without rewriting a single line of code.

Linea launched its mainnet alpha in July 2023 and its token generation event in September 2025. It is governed by the Linea Association, a Swiss non-profit backed by Ethereum-native organizations like Eigen Labs, ENS Domains, SharpLink Gaming, and Status. The network is built to be credibly neutral, censorship-resistant, and economically regenerative for Ethereum itself.

Core Components

Linea relies on a set of interlocking components that work together to deliver speed, security, and scalability across the network. These systems form the backbone of its Ethereum-equivalent Layer 2 infrastructure, allowing developers and users to operate efficiently without compromising security. The core components include:

zkEVM Engine

At the heart of Linea is its Type 2 zkEVM, a zero-knowledge Ethereum Virtual Machine that replicates Ethereum’s execution environment down to the bytecode. This allows developers to deploy dApps without modification and ensures that every tool in the Ethereum stack works out of the box. It is the difference between compatibility and equivalence, and Linea chooses the latter.

zk-SNARK Proof System

Linea uses zk-SNARKs to generate cryptographic proofs that validate batches of transactions. These proofs are succinct, non-interactive, and fast to verify, making them ideal for high-throughput environments. Unlike optimistic rollups, which rely on fraud proofs and challenge periods, zk-SNARKs offer instant finality and airtight security.

Canonical Message Service

This is Linea’s bridge and messaging stack, enabling seamless communication between Linea and Ethereum. It uses Postbots, decentralized actors that listen for contract calls and relay messages across chains. The system is designed to be censorship-resistant and will eventually be fully decentralized.

Lattice-Based Cryptography

Linea incorporates lattice-based cryptography to future-proof its security against quantum attacks. This cryptographic approach is faster, more resource-efficient, and significantly harder to break than traditional elliptic curve systems. It is not just secure. It is post-quantum secure.

Linea Bridge

The Linea Bridge allows users to transfer assets between Ethereum and Linea with minimal friction. It leverages zero-knowledge proofs to ensure that cross-chain transactions are secure, fast, and cost-effective.

What Problems Does It Solve?

Linea addresses several fundamental challenges facing Ethereum and the broader blockchain ecosystem. This includes:

- Scalability – Ethereum struggles with transaction throughput, limiting the usability of high-demand dApps. Linea’s zk-rollups increase capacity dramatically, enabling thousands of transactions per second.

- High Fees – Gas costs on Ethereum can become prohibitive during network congestion. By processing transactions off-chain and batching them, Linea reduces fees by up to 99 percent.

- Slow Confirmation Times – Optimistic rollups often require multi-day finality periods, frustrating users. Linea’s zk-SNARK proofs enable near-instant withdrawals.

- Developer Friction – Other Layer 2s require code rewrites or adaptation to their unique environments. Linea’s full EVM equivalence allows developers to port applications without modifications.

- Value Retention – Many Layer 2 solutions fail to channel value back to Ethereum, weakening the mainnet ecosystem. Linea integrates ETH staking and token burn mechanisms to reinforce Ethereum’s economic model.

- Security Concerns – Linea combines zk-rollups, zk-SNARK proofs, and lattice-based cryptography to ensure transactions are both private and resilient against emerging threats, including quantum computing.

Utility and Offerings

Linea is an ecosystem of products and incentives designed to attract developers, users, and liquidity. Key utility offerings include:

LINEA Token

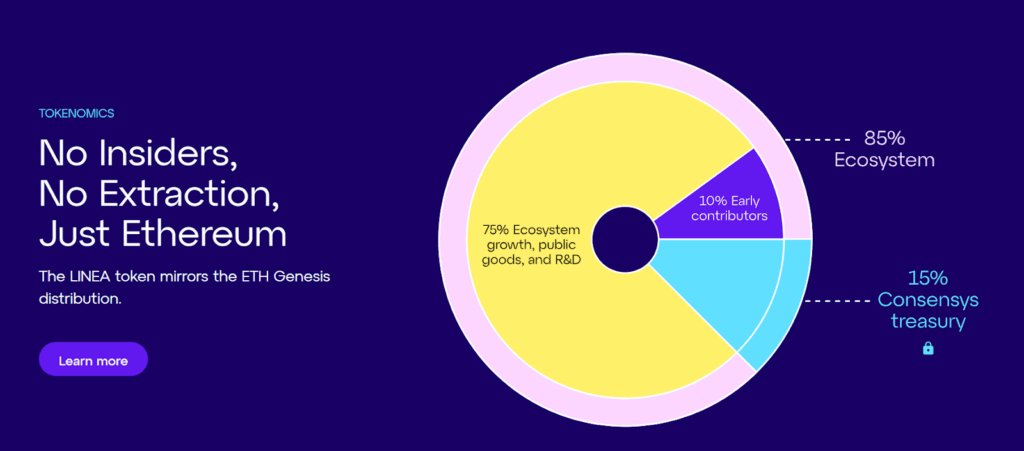

The LINEA token powers the network’s incentive structure. It is used for transaction fees, liquidity rewards, and governance. With a total supply of 72 billion tokens, LINEA is distributed with zero allocation to insiders or venture capitalists.

Ecosystem Fund

The Linea Consortium manages a long-term fund supporting dApp development, liquidity incentives, and community engagement. By allocating 75 percent of ecosystem tokens to growth initiatives, the fund ensures sustainable expansion and incentivizes high-value contributions from developers and users alike.

Staking and Governance

Linea plans to introduce staking mechanisms that allow users to earn rewards and participate in protocol governance. Token holders will be able to vote on proposals and network upgrades, ensuring that Linea remains community-driven.

Developer Tools and Integration

Linea integrates seamlessly with Ethereum-native tools including MetaMask, Truffle, Hardhat, and Foundry. This eliminates friction in migration, accelerates dApp deployment, and ensures developers can leverage familiar workflows.

Key Milestones and Highlights

Linea’s ecosystem is rapidly growing, featuring over 100 integrated projects spanning DeFi, NFT platforms, gaming, and cross-chain solutions. Notable projects include Owlto Finance, Mendi Finance, EchoDEX, Zonic, and HAPI. Moreover, institutional interest is robust, with funding from Microsoft, Coinbase Ventures, SoftBank, Temasek, and Animoca Brands exceeding $725 million.

In addition to this, adoption metrics show millions of users engaging with testnet and mainnet infrastructure, while TVL across Linea DeFi applications has surpassed $1 billion. Overall, the combination of institutional backing, community participation, and developer-friendly architecture positions Linea as a serious contender in the competitive zkEVM landscape.

Roadmap and Plans Ahead

Linea’s roadmap is divided into five phases, each building toward full decentralization and trust minimization. This includes:

- Phase 1 – Currently underway, this phase focuses on open-sourcing the codebase under AGPL-3.0 and achieving 100 percent EVM opcode coverage.

- Phase 2 The next phase will diversify the Security Council and introduce censorship-free withdrawals. This will prevent any single aggregator from blocking transactions and give users full control over their assets.

- Phase 3 – Linea will decentralize validators and expose governance to the community. This will reduce trust assumptions and increase network resilience.

- Phase 4 – The final phase will deploy multiple zkEVM proof sources and limit governance to essential upgrades. The Security Council will act only in cases of systemic risk or inconsistency.

- Final Phase – Expect staking, expanded validator pools, and deeper integration with Ethereum 2.0.

Final Thoughts

In conclusion, Linea represents a bold and comprehensive approach to Ethereum scaling, combining zero-knowledge rollups, full EVM equivalence, and a community-first token model. With its aggressive roadmap, robust architecture, and focus on user and developer adoption, Linea is positioning itself as a leading Layer 2 solution for secure, scalable, and efficient Ethereum transactions. So, as adoption grows and its ecosystem expands, it will be interesting to observe how Linea shapes the future of decentralized applications, DeFi, and multi-chain interoperability across the Ethereum landscape.