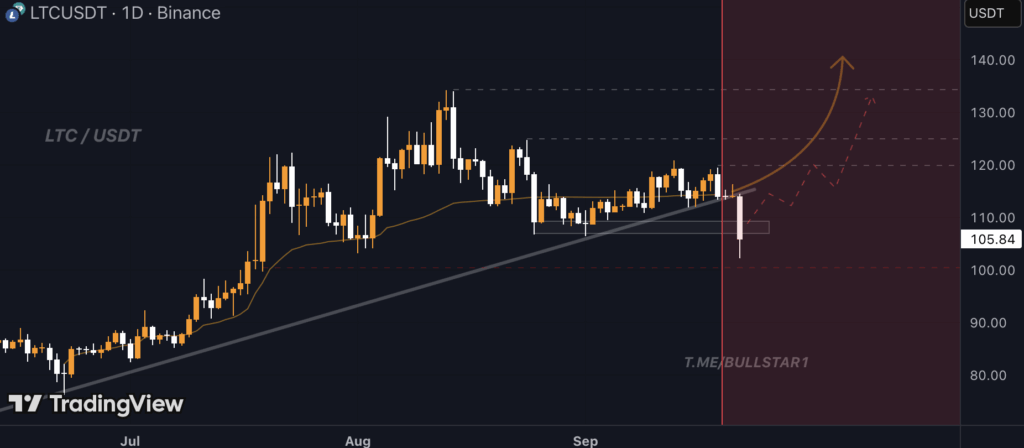

- Litecoin (LTC) rebounded strongly from $111 support, with analysts eyeing a rally toward $130–$140 if bullish momentum holds.

- Whale wallets accumulated over 181,000 LTC following Grayscale’s ETF filing, signaling strong institutional interest.

- Key supports sit at $110 and $105, while resistance at $120 and beyond could unlock higher targets.

Litecoin is making noise again, bouncing off the $111 support zone and showing signs of real strength. The charts now point toward a potential rally into the $130–$140 range, which could come sooner rather than later if momentum keeps up. After weeks of sideways chop, LTC is finally showing some resilience, holding its long-term ascending trendline and building higher lows. Analysts note that whales have been quietly stacking, which usually signals rising confidence among bigger investors.

Smart Money Piling Into Litecoin

Institutional players are starting to take Litecoin seriously, and recent activity proves it. News of Grayscale’s Litecoin ETF filing sent shockwaves through the market, with whale wallets adding over 181,000 LTC in just one day. Within hours, blockchain data flagged 349 transactions—each worth over $1 million—hinting at strategic positioning rather than retail hype. Big money tends to move before regulatory catalysts, and this sudden surge in whale accumulation suggests they’re betting on a strong upside if the ETF clears approval.

Litecoin’s bullish case right now rests on three main pillars: the growing ETF narrative, its long-standing “digital silver” reputation as Bitcoin’s cheaper counterpart, and a technical setup that’s lining up almost perfectly. With whales moving in and retail watching closely, the stage feels set for a bigger push.

Technical Outlook: Key Levels to Watch

From a technical view, the next resistance lies around $120, with $130–$140 becoming realistic mid-term targets if buyers keep control. On the downside, traders are eyeing $110 and $105 as critical support levels. A clean break below could open the door to $95–$100, so risk management here is essential.

Looking back, LTC has a history of grinding through long accumulation phases before sudden rallies. Similar setups after deep corrections in 2018 and 2022 paved the way for multi-month moves higher. Current signals—MACD crossovers, rising volume, and breakouts forming—line up with those past cycles, fueling optimism that this breakout may be real.

Final Thoughts on Litecoin’s Momentum

Litecoin’s story right now is one of cautious optimism. The ETF buzz is pulling in institutions, technicals are leaning bullish, and higher lows are stacking up on the chart. If LTC can stay above $111 and push through resistance with convincing volume, the $130–$140 range is absolutely within reach. Still, traders are wise to stay sharp—any slip under $105 could flip the script quickly. For now though, Litecoin looks like it’s gearing up for another chapter in its “digital silver” narrative.