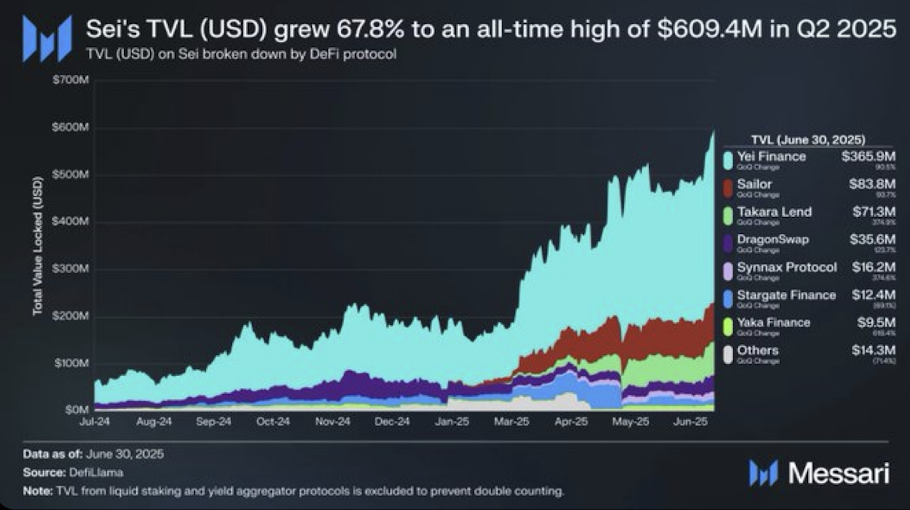

- Sei’s TVL surged 67.8% in Q2 2025, hitting an all-time high of $609.4M.

- Protocols like Yei Finance, Sailor, and Takara Lend dominate liquidity inflows, while smaller apps add healthy distribution.

- Technical analysts eye a triangle breakout, with upside projections targeting the $1.10 range if momentum holds.

Sei has quietly been carving out its place in DeFi, and now the numbers are starting to speak for themselves. In Q2 2025, the chain’s total value locked (TVL) jumped nearly 68%, hitting a fresh all-time high of $609.4 million. For a network still considered young compared to Ethereum or Solana, that’s no small feat.

A big part of this surge came from protocols like Yei Finance, Sailor, and Takara Lend. Together, they pulled in the bulk of the liquidity rushing into the chain. One analyst even remarked on X that Sei is finally showing what “real traction” in DeFi looks like — and it’s hard to argue with that assessment.

Capital Flows Show Healthy Distribution

Messari data shows Yei Finance leading the pack with a massive $365.9 million in TVL — more than half the network’s locked value. Sailor comes in at $83.8M, while Takara Lend holds $71.3M. Smaller players like DragonSwap ($35.6M) and Synnax Protocol ($16.2M) are also contributing, rounding out a more diverse picture of Sei’s DeFi growth.

This spread of liquidity across multiple protocols is an encouraging sign. Instead of one project dominating the chain, adoption looks more balanced. That kind of diversification usually points to stronger, more sustainable growth rather than a hype-driven pump that fizzles out quickly.

Market Data Backs the Expansion

Zooming out, Sei’s broader market stats tell a similar story. At around $0.32 per token, Sei currently sits at a $1.94 billion market cap, ranked 82nd among crypto assets. Daily trading volume remains healthy at $104 million, even though the token slipped about 1.4% over the past day.

With 6.12 billion tokens circulating, Sei has a wide distribution that supports accessibility, while liquidity is deep enough to handle new inflows. Combine that with the $609M TVL milestone, and it looks like adoption is steadily turning into on-chain activity and locked capital.

Technicals Hint at a Breakout

From a trading perspective, Sei has been consolidating around $0.32, with analysts spotting a descending triangle pattern that often sets up for a breakout. Mister Crypto, a popular trader on X, shouted in all caps: “$SEI BREAKOUT INCOMING!” — which, love him or not, shows how closely this coin is being watched.

If Sei manages to crack through its upper resistance, the chart suggests a possible run toward $1.10. That’s a bold call, but not impossible given how fast momentum can flip in DeFi tokens. Of course, volatility is still high and moving averages have been mixed, so traders are waiting for real confirmation before piling in.