- Rex Shares launched the first U.S. XRP and Dogecoin ETFs on CBOE, marking a milestone for institutional crypto adoption.

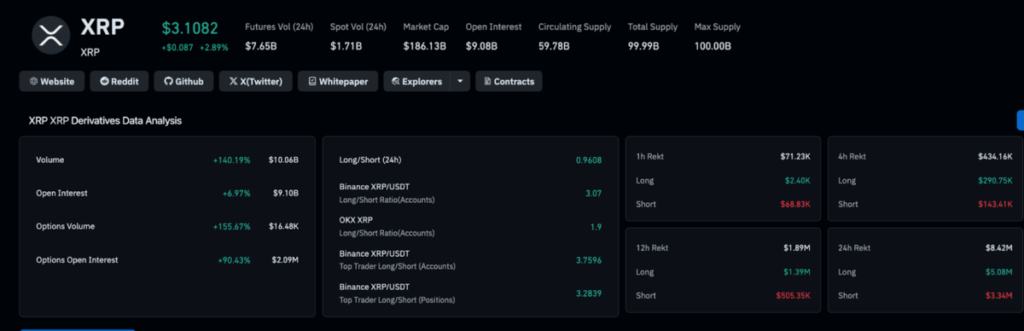

- XRP futures trading volumes jumped 140% to $10B, with open interest up 6.7% to $9B, signaling strong new inflows.

- A decisive close above $3.10 could trigger a breakout toward $4, similar to Solana’s ETF-driven surge earlier this year.

Ripple’s XRP just crossed a fresh milestone, brushing past $3.10 after Rex Shares launched the first-ever U.S. XRP ETF on the CBOE exchange. The timing couldn’t have been sharper, coming right after the Fed’s rate cut on Wednesday, which already had markets buzzing. While XRP’s spot price only moved up around 5% this week, derivatives activity is hinting at something far bigger lurking around the corner.

Rex Shares Brings XRP and Dogecoin ETFs to Market

On Thursday, Rex Osprey rolled out the very first U.S.-listed ETFs tied to Spot Dogecoin and Spot XRP. Trading under the tickers DOJE and XRPR, the products give investors direct exposure to these cryptos through spot holdings and related exchange-traded products. CBOE, one of America’s biggest exchanges, confirmed the listings in an official announcement. For Rex Osprey, this isn’t uncharted territory—its Solana ETF recently raked in $300 million in just three months, fueling a 68% jump in SOL’s price.

XRP Futures Flash Bullish Signs

The real story is in derivatives. In just 24 hours, XRP futures trading volumes exploded 140% to $10 billion, while open interest climbed 6.7% to $9 billion, according to Coinglass. That’s not just noise—it’s fresh capital coming into play. Open interest rising faster than spot price suggests the rally isn’t just speculation but backed by actual inflows. Plus, daily trading volume outpacing open interest shows an intense tug-of-war between profit takers and new buyers, with bulls soaking up the selling pressure.

What’s Next for XRP

If XRP can decisively close above $3.10, traders are eyeing a potential run toward $4, powered by ETF inflows and institutional adoption. That path mirrors Solana’s breakout after Rex Osprey’s ETF launch earlier this year. For now, XRP lags behind other altcoins like Avalanche and Sui, which posted double-digit gains after the Fed’s cut—but derivatives metrics suggest XRP could just be warming up.