- XRP ETFs could attract $8 billion in inflows during year one, with odds of October approval now above 90%.

- Ripple is gaining traction in stablecoins and RWA tokenization, strengthening long-term fundamentals.

- Technicals remain bullish, with XRP holding above the 100-day EMA and targeting $4.29 if ETF approvals spark momentum.

XRP is sitting right on the edge of what could be its biggest breakout in years. With the countdown ticking toward final approvals for spot XRP ETFs, Ripple’s price has been holding steady at the critical $3 support level. Traders are watching closely, and now, some big names in the industry are making bold calls about what’s coming next.

XRP ETFs Could See $8 Billion in First-Year Inflows

Kris Marszalek, the CEO of Crypto.com, dropped a huge prediction this week—he expects spot XRP ETFs to pull in about $8 billion in inflows during their first year. That number matches estimates from JPMorgan analysts, who also suggested Solana ETFs could see $6 billion in the same timeframe.

It may sound ambitious, but history suggests it’s not unrealistic. Spot Ethereum ETFs have already raked in $13 billion within 15 months of launch. If XRP ETFs do hit $8 billion, it would equal around 4.4% of its total market cap—nearly double the relative share Ethereum ETFs pulled in compared to ETH’s size.

The SEC is reviewing ten different XRP ETF filings from major players like Bitwise, WisdomTree, Franklin Templeton, 21Shares, and Canary Capital. Deadlines for decisions are coming fast—October 18, 19, and 29—meaning multiple funds could get the green light all at once. Betting platform Polymarket now gives XRP ETFs over a 90% chance of approval in October.

This setup has traders leaning bullish into the decision window. But as always in crypto, some warn of a “sell the news” dip if the hype cools off after approvals hit.

Ripple Expands into Stablecoins and RWA

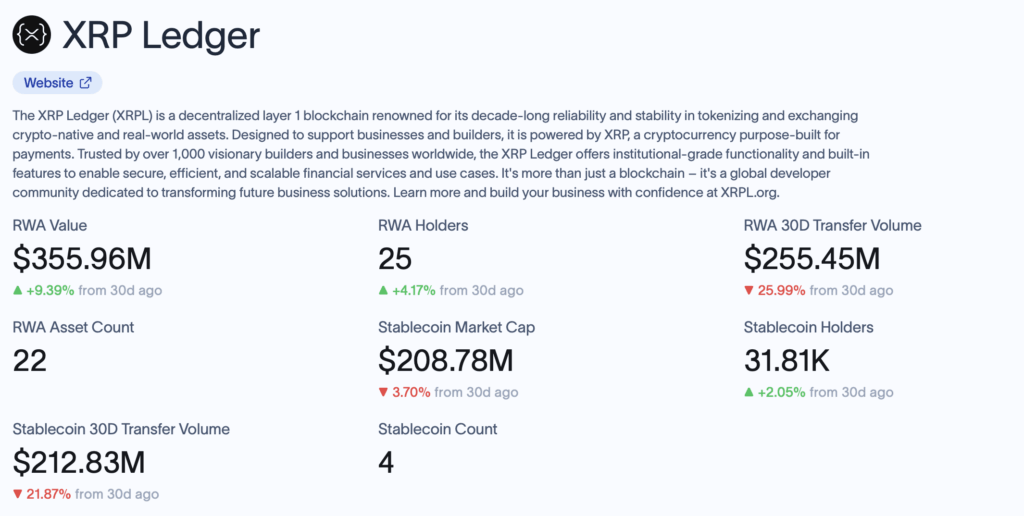

Beyond ETFs, Ripple has been carving a strong foothold in two of the hottest sectors of crypto right now: stablecoins and real-world asset (RWA) tokenization. Data from RWA.xyz shows the XRP Ledger now ranks as the tenth largest player in RWA, with over $294 million in assets—a 10% jump in just a month.

Projects like VERT Capital, RLUSD, and OpenEden Digital are leading the charge on the XRP Ledger, helping it emerge as a serious player in tokenized finance. At the same time, Ripple USD (RLUSD) has exploded to a $730 million market cap, putting it among the fastest-growing stablecoins in the industry.

Much of this momentum came after the U.S. passed the GENIUS Bill, giving clearer legal ground for regulated stablecoins. Analysts see Ripple’s dual growth in RWAs and stablecoins as a long-term strength that complements the ETF narrative.

XRP Technical Analysis: Bullish Setup Intact

From a charting perspective, XRP looks set for action. It continues to hold above its 100-day EMA, which has acted as solid support since mid-summer. More importantly, the coin has broken out of a bullish pennant formation and appears to be retesting the breakout zone—a classic continuation signal.

On top of that, XRP is creeping above the Ichimoku cloud, another bullish technical marker. If momentum builds around ETF approvals, analysts expect a push toward the Murrey Math overshoot level near $4.29. A move like that would signal renewed investor confidence and could reset the narrative for XRP heading into Q4.