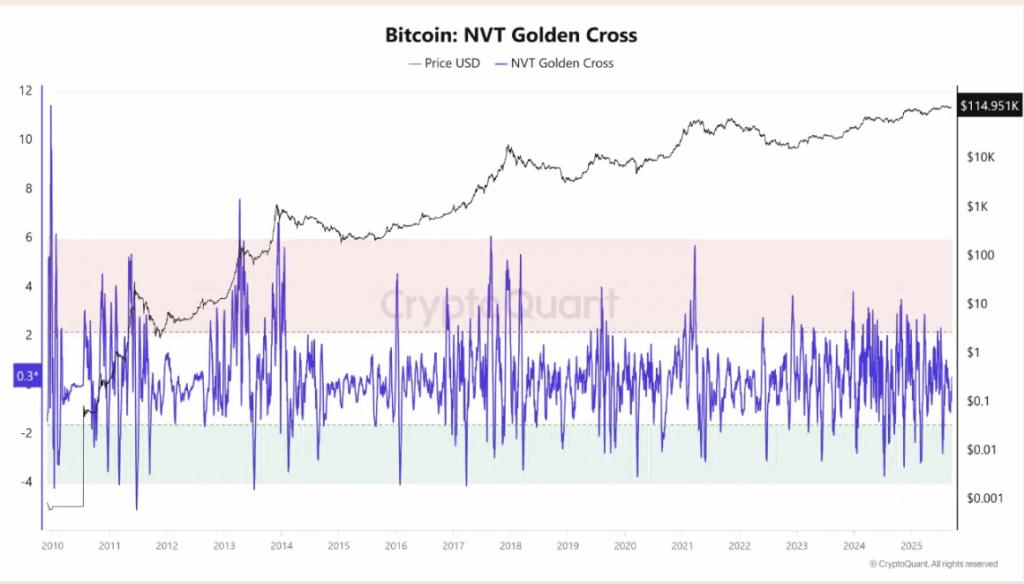

- Bitcoin’s NVT Golden Cross at 0.3 signals healthy growth potential without overheating.

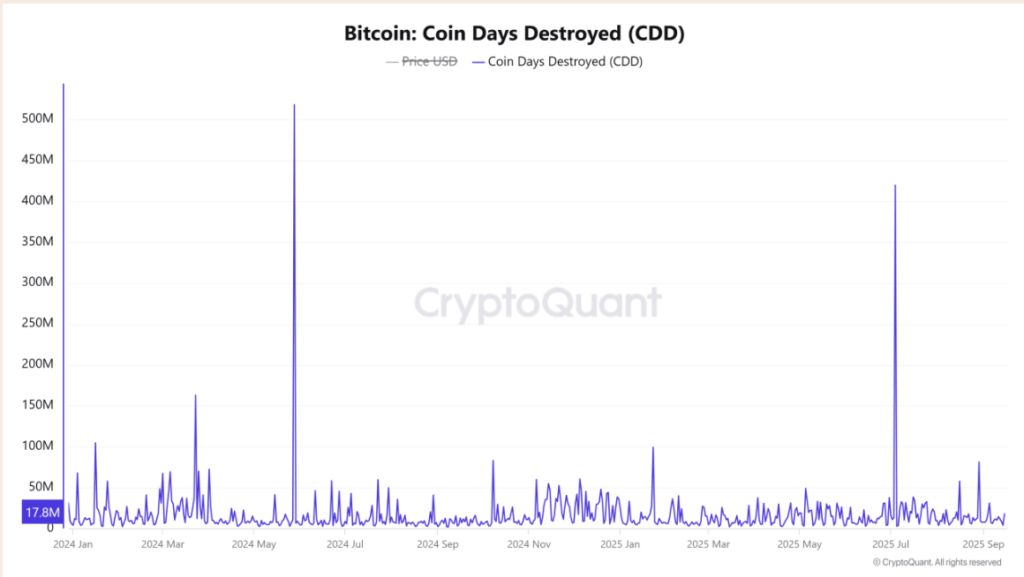

- Exchange inflows and rising CDD hint at cautious profit-taking by long-term holders.

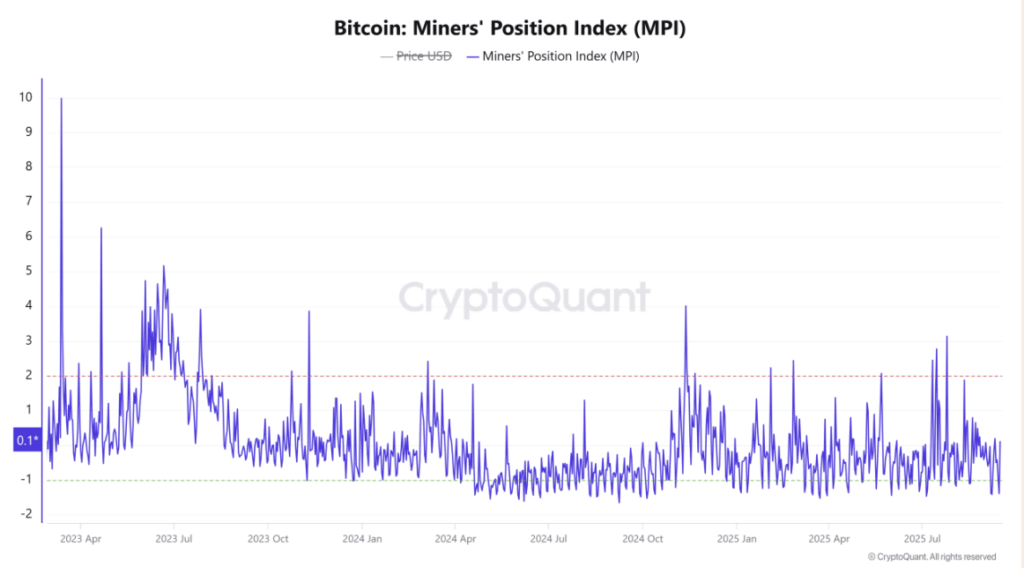

- Miners’ selling pressure stays minimal, supporting BTC’s push toward the $150K range.

Bitcoin’s rally isn’t running too hot just yet, though a few early signs of caution are creeping in. The NVT Golden Cross sits at 0.3 right now — a neutral level. That basically means BTC has room to grow without tipping into speculative excess. Historically, readings above 2 have screamed “cycle top,” while deep negatives marked accumulation zones. Sitting in the middle gives the market some breathing room, but traders are still watching closely.

This zone has lined up with past expansions, suggesting there’s fuel left in the tank. Still, it’s not a one-way street, and longer-term holders shifting behavior could start to tilt the balance.

Exchange Inflows Point to Subtle Profit-Taking

On-chain signals are hinting at quiet moves behind the curtain. Exchange Inflow CDD ticked up 3.17%, showing that older, long-held coins are finally making their way onto exchanges. When veteran wallets wake up like this, it usually means profit-taking is in play.

The increase isn’t huge — more like a cautious shuffle than a stampede — but history shows these moves often happen before corrections. Right now, it looks more like repositioning than full-on distribution, which leaves room for BTC’s upward grind to continue a bit longer.

Coin Days Destroyed Rises, Dormant Coins Come Alive

Coin Days Destroyed (CDD) climbed nearly 6%, showing a slight rise in long-term holders spending coins. CDD is one of those deeper metrics that doesn’t just track transactions but measures the age-weighted activity of coins. In short, it tells you when the old money starts moving.

In previous cycles, spikes in CDD often came before volatility — since fresh supply hits the market. But today’s jump doesn’t match the extreme levels seen before major sell-offs. More likely, this reflects healthy rotation, though it could tip into riskier territory if the trend accelerates.

Miners’ Index Spikes but Remains Calm

Interestingly, miners aren’t adding pressure despite a sudden surge in the Miners’ Position Index, which spiked 150% in 24 hours. Even with that jump, MPI sits at just 0.10 — far from danger levels. High readings here usually suggest miners are about to dump into strength, but the current level implies they’re holding back.

This restraint is keeping supply-side risk low and gives bulls more confidence. For now, miners seem content to let the market climb rather than flooding exchanges with fresh supply.

Outlook: Room to Grow Toward $150K, but Keep an Eye on Old Coins

Putting it all together, Bitcoin looks balanced — neutral NVT Golden Cross, modest profit-taking from long-term holders, and miners largely sitting on their reserves. The broader structure still favors upside momentum, with $150,000 targets not out of reach.

The only real caution comes from dormant coins waking up, a signal that sometimes precedes turbulence. If inflows accelerate, the rally could wobble, but for now, the market seems positioned for more growth rather than collapse.