- TRON gas fees cut 60%, dropping average fees to $0.59, the lowest since 2024.

- Whale transactions made up 86% of USDT volume, fueling network growth.

- TRON outpaces Ethereum in stablecoin settlements, with higher average transaction sizes.

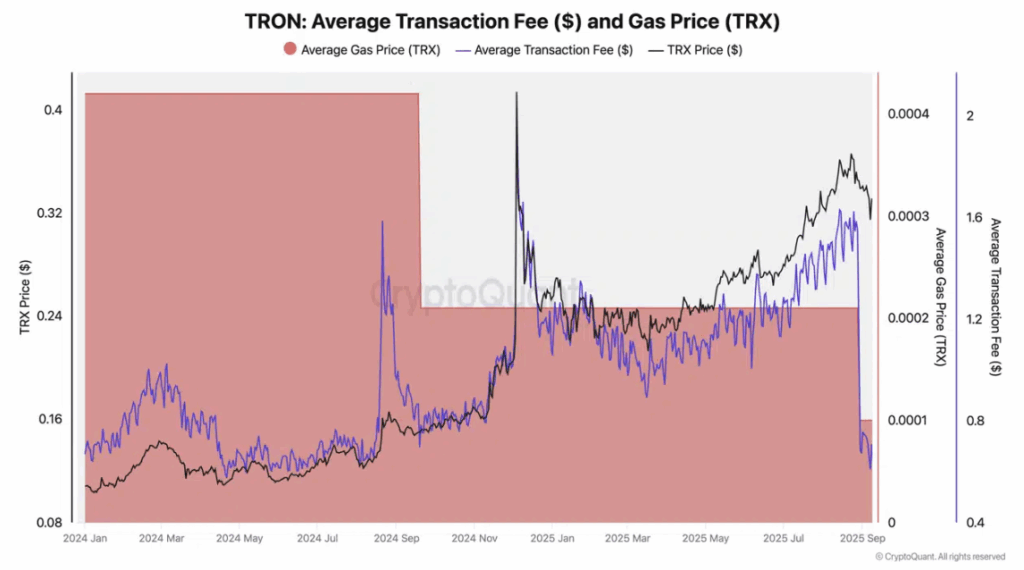

On August 29, the TRON (TRX) network made a historic move by reducing its transaction gas price by 60%, lowering the energy unit from 210 sun to 100 sun, according to CryptoQuant Research. This drop brought average fees to just $0.59 by September 8, the cheapest level since April 2024.

The fee cut did have one downside—network revenue fell from $13.9M daily before the change to around $5M by September 7. Still, cheaper costs have spurred activity and positioned TRON as one of the most cost-efficient blockchains for stablecoin transfers.

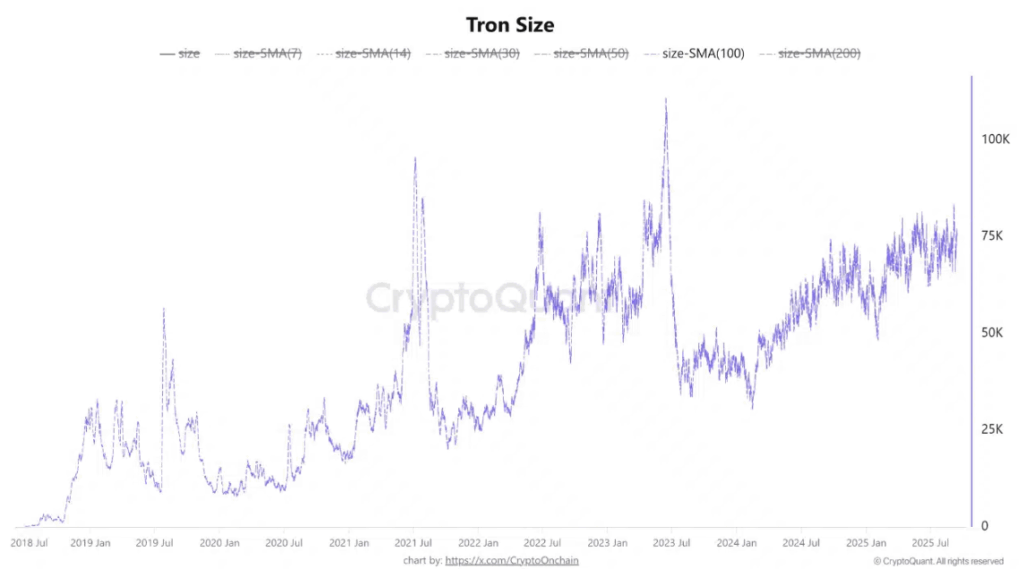

TRON Network Activity Reaches Multi-Year Highs in Transactions

Despite lower revenue, on-chain growth has been strong. The 100-day moving average of block size surged to its highest since July 2023, reflecting a steady rise in data and transaction volume. TRON has also been handling nearly 11M transactions daily, close to its historic highs, signaling consistent adoption.

This kind of organic growth suggests that TRON isn’t just benefiting from lower fees—it’s seeing real demand and usage.

Whale Transactions Dominate TRON Stablecoin Transfers

Whales are playing a major role in TRON’s growth. On September 12, analyst Darkfost revealed that 86% of USDT transfers on TRON came from transactions above $100k. This “institutional grade” activity shows large players are heavily relying on TRON for settlement.

Such dominance underscores TRON’s role as the leading network for USDT transfers, particularly in cross-border payments and large-scale remittances.

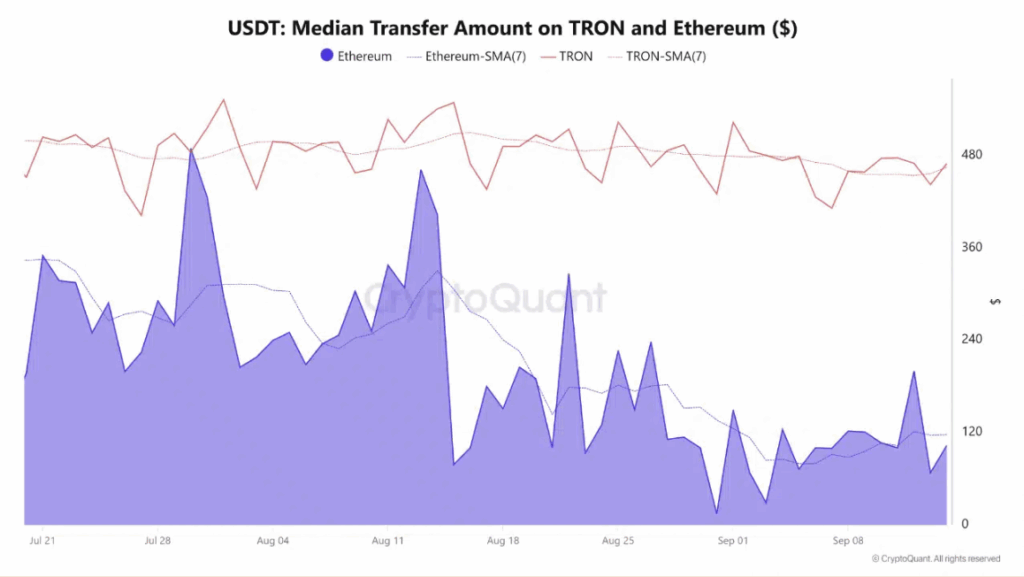

TRON vs Ethereum: Stablecoin Settlement Shows Big Advantage

A clear gap has opened between TRON and Ethereum in USDT usage. The average USDT transaction size on TRON sits at $465 (7-day SMA), while Ethereum averages just $117.

Ethereum’s average has been falling, likely tied to smaller DeFi-related transactions. TRON, on the other hand, has maintained steady transaction sizes—proving itself as the go-to blockchain for large-scale stablecoin settlement.

TRON Price Outlook Strengthened by Stablecoin Growth and Adoption

TRON’s combination of lower fees, rising whale activity, and strong on-chain growth paints a bullish picture for TRX. With over 75% of USDT supply circulating on TRON and institutional players increasingly relying on its network, TRON is solidifying its role as the backbone for stablecoin transactions.

If momentum continues, the network’s adoption could translate into further upside for TRX price in the months ahead.