- Cardano bulls see $3.50 as achievable, backed by Voltaire, DeFi growth, and whale accumulation.

- Bears warn of slow development, centralization concerns, and tough competition from ETH and SOL.

- The Voltaire upgrade is the make-or-break moment that could define ADA’s long-term future.

Cardano (ADA) is sitting at a crossroads, its price caught in a tug-of-war that could swing either way. On one hand, bulls are eyeing a massive breakout toward $3.50, fueled by technical strength, upgrades, and whale demand. On the other, critics point to slow development, fierce rivals, and a shaky global backdrop that could drag everything lower.

Right now, the stakes couldn’t be higher. For ADA, the promise of the Voltaire era collides with the reality of competition and market pressure.

Why Bulls Believe Cardano Price Could Soar

Optimists see a three-pronged case for ADA. First, the long-awaited Voltaire era is finally rolling out. Through the Chang hard fork, power is shifting from developers to the community, ending with the symbolic destruction of Cardano’s “genesis keys.” This governance shift is designed to cement trust and decentralization. The last time Cardano introduced a big upgrade—Alonzo in 2021—ADA doubled in weeks. Bulls are betting Voltaire could spark something similar.

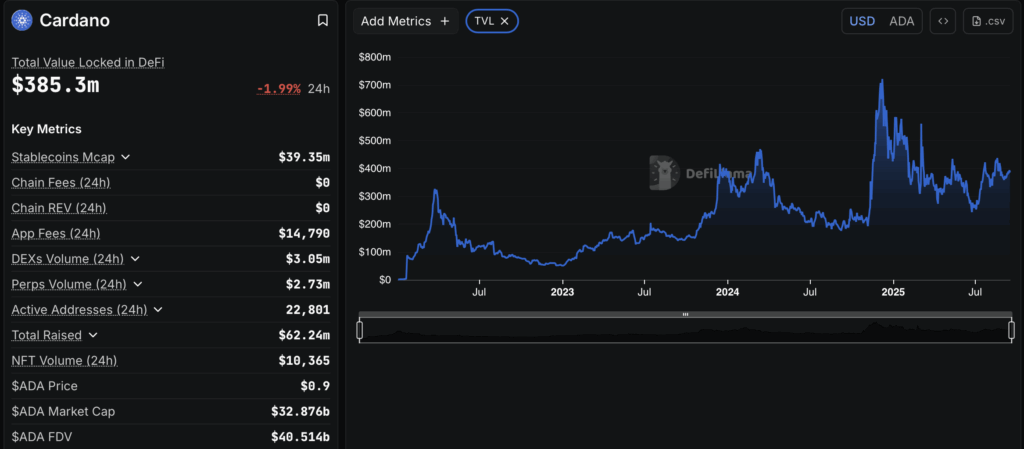

Second, Cardano’s DeFi ecosystem is no longer an afterthought. Total Value Locked has exploded past its old sub-$100M lows, with dApps like Minswap and Indigo driving real usage. The last time TVL jumped 270% in late 2024, ADA followed with a 300% price run. Traders see history setting up to repeat.

And third, big money is moving in. On-chain data showed whales grabbing 180M ADA worth $160M in just two days this August. Add another $73M from institutions and a 30% rise in custody balances, and it’s clear smart money is betting on ADA’s future. Derivatives data backs this up too, with Open Interest climbing and funding rates leaning bullish.

Cardano Price Technical Analysis: Key Levels to Watch

At the time of writing, ADA is hovering near $0.93, a level that lines up with the 0.618 Fibonacci retracement zone—a notorious resistance line. A clean breakout here could pave the way to $1.019, and possibly $1.166 if momentum snowballs.

Indicators are supportive: Parabolic SAR remains bullish, and momentum looks intact. The only challenge is whether buyers can sustain enough pressure to break through resistance without triggering another sharp pullback.

A move above $1.00 would be more than psychological—it could be the start of a bigger run. But hesitation here risks another round of sideways drift.

The Bear Case: What Could Kill Cardano’s Rally

For all the optimism, ADA still faces the same criticisms it’s carried for years. Its careful, peer-reviewed approach to upgrades is seen by many as painfully slow, especially compared to fast-moving rivals like Solana. That’s where the “ghost chain” label comes from—critics argue the network doesn’t reflect real-world use despite its promises.

Centralization concerns also remain. Until Voltaire is fully executed, Input Output Global still holds the keys. Any hiccup in this transition will only deepen skepticism. Meanwhile, Ethereum dominates DeFi, and Solana is crushing daily activity metrics. Cardano is fighting giants that are growing just as fast—if not faster.

And then there’s the macro picture. Rising interest rates, shaky global markets, and Bitcoin’s volatility all weigh heavily. If Bitcoin sneezes, ADA almost always catches a cold. Regulation is another wildcard: the SEC labeled ADA a security, kicking it off some U.S. exchanges, but in Europe, its MiCA compliance work may turn into an advantage.

Cardano’s Final Test: Can Voltaire Deliver?

A $3.50 ADA would push Cardano’s market cap near $128B, on par with Solana and BNB. The bull case is compelling: decentralized governance, rising DeFi usage, and whales stacking tokens. But the risks are just as real: slow execution, fierce competition, and shaky global sentiment.

At the end of the day, everything comes down to execution. If Voltaire launches smoothly and genuinely transfers control to the community, it could silence critics and mark the start of a new growth phase. But if delays or setbacks hit, Cardano’s reputation for being “too slow” might prove fatal.