- Tron price surged from $0.29 to $0.35 as whale dominance returned, with 86% of USDT flows driven by large transfers.

- Network activity is booming, with active accounts at 298M and daily transactions soaring past 11M.

- Both whales and retail are accumulating TRX, but overbought signals suggest potential volatility ahead.

Tron (TRX) has been on a steady climb since dropping to $0.29 last week. The coin has been moving inside an ascending channel, gaining more than 7% to touch a local high of $0.355 before easing slightly to $0.352 at the time of writing. The rebound didn’t just come from retail activity—bigger players are back in the mix.

According to CryptoQuant analyst Darkfost, whale activity on Tron has surged. On September 13, a staggering 86% of all USDT volume on the Tron network came from transactions over $100k. That level of dominance hasn’t been seen since 2023 and signals institutions and large holders stepping back in. Interestingly, this uptick came right after Tron’s Nasdaq introduction, which seems to have fueled deeper liquidity flows.

On-Chain Activity Shows Tron Adoption Is Growing

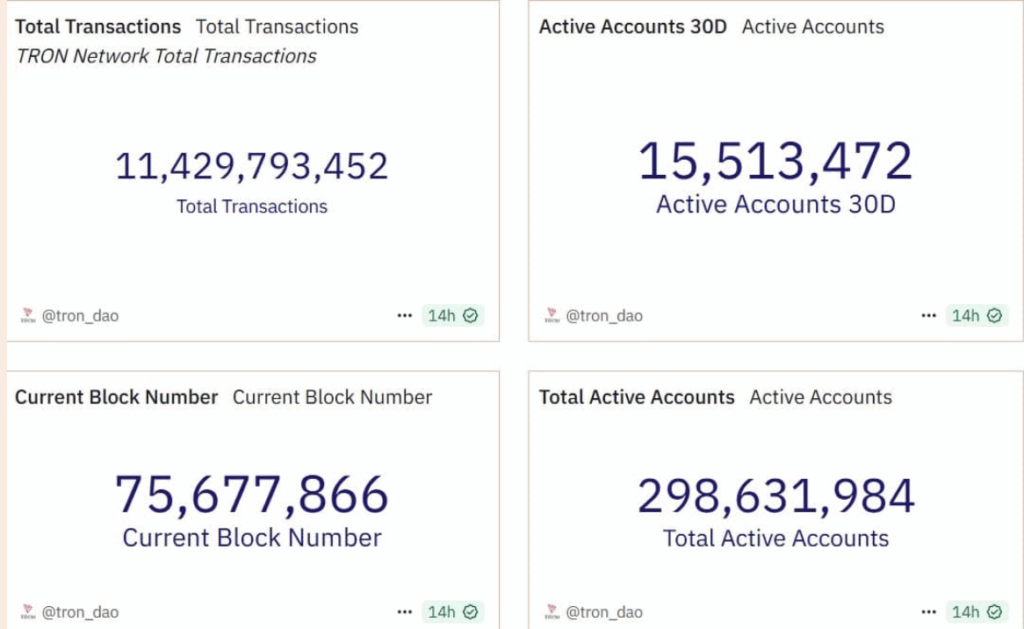

Beyond whales, the Tron network is buzzing with activity across the board. Data from Dune shows total active accounts have climbed to 298.6 million, with 30-day active accounts hitting 15.5 million. Daily transactions have skyrocketed too—jumping from around 4 million in 2023 to 11.4 million today.

This kind of growth in both accounts and transactions usually signals more than just hype—it points to sustained adoption. Historically, when usage metrics rise in tandem with price, it sets the stage for more stable upward momentum. Tron seems to be enjoying exactly that kind of setup right now.

Retail Investors Fuel Buy Pressure on TRX

Retail traders aren’t sitting this one out either. Coinalyze data shows TRX has seen strong buying pressure for five consecutive days. In the last 24 hours alone, Tron recorded $218.89 million in buy volume compared to $153.9 million in sell volume, giving a buy-sell delta of nearly $65 million.

This clear tilt toward accumulation reflects aggressive participation from smaller investors. Historically, when retail joins whales during accumulation phases, it often sparks stronger rallies, especially in assets trading near breakout levels.

TRX Technicals Point to Momentum and Volatility

With whales, retail, and network growth all firing at once, TRX is showing strong demand. The price jump from $0.29 to $0.35 lines up with this renewed energy. Indicators are also flashing momentum: TradingView data puts the RSI at 58, just nudging into bullish territory, while the Stochastic RSI has spiked to 99—deep in overbought conditions.

That mix of signals usually means two things: bulls have the upper hand, but volatility is likely around the corner. If the buying pressure sustains, TRX could keep pushing higher. Still, traders should watch for sharp swings as momentum indicators suggest both opportunity and risk.