- Gemini (GEMI) surged 24% in its Nasdaq debut, raising $425M at $28 per share, well above its initial target range.

- The IPO valued Gemini at $1.3B, highlighting strong institutional demand for crypto-related equities.

- Gemini’s listing joins a wave of hot crypto IPOs in 2025, with Circle and Figure also seeing massive first-day gains.

Gemini (ticker GEMI) made a loud entrance on Wall Street, kicking off its Nasdaq debut with fireworks as shares spiked more than 24% on day one. The Winklevoss twins’ exchange raised a hefty $425 million, adding fuel to what’s quickly turning into a full-blown crypto IPO boom.

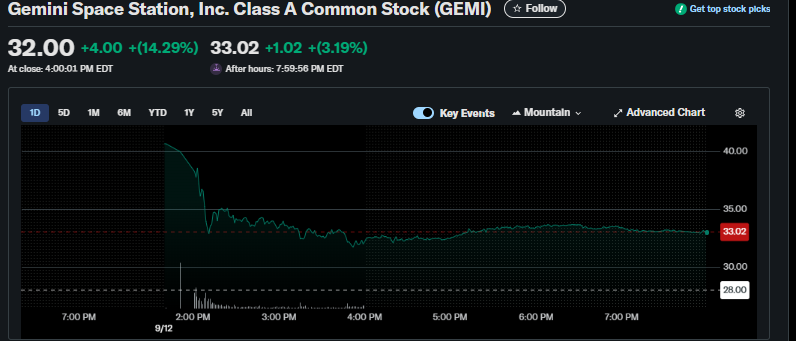

At one point Friday morning, GEMI shot past $40 before cooling off to around $35 by the afternoon. Even with the dip, the fresh listing still locked in a market cap near $1.3 billion—solid numbers for a platform that isn’t even one of the top exchanges by trading volume. Investors, clearly, are buying the story.

IPO Frenzy and Investor Hunger

Gemini priced its IPO at $28 a share, well above the $17–$19 whispers from earlier drafts. Demand was so strong the final range was pushed to $24–$26, and yet the stock still overshot. With 15.2 million shares floated, the twins walked away with $425 million raised, showing there’s no shortage of appetite for regulated U.S. crypto plays.

The timeline was fast, too. Gemini filed its S-1 with the SEC on September 2 and was trading on the Nasdaq just 10 days later. A sprint like that only happens when markets are hot, and right now, investors seem eager to latch on to anything tied to digital assets.

More Than Just Gemini—Crypto IPO Wave

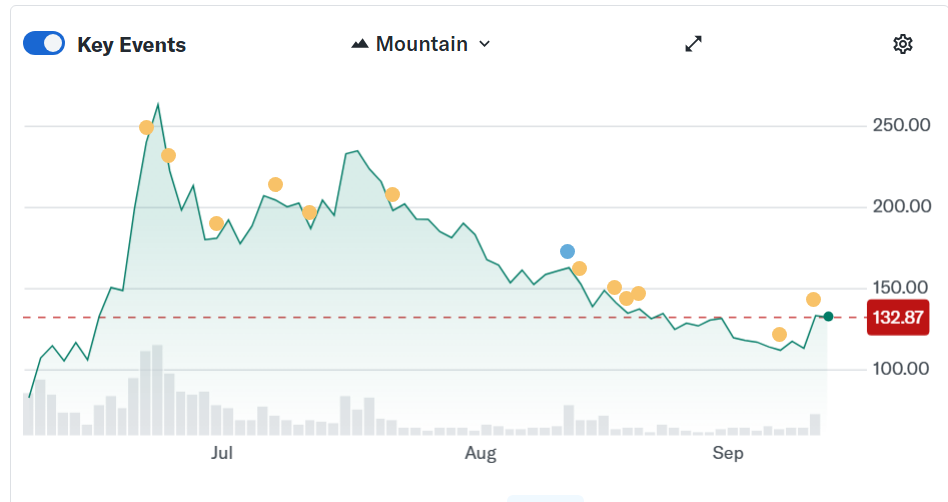

This isn’t an isolated case. Crypto IPOs have been red-hot in 2025. Stablecoin giant Circle (CRCL) has been the biggest headline grabber, with its stock soaring over 160% since launch and now trading above $60. That gives it a market cap north of $33 billion, putting it in rare company.

Then there’s Figure Technology Solutions (FIGR), which popped 24% on its first day, adding another 12% the next session. And even outside of straight IPOs, companies like Mega Matrix (MPU) are pivoting hard into crypto, unveiling multi-billion-dollar plans around stablecoins. Its stock has been whipsawing but is still up 150% in the past six months.

The Bigger Picture

For Gemini, the strong debut underscores two things: investor faith in regulated exchanges and the broader hunger for crypto equity exposure. While Bitcoin, Ethereum, and other tokens remain volatile playgrounds, public markets are signaling they want in on the upside too—only with ticker symbols and quarterly filings attached.

The Winklevoss twins might not run the biggest exchange, but Friday’s rally proved they’re still among the loudest names in the game.