- Risk management is your survival tool—set limits before chasing profits.

- Spot trading is safer for most; futures drain accounts if misused.

- A trading plan and calendar awareness will keep you ahead of the crowd.

Bull markets look easy on the surface—prices move up, coins pump, and everyone feels like a genius trader. But here’s the uncomfortable truth: 95% of newcomers still lose money in bull runs. Not because they didn’t buy the right tokens, but because they ignored the basics.

The reality is that success doesn’t come from complicated indicators or secret formulas—it comes from a handful of simple, repeatable habits that our Crypto 101 students master before placing their first trade.

If you can master the following five fundamentals, you’ll be better prepared than most of the crowd heading into the next cycle.

1. Set Your Loss Limit First—Before You Click Buy

Risk comes first. Always. Before you even think about how much money you could make, decide how much you’re willing to lose on a single trade. A good benchmark? Around 1% of your portfolio. That way, a normal market wick won’t wipe you out.

The mistake most people make is going too heavy on a “sure thing.” A small dip triggers panic or a forced stop, and suddenly they’re down 20–30% in one shot.

Example: On a $1,000 account, risking 1% means you’re prepared to lose $10 on a trade. That same -5% dip that destroys someone risking $200 only leaves you with a small scratch. Survive long enough, and you’ll thrive.

This mindset flips trading on its head: think about your worst-case scenario first. If you can live with that, then the trade makes sense.

2. Know What You’re Trading—Spot vs. Futures (and the Hidden Fees)

There’s a big difference between owning coins and trading contracts. Spot means you actually own the token. Futures means you’re borrowing leverage, often paying ongoing fees just to hold the position. And those fees add up faster than you’d think.

Plenty of traders bleed out by holding a futures contract in a sideways market. No major price move, yet their balance keeps shrinking. Worse, small moves in the wrong direction can wipe out an over-leveraged position completely.

Example: Buy on spot, and a flat week leaves you even. Buy on futures with 10× leverage, and you might get stopped out from nothing more than noise.

When the market chops, futures are dangerous. Spot is simpler, safer, and often smarter.

Want to master the fundamentals of crypto trading? Join our comprehensive FREE Crypto 101 course HERE

3. Don’t Chase Green Candles

It’s the oldest mistake in the book—FOMO buying right after a big breakout. Prices spike, Twitter explodes, and people rush in at the exact moment momentum is fading. Then comes the pullback, leaving late buyers holding the bag.

The better move? Wait. Great trades often come not at the top of a candle but after the market breathes, retests, and stabilizes.

Example: A coin spikes above yesterday’s high, rejects, and then later retests that same level as support. The patient trader enters there and rides the trend. The impatient one panic-buys the wick and sells in frustration minutes later.

Trading isn’t about catching every move—it’s about catching the right ones.

4. Watch the Calendar—News Drives Markets

Markets don’t move randomly. Major listings, protocol upgrades, token unlocks, or ETF headlines all spark huge swings in price. If you’re paying attention, you can be early. If you’re not, you’ll be the one buying after everyone else is already celebrating.

Example: A project rallies into a hyped event, then immediately dips when the news is officially announced. The smart money was in early and sold into the pump. The latecomers bought the top.

The lesson? Mark key events on a simple calendar, set alerts, and have a plan. Trade the buildup, not the afterparty.

Community Win: Our TradeHero members called the Solana breakout 3 days before it happened by tracking the lead up to an anticipated bullish Fed meeting. While others chased the move, our community was already positioned.

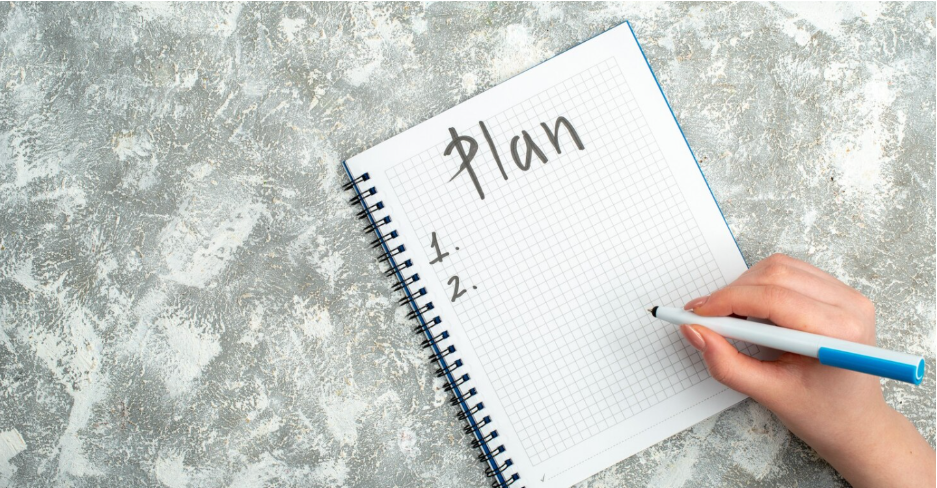

5. Have a One-Page Plan—And Stick to It

Here’s the biggest fundamental of all: write down your trade before you place it. Entry price, stop loss, and take-profit levels. Once it’s written, stick to it.

The mistake most people make is moving stops wider or “holding long-term” the moment a trade goes red. Small losses spiral into disasters.

Example: Two traders enter the same setup. One takes the small stop, waits, and re-enters later for a win. The other ignores the stop, holds through the drop, and sees their account bleed away. Same setup, totally different outcomes—all because of discipline.

Your plan isn’t just a guide—it’s a shield from your own emotions.

Learn These the Easy Way, Not the Expensive Way

You don’t need to reinvent the wheel. These five fundamentals—risk first, understand your product, don’t chase, respect the news cycle, and stick to a plan—are what keep you alive long enough to win. They aren’t glamorous, but they work.

The difference between profitable traders and the 95% who lose money isn’t luck—it’s education.

Our Crypto 101 course breaks down each of these concepts in detail, plus the psychological framework you need to actually implement them when money is on the line. From students who have completed the course, 73% report improved trading discipline.

The next bull run will mint winners and losers. The difference won’t just be luck—it’ll be who respected the basics. Master these now, before the market gets wild again, and you’ll be miles ahead of the traders who think they can wing it.

Ready to build your foundation the right way?

Start your crypto education with our free Crypto 101 course – Join thousands of students who chose education over gambling HERE

Already understand the basics? Join our TradeHero community where educated traders share signals, analysis, and support each other’s growth.