- Solana broke past $220 with over $17M in short liquidations, flipping resistance into support and reigniting bullish momentum.

- Price targets now sit around $238, $250, and potentially $300 if the rally continues to hold.

- Institutional buying, including Galaxy Digital’s $302M accumulation, is adding strong fuel to Solana’s uptrend.

Solana has pulled off a major move, smashing through the $220 level with a burst of energy that caught traders off guard. The breakout came hand-in-hand with over $17 million worth of short liquidations, forcing sellers to scramble and giving bulls fresh ammunition. After months of sideways action, this surge resets the chart and hints that Solana may finally be ready for another big leg upward. The momentum looks especially strong with activity being driven heavily through on-chain perpetuals, rather than centralized venues, adding a bit more conviction to the rally.

Short Liquidations Fuel Fresh Momentum

When SOL crossed $220 for the first time in eight months, it triggered a wave of liquidations that poured gasoline on the rally. Traders who had been betting against the token suddenly found themselves covering positions, pushing price even higher. Clearing $220 doesn’t just represent a number—it flips a crucial level of resistance into a base of support, shifting sentiment back into the bulls’ hands. If SOL can defend this zone, the next targets sit around $238 and $250, both of which historically acted as supply walls. Holding above $220 might very well set the stage for September to become one of Solana’s strongest stretches of the year.

Bulls Eye $300 as Trend Strengthens

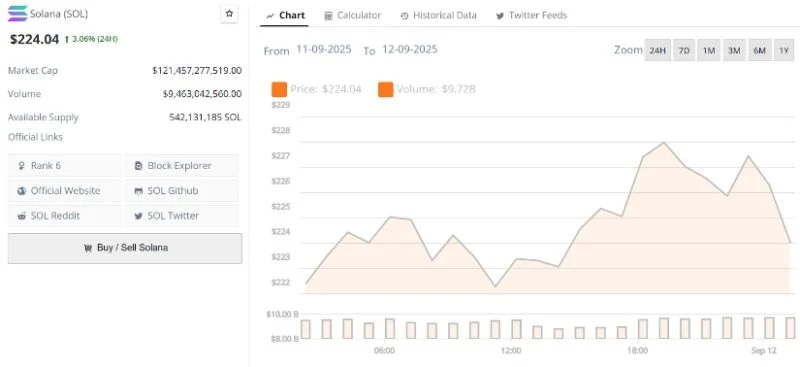

With the rally back in motion, analysts are already pointing toward $300 as the next big milestone for Solana. The token is hovering around $224 after its breakout, but the structure of the chart is what excites market watchers most. A clear sequence of higher lows has built up to this moment, the kind of setup that often drives extended runs. Should SOL manage to pierce through the $250 resistance, the pathway toward $280 and $300 starts to open up. This pattern has bulls confident that Solana isn’t just bouncing, but actually gearing up for something more sustained.

Technical Setup and Institutional Interest

On a technical level, Solana has flipped the $216 region from resistance into support, giving it a solid floor to work from. The next test looms at $238, and if that breaks cleanly, prior highs come back into play. Analysts like Lennart Snyder suggest any pullbacks into $216 may actually strengthen the rally, offering bulls a chance to reload before the next wave. Adding fuel to the fire, Galaxy Digital has been buying aggressively—scooping up over 1.35 million SOL worth $302 million in just half a day. That kind of institutional appetite doesn’t just move charts—it builds long-term conviction that Solana might be pressing into a whole new phase.