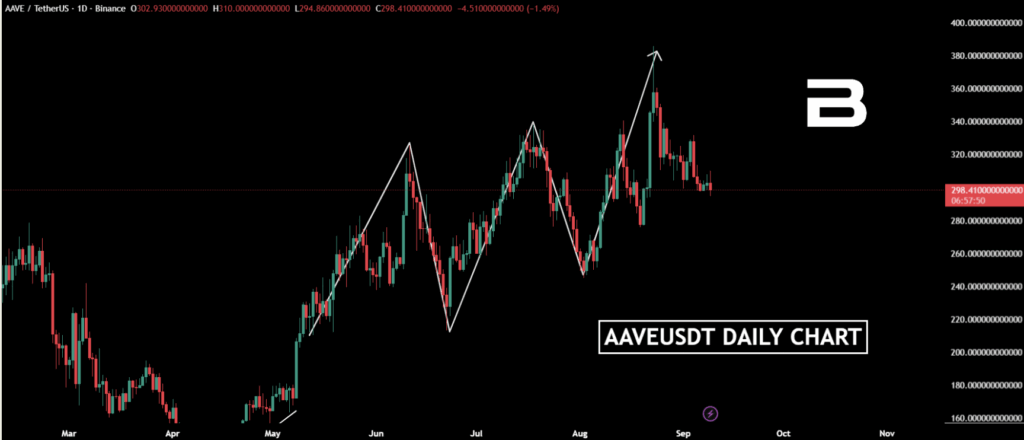

- AAVE trades near $297 with bullish momentum intact.

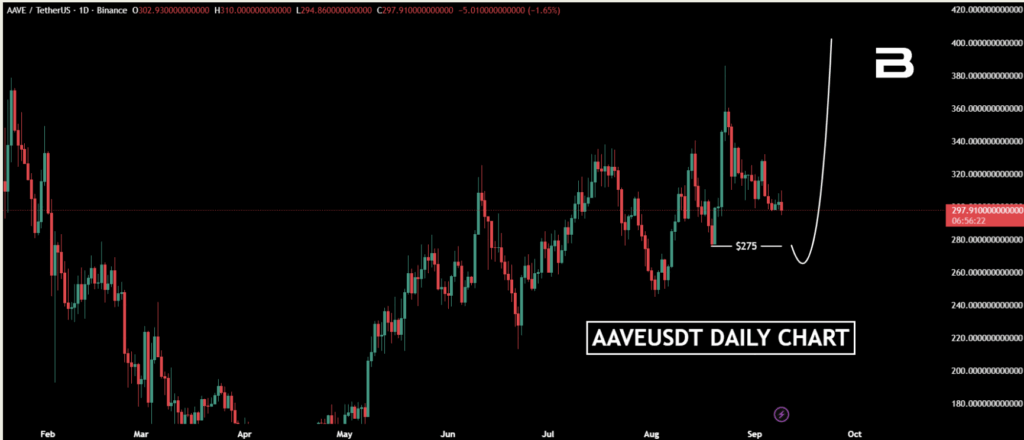

- Key liquidity support at $275 may act as the springboard.

- Upside target sits around $400, if momentum continues.

AAVE isn’t just another DeFi token—it’s one of the first decentralized lending platforms that reshaped crypto finance. With features like flash loans, flexible interest rates, and a governance system powered by the AAVE token, it continues to stand out as a top DeFi project.

Right now, AAVE is trading near $297, and the charts show a clear bullish trend. Higher highs and higher lows suggest that the uptrend isn’t done yet. But the question traders are asking isn’t just will it rise? but rather where’s the next move coming from?

Key AAVE Support Level at $275 Could Drive Next Move

Looking down the chart, a strong liquidity zone sits around $275. If price dips into that range, it could act as a launchpad, helping AAVE gather momentum for its next push. Many traders see this type of dip as the market “catching its breath” before another sprint.

If the bounce plays out, the logical next target sits around $400—a level backed by both past resistance and bullish technical projections.

Why Traders Are Watching Liquidity Zones on AAVE

Markets often sweep liquidity zones before trending higher, shaking out weaker hands while stronger buyers accumulate. This makes $275 a critical zone to watch. Ignoring it and simply chasing the green candles could expose traders to unnecessary risk.

That said, nothing in crypto is guaranteed. AAVE could break out immediately or dip further than expected. Proper risk management remains key, especially in volatile markets.

AAVE Price Forecast: Can Bulls Push Toward $400?

At the moment, AAVE’s structure looks constructive. If the token holds above $275 and bulls maintain momentum, the road to $400 looks realistic. On the flip side, failure to defend support could extend consolidation before the next big move.

For now, patience might be the best strategy—waiting for the market to show its hand before going all-in.