- TRON price dipped under $0.333 support, with technicals hinting at a possible slide to $0.319 or even $0.297.

- On-chain metrics are weak, with TVL, revenue, and trading volume all dropping sharply in recent weeks.

- Despite bearish signals, Bravemorning Limited pumped $110M into TRX, and long traders still dominate futures positioning.

TRON [TRX] hasn’t had the smoothest ride lately. Within just two weeks, the token slipped under key support levels at $0.3440 and $0.333, sliding deeper into bearish waters.

Still, the story isn’t that simple. Even as on-chain numbers weaken, bullish traders are stacking long bets and a $110 million treasury injection has sparked debate on whether TRX can actually turn things around.

At the time of writing, TRX hovered around $0.3313, down a little over 2% in the past 24 hours. Daily trading volume ticked up slightly to $885.36 million, showing plenty of participation, though it’s clear sellers are still leaning heavy.

Why TRX Keeps Dropping

Part of the reason behind TRX’s struggles seems to be soft fundamentals. DeFiLlama data showed TRON’s TVL falling from $6.28B in early August to about $6.009B now. Revenue dropped too, from $6.68M to $5.33M. Even trading volume got slashed in half — tumbling from $9.65B to $4.51B.

If those figures don’t bounce back soon, downside pressure on TRX could only get worse.

Technical Picture: Bears in Control

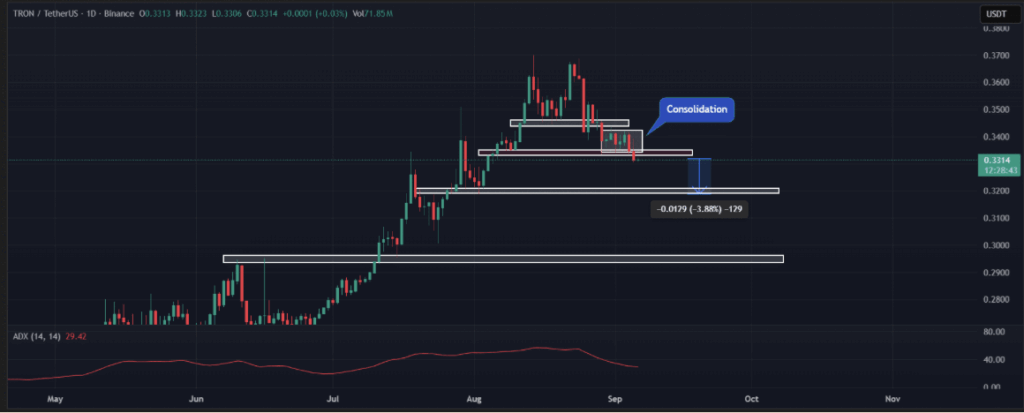

AMBCrypto’s chart analysis wasn’t too encouraging either. TRX slipped below the $0.333 line, confirming a bearish breakdown. On the daily chart, the last candle even formed a hammer pattern — not a bullish one, but a bearish hammer that signals more pain might be coming.

If TRX stays under $0.333, it could test the $0.319 zone next, with a chance of dipping all the way to $0.297 if momentum holds. The Average Directional Index (ADX) sat at 29.42, which confirms that a strong trend is in play — and right now that trend isn’t friendly to bulls.

But Longs and Treasury Boost Spark Hope

Here’s the twist: while fundamentals scream bearish, trader positioning tells a different story. CoinGlass data showed the TRX Long/Short ratio at 1.24, its highest since early August. About 55% of traders are betting long, compared to 44% short.

And then there’s Bravemorning Limited, TRON’s biggest shareholder, making a bold move. The firm injected another $110M into TRX by exercising all outstanding warrants, adding 312.5M tokens to the treasury. That pushed Tron Inc.’s stash above $220M, a signal of long-term faith even as the charts wobble.

TRON’s at a weird crossroads right now. Fundamentals look shaky, price charts point bearish, but traders and deep-pocketed backers aren’t ready to give up just yet. Whether that confidence holds — or gets crushed by weak metrics — might decide where TRX heads next.