- SOL Strategies secures Nasdaq approval, set to trade under ticker STKE on September 9, boosting liquidity and institutional visibility.

- The firm now holds 435,064 SOL (~$89M) plus 3M SOL staked (~$741M), ranking third among public Solana treasuries.

- Shares jumped nearly 20% on the Canadian exchange, as investors eye Solana’s Alpenglow upgrade and stronger revenue growth.

SOL Strategies, a Canadian firm known for its Solana treasury and validator business, just scored approval to list its common shares on the Nasdaq. Trading is expected to kick off September 9 under the ticker STKE, the company said Friday.

The stock will still trade on the Canadian Securities Exchange as HODL, but it won’t be on the OTCQB Venture Market anymore. Shareholders there won’t need to lift a finger—their positions will automatically convert to the new Nasdaq listing.

CEO Leah Wald called the move a game-changer: “For us, this means deeper capital markets, greater institutional visibility, and partnerships we couldn’t reach otherwise. For shareholders, it’s more liquidity, broader access, and the credibility that comes with being in Nasdaq’s orbit.”

Building Solana’s Institutional Story

The listing isn’t 100% wrapped yet—it’s still contingent on final SEC registration and regulatory checks. But once live, the firm expects to ramp up its Solana validator operations, drawing more institutional attention into the network.

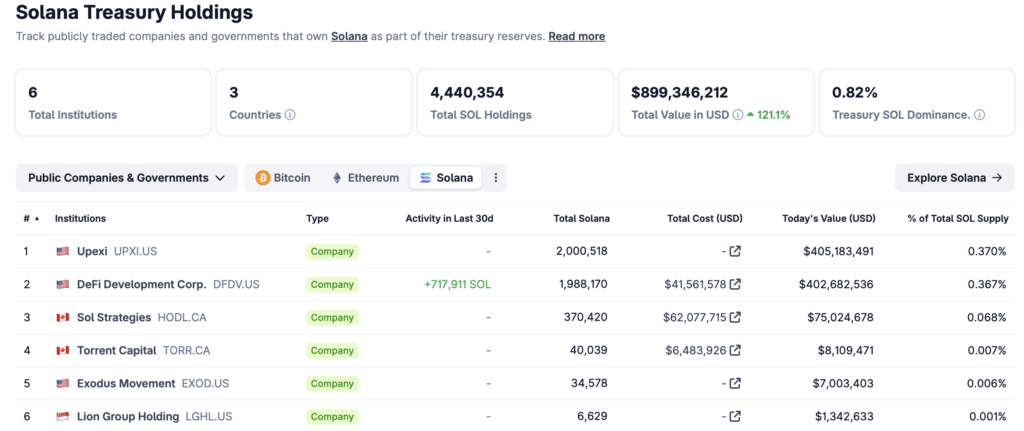

As of August 31, SOL Strategies held 435,064 SOL worth about $89 million, plus an additional 3 million SOL staked, valued near $741 million. That puts them in third place among publicly traded Solana treasuries, behind only Upexi and DeFi Development Corp, each sitting on roughly $400M worth of SOL.

It’s no coincidence this comes as Solana itself is riding momentum. The network just passed a major upgrade vote—nicknamed Alpenglow—which slashes transaction finality from 12 seconds to a blazing 150 milliseconds. Developers and validators have called it one of the most important changes in Solana’s history, setting the stage for real institutional-grade adoption.

Market Reaction and Growth Numbers

Investors seemed to like the news. Shares of HODL on the Canadian exchange jumped nearly 20% to $10.21 CAD (~$7.37 USD).

Meanwhile, SOL Strategies’ revenue picture has been heating up fast. The firm reported $8.7M in annualized revenue for Q2, more than doubling from the $3.5M it pulled in during Q4 of 2024.

Wald summed it up with a punchy statement: “This puts us on the same stage as the world’s most innovative public companies. For us, it’s about showing the market we’re here to fight for a top seat.”