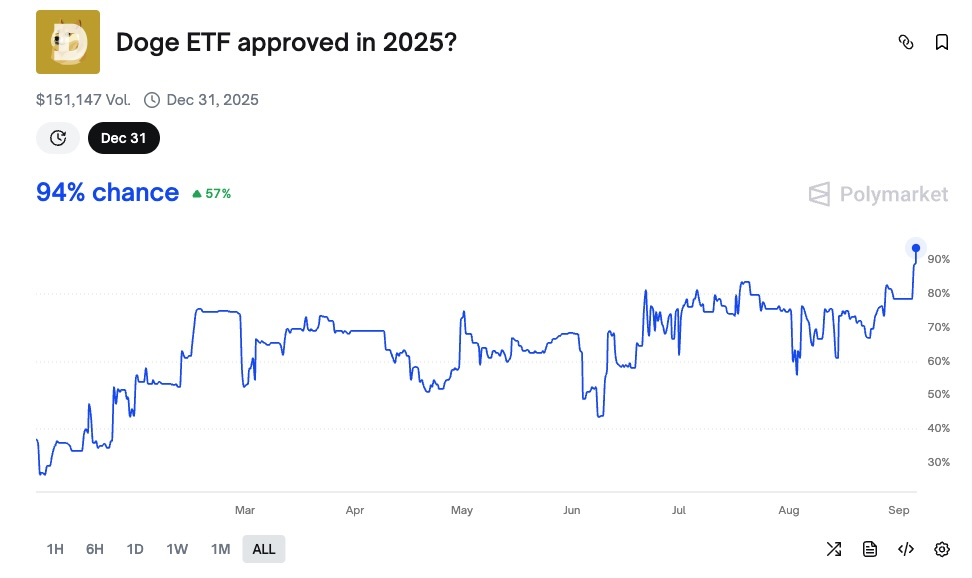

- Dogecoin ETF approval odds hit 94% on Polymarket, sparking renewed hype of a breakout.

- Nasdaq-listed Thumzup Media acquires DogeHash, expanding to 3,500 mining rigs with a $50M raise.

- Analysts see chart patterns echoing 2017 & 2021 rallies, fueling talk of DOGE hitting $10.

Dogecoin’s been wobbling between $0.20 and $0.22 lately, caught in one of those sideways drifts that test the patience of even its most loyal fans. But under the surface, something big might be brewing. Analysts are pointing to chart setups that look eerily like the early stages of the 2017 and 2021 rallies, and now there’s a new catalyst in play—ETF odds. According to Polymarket, the chance of a spot Dogecoin ETF getting the green light has soared to 94%, turning whispers of a breakout into loud speculation about a $10 DOGE.

Familiar Patterns, Bigger Stakes

For a meme coin that started as a joke, DOGE has shown time and time again that it can steal the spotlight. The price chart right now hints at a bottoming structure, the kind that’s sparked past parabolic runs. Popular trader Tardigrade called it out, saying DOGE looks primed for a reversal. If history rhymes, we could see the coin leapfrog past $1 and maybe sprint toward $10, just like it did in earlier bull cycles. This isn’t just retail hype, either—institutions are circling. CleanCore is setting up a Dogecoin Treasury, and Thumzup Media, a Nasdaq-listed firm tied to Donald Trump Jr., is jumping in with both feet.

Mining Expansion and Institutional Moves

Thumzup Media just revealed a deal to acquire DogeHash Technologies, a mining outfit with 2,500 rigs already humming away and another 1,000 on the way. That’s 3,500 rigs in total, enough to give them serious weight in the DOGE mining scene. To bankroll this play, the company raised $50 million in August through a stock offering at $10 per share. Moves like this hint at growing corporate confidence that Dogecoin isn’t just a meme—it’s infrastructure.

ETF Speculation Reaches Fever Pitch

The real accelerant, though, could be ETFs. Rex Shares, through its Rex-Osprey DOGE ETF filing, has brought DOGE back into the regulatory spotlight. If the SEC approves it soon, as some expect, it could unleash a wave of institutional demand that retail alone could never match. Prediction markets like Polymarket already have the odds pegged at 94%. For a coin that lives off hype and momentum, that’s enough to turn sideways trading into a rocket launch.