- Hyperliquid has proposed USDH, a native stablecoin pegged to the dollar, pending validator approval through on-chain voting.

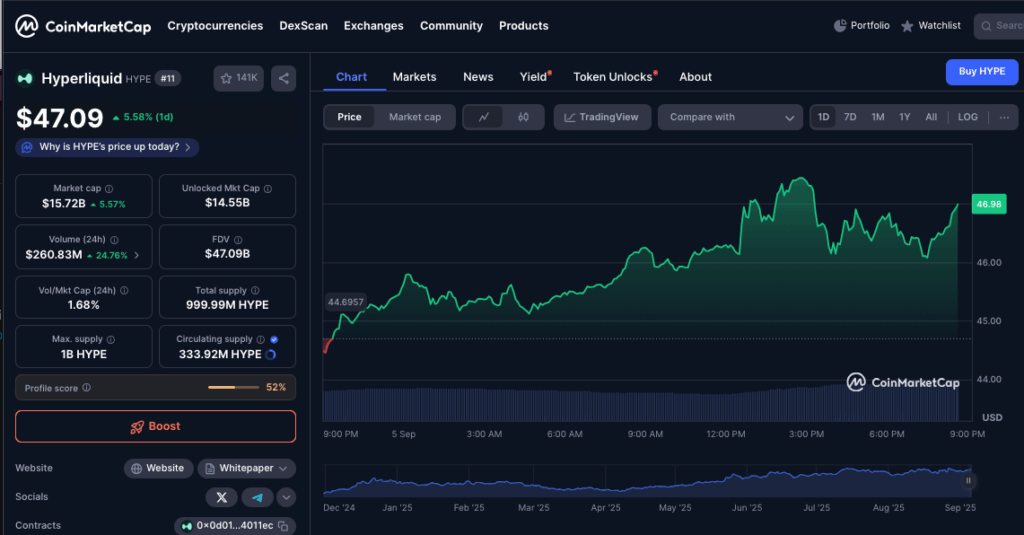

- HYPE token jumped 3.4% to $47 after the announcement, showing strong market optimism despite no official listing yet.

- The plan uses a dual-token stablecoin model for transparency and comes alongside an 80% cut in spot market fees plus new public spot quotes.

Hyperliquid is making waves again—this time with plans to roll out USDH, its own native dollar-pegged stablecoin. The catch? It’s not live yet. The proposal still needs validator approval through an on-chain vote, but the very mention of it was enough to send the HYPE token up 3.4% in a single day, hitting $47. Traders are clearly paying attention, even if the stablecoin itself hasn’t officially landed on the site.

Governance First, Trading Later

The exchange confirmed in Discord that the USDH rollout will only move forward if validators green-light the design and select the development team. It’s the same process Hyperliquid uses for asset delistings, keeping decisions anchored in community governance. For now, USDH hasn’t shown up on Hyperliquid’s homepage, but the market seems to be pricing in optimism anyway. Price action on September 5 shows that HYPE bulls quickly seized the narrative, pushing the token higher despite the lack of concrete launch details.

Stablecoin Wars Heat Up

The timing is no coincidence. Since the Genius Act was signed into law back in July 2025, stablecoins have been on fire. USDC and USDT are hitting new supply records, Trump-backed WLFI rolled out USD1, and even JPMorgan jumped in with its own JPMD token. Hyperliquid’s pitch? Give users a decentralized stablecoin that’s more transparent than the big guys.

They’re eyeing the dual-token model pioneered by Tether co-founder Reeve Collins with STBL. That setup separates peg maintenance from yield generation, with one token ensuring stability while another distributes yield directly to users. It’s a way of making reserve management less murky while giving holders more control over returns. For investors still burned by algorithmic disasters of the past, transparency is the real selling point.

Fees Slashed, Transparency Boosted

Alongside the USDH proposal, Hyperliquid dropped a hefty protocol update. Fees on dual-currency spot market pairs—maker, taker, and user—are set to fall by 80%. Public spot quotes are also going live, bringing more visibility to order books. Taken together, the updates underline Hyperliquid’s strategy: keep pushing for transparency, cut costs for traders, and build new tools that make decentralized markets feel a little less like the Wild West.