- Cardano’s price is up 40% since Q3 began, but on-chain activity has collapsed.

- ADA’s DeFi ecosystem lags as Chainlink integration remains costly and complex.

- Without oracle data support, Cardano risks falling further behind Ethereum’s momentum.

Cardano’s ADA has been quietly stacking wins on the price chart, logging three straight months of gains. Since the start of Q3, the token has climbed nearly 40% off its $0.57 base, flashing signs that another double-digit move in September could be on the table. But here’s the twist — while price action looks resilient, the on-chain picture paints a much gloomier story.

Price Up, Activity Down

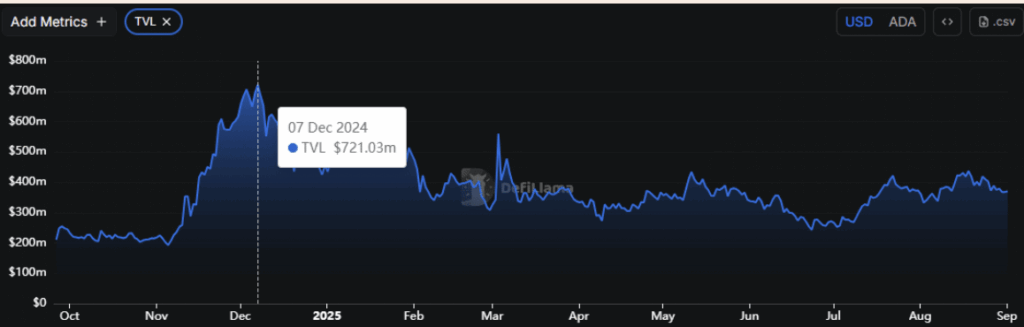

Despite ADA’s steady rally, usage across its network is in retreat. Daily active addresses have fallen off a cliff, almost 100% lower compared to three months ago. Total Value Locked (TVL) has been slashed in half, sliding from $721 million during the election run to under $400 million now, per DeFiLlama. That kind of split between rising prices and fading activity often raises eyebrows, hinting at possible manipulation or at the very least, a rally without strong fundamentals backing it.

Derivatives data has only added to the chop. On August 18, ADA spiked to $0.96 while open interest in futures markets surged to $1.87 billion. But without follow-through, the price slipped back to $0.80 and OI cooled to $1.54 billion. It’s the kind of stop-start action that traps both bulls and bears, feeding more volatility into an already messy setup.

Why Chainlink Could Be the Missing Piece

Part of Cardano’s problem isn’t just sentiment — it’s infrastructure. Unlike Ethereum, which taps directly into Chainlink for reliable oracle data, Cardano’s unique architecture (its Plutus programming language and Ouroboros consensus) makes integration way more complicated. It requires custom adapters, extra development, and higher costs.

Charles Hoskinson himself admitted as much, claiming Chainlink “gave us an absurd number” for integration, while noting Sergey Nazarov “knows he’s sitting on a golden egg.” The lack of easy access to oracle data has slowed down DeFi growth on Cardano, leaving fewer projects launching compared to ecosystems like Ethereum.

The Road Ahead

Ethereum’s advantage here is obvious. With Chainlink fully plugged in, ETH gained nearly $10 billion in TVL just in August, while Cardano lags behind. If ADA wants to move beyond speculative pumps and actually build a thriving DeFi ecosystem, it will need to compromise and bring in Chainlink — or risk being left further behind.

For now, the charts may look bullish, but under the hood, Cardano still feels like it’s running uphill with weights strapped to its legs.