- Solana trades near $203 after bouncing back above $200, but momentum looks fragile.

- NUPL and CDD metrics show long-term holders sitting on large profits and moving old coins, signaling profit-taking risk.

- Key supports sit at $196, $191, and $175, while reclaiming $207 could cancel the bearish setup.

Solana’s price was hovering around $203 at press time, clawing back after briefly dipping under the $200 mark earlier in the day. That tiny bounce kept daily losses limited to about 1%, but the bigger picture still looks shaky. Bulls have managed to pull SOL back over $200, yet on-chain data hints that the recovery might not last long.

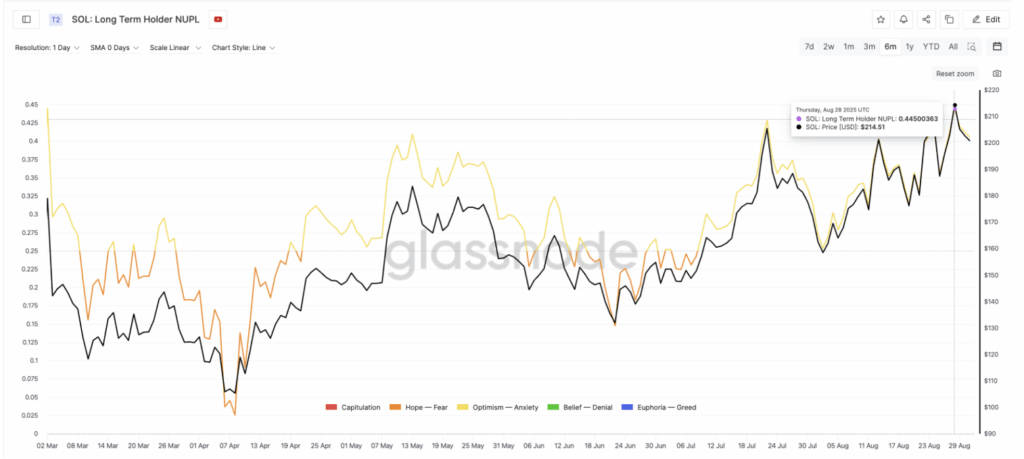

Long-Term Holders Sitting on Heavy Profits

One of the first warning signs is the Net Unrealized Profit/Loss (NUPL) metric for long-term holders. This basically shows if investors are sitting on paper profits, and when the number runs high, there’s always the temptation to cash out. On August 28, Solana’s long-term NUPL hit 0.44 — the highest in half a year and very close to its March peak at 0.4457. That last time, SOL tanked from $179 to $105 in under two weeks, a brutal 41% correction. A similar move in July saw the price drop 23% after another NUPL spike. Right now, the reading has cooled a bit to 0.40, but that’s still well above normal levels, flashing profit-taking risk.

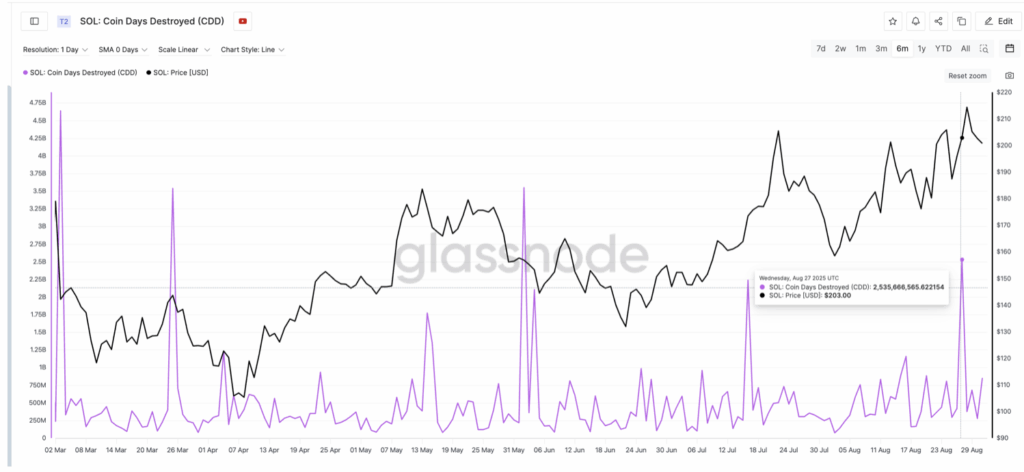

Old Coins on the Move Signal Selling Pressure

This risk isn’t just theoretical either. The Coin Days Destroyed (CDD) metric, which tracks older coins moving on-chain, has spiked again. Historically, each time this signal lit up, Solana’s price corrected not long after. Back in March, a CDD spike coincided with a drop from $142 to $118, while another one pulled it from $143 to $105. Even in July, the correction was delayed, but SOL still fell from $205 to $158. The latest CDD surge on August 27, right as Solana hovered at $203, suggests long-term holders may already be quietly selling into strength.

Key Levels Define the Next Move

Technically, Solana is trading at a fragile point. Right now, it’s trying to hold $201 as temporary support after flipping that level. For the bullish case to stay alive, SOL needs a daily close above it. If it slips under $196 or $191, momentum turns bearish quickly, and a break below $175 could confirm a much deeper correction. On the flip side, a clean move above $207 — with a strong candle close — would fizzle out the bearish case and bring buyers back into play. Until then, the data suggests the rebound over $200 might be running on thin ice.