- AVAX jumped 12% after bouncing off ascending triangle support.

- Technicals point bullish, but on-chain data shows sellers remain active.

- Liquidity clusters above price could trigger a breakout if shorts get squeezed.

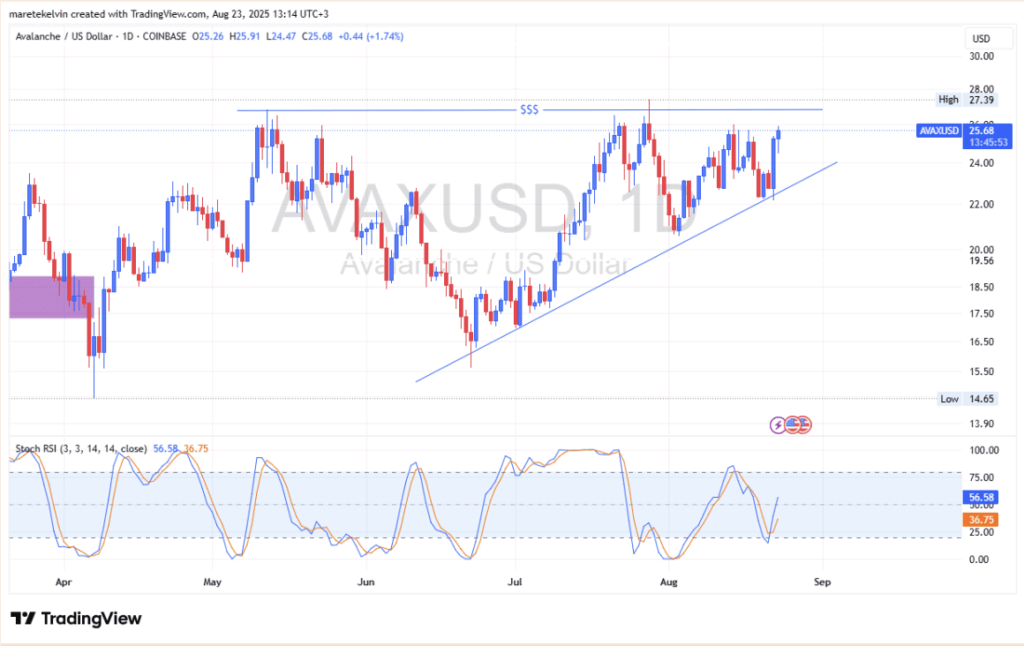

Avalanche (AVAX) has been coiling inside an ascending triangle for months, with price action grinding tighter into the structure. This week’s bounce off triangle support gave bulls a jolt of momentum, with AVAX shooting up more than 12% in just a day. The setup now has traders watching closely—will this finally be the breakout move, or just another fake-out before more chop?

Momentum Building but Not Yet Secured

On the technical side, signs are leaning bullish. The stochastic RSI just flipped upward from oversold levels, showing that buyers are creeping back into the market. That doesn’t guarantee continuation, of course, but when paired with the recent surge, it gives bulls some extra leverage heading into the final stretch of consolidation. Still, sellers haven’t fully stepped aside, and that tension is keeping AVAX pinned below the key breakout zone.

Sellers Still Pushing Back

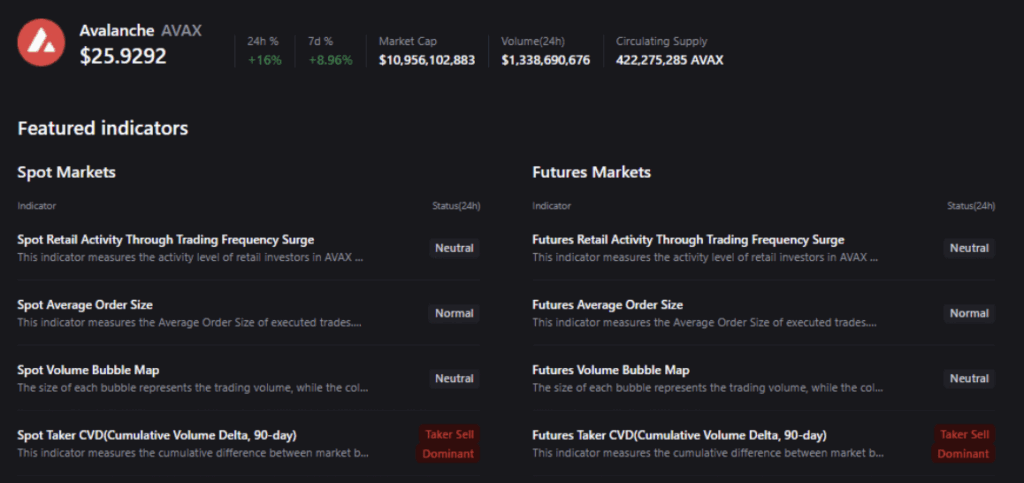

On-chain signals show that selling pressure hasn’t gone away. Spot cumulative volume delta and futures positioning both suggest that a good chunk of the recent upside has been met with steady sell orders. In other words, price is pushing higher, but it’s grinding against resistance from active sellers. That tug-of-war explains why AVAX hasn’t yet managed a clean breakout, even with the bullish momentum showing up on charts.

Liquidity Could Be the Tipping Point

What could flip the switch is liquidity. CryptoQuant’s liquidation maps highlight clusters of liquidity sitting just above current levels. These zones often act like magnets—if AVAX drifts into that region, forced liquidations could trigger a quick push higher as shorts scramble to cover. That sort of move tends to spark confidence, drawing in fresh capital and reinforcing the breakout narrative.

For now, AVAX is sitting right at a crossroads. The triangle structure and oscillators give the edge to bulls, but the hesitation from sellers is still in play. If momentum and liquidity align, Avalanche could finally break through and push higher into the $50–$55 range. But if momentum fizzles again, consolidation could stretch on a while longer. Bias, though, is slowly but surely tilting bullish.