- Tesla’s financial report shows the electric car maker did not sell any of its BTC in the last quarter of 2022.

- However, the company reported $34 million impairment charges to its Bitcoin holdings.

- It is estimated that Tesla currently holds 9,720 BTC worth over $225 million.

Tesla (TSLA) did not sell any bitcoin during the fourth quarter (Q4) of 2022, marking the second straight quarter that the electric car manufacturer did not buy or sell any Bitcoin that year, according to the latest earnings report released on Wednesday, January 25, 2023.

Tesla is a Texas-based American multinational automotive and clean energy company. According to estimates, the company currently holds 9,720 BTC. At current rates, Tesla’s BTC holdings are worth more than $223 million.

Tesla’s Q4 Earnings Report

The Q4 report showed that as of December 31, 2022, Tesla held $184 million in digital assets, a 16% drop ($34 million) from the previous quarter when the company recorded $218 million. The decrease in the value of the company’s digital assets is attributed to cryptocurrency price fluctuations that were particularly noticeable between September and December of 2022.

At the end of Q3, the BTC price was slightly below $20K, compared to the $16.5K recorded at the end of Q4. Reportedly, the electric carmaker did not change its Bitcoin holdings in the third quarter.

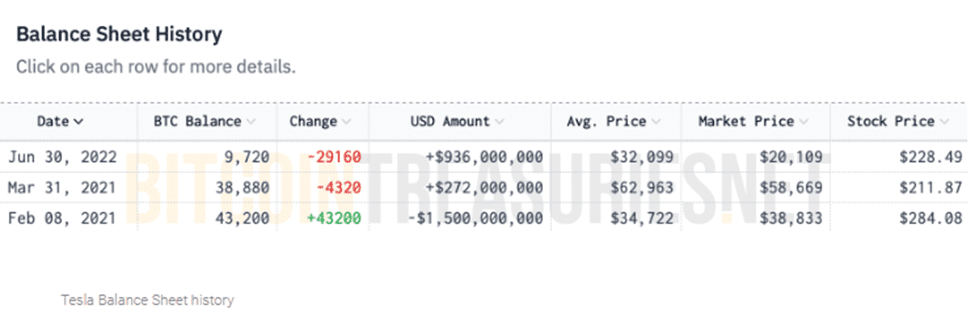

However, the case was different in Q2, where Tesla surprised crypto investors when it sold $936 million worth of BTC. This was around 75% of its total considerable crypto holdings, adding $936 million to its financials. Their goal drove the move to raise cash amid uncertainties around COVID-19 lockdowns in China.

According to market pundits, Tesla made a profit of around $64 million after selling most of its BTC. Nevertheless, Tesla CEO Elon Musk explained that at the time, the company was open to increasing its Bitcoin exposure in the future, adding that the sale “should not be taken as some verdict on Bitcoin.” Musk noted:

“The company sold BTC to prove liquidity of Bitcoin as an alternative to holding cash on a balance sheet.”

In general, Tesla reported adjusted earnings per share of $1.19 for Q4. This was ahead of the unanimity of analyst estimates reported to FactSet of $1.13 per share on revenue of $24.3 billion, lower than analyst estimates of $24.7 billion.

Notably, Tesla shares were up 10.97% to $160.27 hours after trading on Friday, January 27.

Elon Musk’s Tesla Escapes Liquidity Trap

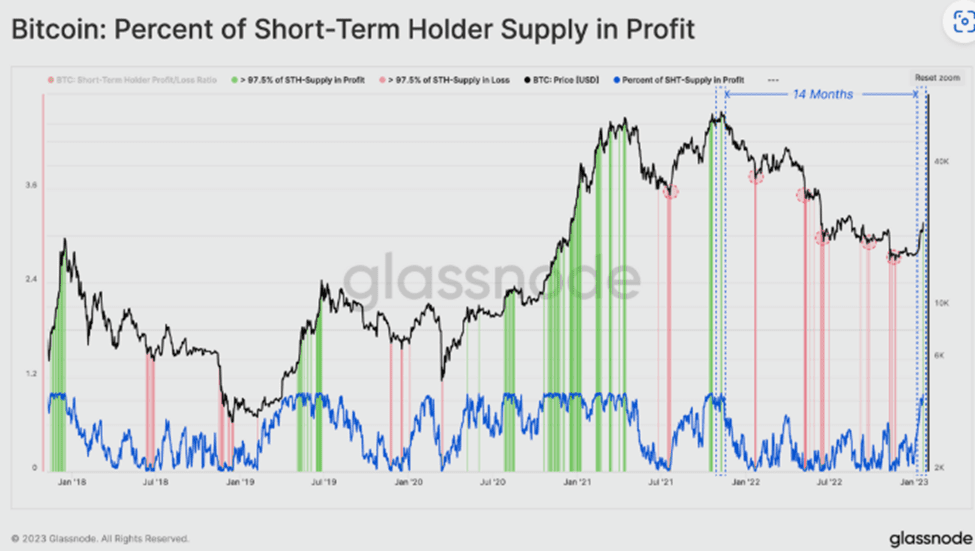

It is worth noting that by holding its Bitcoin assets, the firm escaped the exit liquidity trap that plagued BTC holders since the asset climbed above $23,000.

The recent Bitcoin rally that kicked off in January 2023 surprised many investors. However, alongside surging prices, there has been a spike in motivation for holders and miners to take exit liquidity following the prolonged bear market of 2022.

New investors and miners on the Bitcoin network have been motivated to book profits, alongside a spike in resilience for long-term holders.

When the crypto market suffers a prolonged bottom (or top) discovery stage, the behavior of new investors becomes a critical factor in the formation of local recovery (or correction) pivot points. The behavior is assessable using the Percentage of Short-Term Holder Supply in Profit metric by crypto intelligence tracker Glassnode.

Tesla’s average cost per Bitcoin stands at $32,099, making the firm more likely to profit from shedding BTC holdings the moment the most major crypto asset by market cap tags the $32,000 level. The electric carmaker is unlikely to sell its BTC before it reaches the key $32,000 mark because doing so would mean Tesla books losses.

Therefore, the company’s break-even for Bitcoin holdings stands at $32,099, with experts on crypto Twitter interpreting the firm’s move to hold on to BTC as a show of commitment to embracing Bitcoin and cryptocurrencies in general.