- XRP hit a 7-year high of $3.65 before correcting over 20%.

- A possible September rate cut could boost risk assets like XRP, though odds are slipping.

- With the SEC case over and ETF filings pending, XRP’s bigger breakout might only just be getting started.

Ripple’s XRP recently printed a fresh all-time high at $3.65 on July 18 — its first peak in over seven years. But the celebrations didn’t last long. The token has since dropped more than 20% from those highs, trading near $2.87 at press time. According to CoinGecko, XRP is still down 11% on the week, 2.8% across the last 14 days, and 16% for the month. That said, zooming out shows it’s up an eye-popping 387.7% since August 2024. Short-term pain, long-term strength.

Could a Fed Rate Cut Light the Fuse?

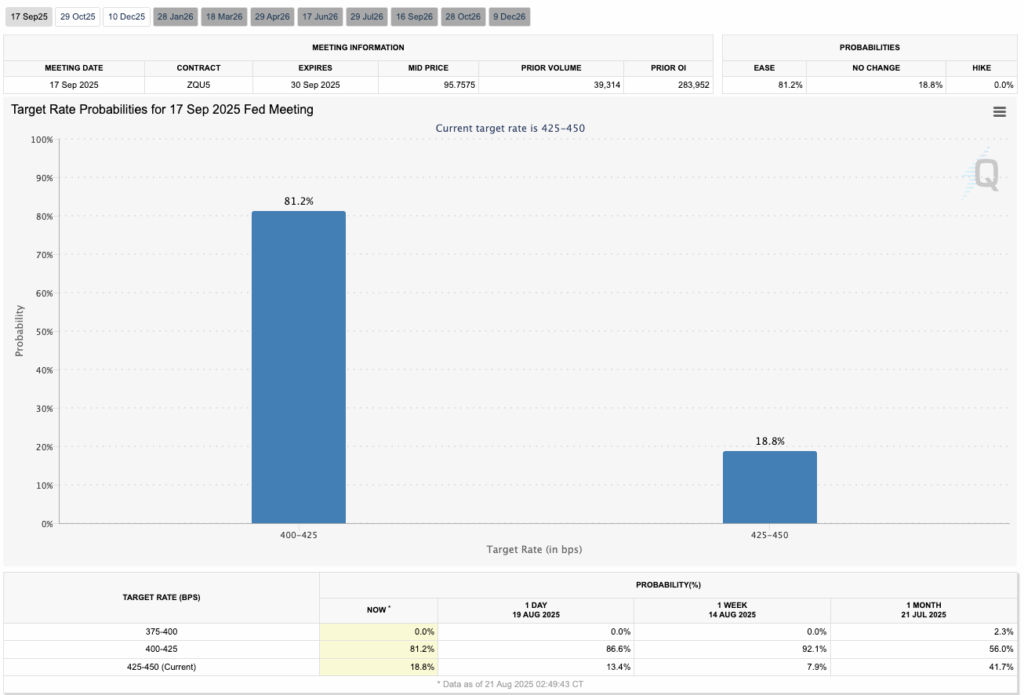

The conversation now shifts toward macro events. The CME FedWatch tool currently shows an 81.2% probability that the U.S. Federal Reserve will trim rates by 25 basis points in September. A cut like that tends to juice demand for risk assets, and XRP could be one of the beneficiaries.

But here’s the catch — those odds are slipping. Just days ago the same model gave a 96% chance, then it fell to 84%, and now sits at 81%. As we get closer to the Jackson Hole gathering, expectations may wobble further. If confidence continues to fade, risk-on assets like XRP may stall until stronger signals arrive.

Ripple’s SEC Cloud Is Gone, ETFs Could Be Next

XRP spent years struggling under the shadow of the SEC lawsuit, which many argue stunted its adoption. With that case now closed, the token finally has a clean runway. That alone could keep buyers interested even during market dips.

Adding more fuel, multiple XRP spot ETF applications are waiting on SEC desks. If approval comes, the impact could mirror what we’ve seen with Bitcoin — major institutional inflows, new credibility, and potentially new highs. Bitcoin’s run to record prices after its ETF nod is still fresh in investors’ minds, and XRP holders are hoping history rhymes.

Final Thoughts

XRP is at a crossroads. On one side, a Fed rate cut and possible ETF approval could send the token ripping through old resistance. On the other, shifting macro sentiment and technical corrections might keep it pinned under $3 for a while longer. For now, the long-term outlook remains stronger than the short-term chop, but as always with crypto, timing will be everything.