- XRP slipped below $3, but chart fractals suggest a potential 60%–85% rally into Q4, targeting $4.35–$4.85 if momentum sustains.

- Whale flows remain negative, hinting at short-term weakness, but data shows distribution may be nearing exhaustion.

- The $2.65–$2.33 zone could act as a key accumulation area before XRP pushes higher.

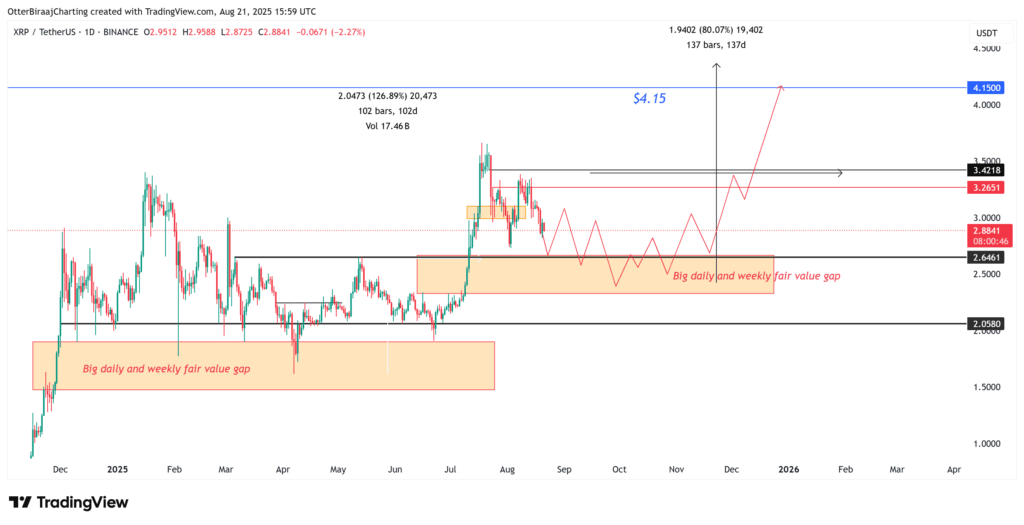

XRP closed Tuesday under the $3 psychological barrier, dipping to $2.87 as its two-week correction dragged on. Traders eye the move with mixed emotions—short-term sentiment leans bearish, but the broader setup is flashing something else entirely. A repeating fractal pattern on the charts is suggesting that XRP might be coiling for a larger rally later this year, one that could push it as high as $4.85 if momentum aligns.

Fractals, those repeating price structures that echo across timeframes, often carry weight when they appear at inflection points. The current structure mirrors XRP’s January 2025 run, when the token hit $3.40 before unwinding back to $1.60 in April. That pullback tapped into fair value gaps (FVGs)—areas where liquidity builds up—before price ripped higher again. Right now, a fresh FVG sits between $2.32 and $2.66, a zone traders are watching closely. If XRP dips there and buyers step in, the case for another expansion phase strengthens dramatically.

Technical Picture and Potential Upside

Analysts note that diminishing returns could temper this next move, but projections still show 60%–85% upside in Q4. If XRP can break decisively above $3.85, it enters what’s known as “price discovery,” where resistance is thin and rallies can accelerate. From there, targets between $4.35 and $4.85 come into play.

Macro conditions may add fuel. With growing speculation around U.S. interest rate cuts and broader liquidity inflows into risk assets, XRP could benefit from a more favorable environment. Still, short-term volatility is expected—price may chop lower before reaccumulation sets the stage for the bigger move.

Whale Flows: Exhaustion or More Pain?

On-chain data is showing that whale flows—large holders moving tokens—are still net negative. That typically suggests selling pressure in the near term. But zooming out, the pattern looks familiar. A similar distribution wave hit in Q2, right before XRP carved out its April bottom.

Now, the 90-day average of whale netflows is hinting that distribution may be peaking again. If that flips to accumulation, history suggests whales could start rebuilding positions around the $2.65–$2.33 zone. That’s the exact same range aligning with the current fair value gap, creating a potential confluence for the next leg up.

The Bigger Picture

XRP’s short-term fate will likely hinge on whether $2.93 support holds or cracks lower into the FVG. But the broader setup, combined with historical fractal behavior and whale flow exhaustion, leans toward bullish continuation into Q4. Traders just need patience—the fireworks may not kick off until that liquidity zone gets tested.