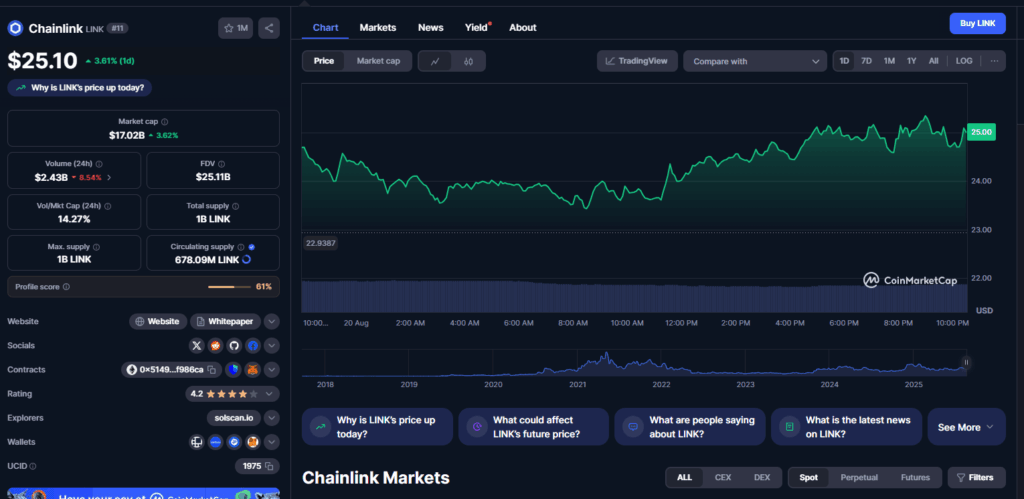

- Chainlink surged past $26 before stabilizing around $24, supported by strong ecosystem growth.

- Wallet activity is spiking, with nearly 10,000 new LINK addresses created in a single day.

- Analysts predict LINK could rise to $31 by November 2025, if momentum and adoption continue.

Chainlink has quietly turned into one of the most-watched crypto tokens of this bull cycle. The latest rally pushed LINK beyond $26 for the first time in months, reminding traders why it has often been called the “backbone” of decentralized finance. Since then, the price has cooled a bit, hovering around $24, but on-chain activity hints that something bigger may be brewing. For many investors, the question now isn’t if Chainlink will move again—it’s how far and how fast when it does.

The broader mood around LINK feels different this time. The token isn’t just riding general market hype; its ecosystem is showing signs of genuine expansion. Partnerships, integrations, and network growth are all adding fuel to the fire, setting the stage for what could be the project’s strongest run since its earlier cycles.

Surge in Wallet Growth and Adoption

A new Santiment report revealed just how active the Chainlink community has become. On Sunday alone, more than 9,800 addresses made at least one transfer, while the following day saw 9,625 fresh wallets created on the network—both marking record highs for 2025. These metrics point to something deeper than speculation: genuine adoption and new users flowing in.

The last time LINK showed this kind of wallet growth, it was a precursor to a major rally. Analysts believe that if this momentum holds, Chainlink could finally move beyond the sideways trading that has capped its progress for much of the year. In other words, the groundwork is being laid for another breakout.

The Road Ahead: Can LINK Push Higher?

Forecasts remain bullish. According to CoinCodex data, LINK could climb nearly 29% from current levels to reach around $31 by November 2025. Technical indicators show a solid mix of bullish momentum alongside moderate fear in the market—conditions that sometimes precede strong moves higher.

Still, traders are split. While some see this as a prime entry point, others warn that LINK could stall if broader market conditions turn sour. Yet with steady wallet growth, increased on-chain activity, and a swelling ecosystem of integrations, many believe the probability of another major rally outweighs the risks.

Final Thoughts

Chainlink’s story in this cycle is no longer just about price. It’s about adoption, infrastructure, and becoming an irreplaceable piece of the crypto puzzle. If the data keeps trending upward, LINK might not just revisit past highs—it could write new ones. For now, the market is watching closely, waiting for the next move.