- Avalanche’s price pulled back from $25+ to around $23.6, but on-chain data shows strength with daily transactions jumping from 500K to over 1.3M in just a month.

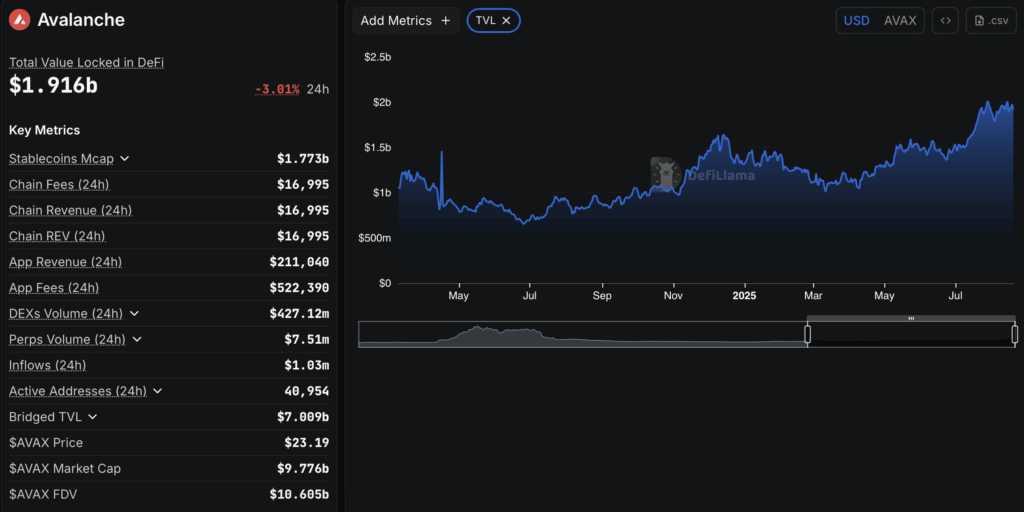

- Stablecoin growth, DeFi traction, and rising TVL highlight strong fundamentals, even as market-wide corrections weigh on AVAX’s short-term momentum.

- Avalanche is pushing deeper into real-world asset tokenization, with $250M in RWAs coming onchain via Grove, Visa settlement deals, and even tokenized whisky bottles from Bowmore.

Avalanche has had a strange week. On one hand, the token slipped from highs above $25, dragged down by a market-wide pullback that left most coins in the red. On the other hand, its network activity is surging, flashing a much healthier picture beneath the surface.

Price Under Pressure, Market Cools Off

AVAX touched $25.64 on August 18 before retracing to around $23.61, marking a 5% daily drop. The move was part of a broader sell-off—Bitcoin slid below $115k while Ethereum dipped close to $4,200. In short, the usual profit-taking wave hit. For Avalanche though, it was more of a technical cool-down than a collapse, especially given the data showing strong fundamentals building underneath.

Transactions Surge Past 1.3M Daily

According to fresh numbers from analytics platform Nansen, Avalanche’s daily transactions more than doubled in the past month. From half a million a day to over 1.3 million, most of this spike came in just the last two weeks. That kind of acceleration points to rising utility, not just speculative churn. Stablecoin growth and DeFi traction have been major drivers, helping Avalanche maintain relevance even as prices wobble.

DeFi, Tokenization, and Real-World Assets

DeFiLlama data shows total value locked (TVL) on Avalanche has been steadily recovering from the lows of April 2024. But the real buzz is around real-world asset tokenization. In July, Grove announced $250 million in RWAs would be coming onchain via Avalanche, followed by a global stablecoin settlement deal with Visa. More recently, Bowmore, one of Scotland’s oldest distilleries, rolled out tokenized whisky bottles on the network—a mix of tradition and cutting-edge tech that highlights Avalanche’s expanding role.

The Bigger Picture

Price momentum has cooled, sure, but network fundamentals are pressing forward. Analysts suggest that if the current pace of user activity continues, AVAX could be setting up for another breakout once broader market sentiment steadies. For now, Avalanche looks like one of those projects quietly stacking long-term wins, even if the charts don’t scream it yet.