- TRON trades around $0.3455, holding support as overall market sentiment stays bearish.

- Zero-fee TRX and USDT transfers on TRC-20 could boost adoption and long-term demand.

- Volume and technicals suggest a breakout may be close, with $0.357 resistance and $0.33 support as levels to watch.

TRON (TRX) has been caught in the same market storm weighing down much of crypto, slipping slightly despite showing small weekly gains. Over the last 24 hours, TRX dropped 1.71% to trade around $0.3455, though trading activity stayed hot with volume climbing above $1.11 billion. Market cap, meanwhile, dipped by 1.75% to $32.7 billion, reflecting how fragile sentiment has been as Bitcoin drags the wider market down.

Zero-Fee TRX Transfers Spark Optimism

Amid the chop, TRON DAO rolled out what some are calling a breakthrough in crypto usability: zero-fee deposits and withdrawals for both TRX and USDT on TRC-20. This move wipes out hidden charges and delays that usually frustrate retail users, while also offering lightning-fast transactions. Analysts see it as more than a nice perk—it’s a structural change that could make TRON more attractive to both individual investors and larger institutions. Security, transparency, and speed remain the cornerstones, and if adoption picks up, it might help TRX shrug off short-term bearish momentum.

TRX Price Stuck Between Support and Resistance

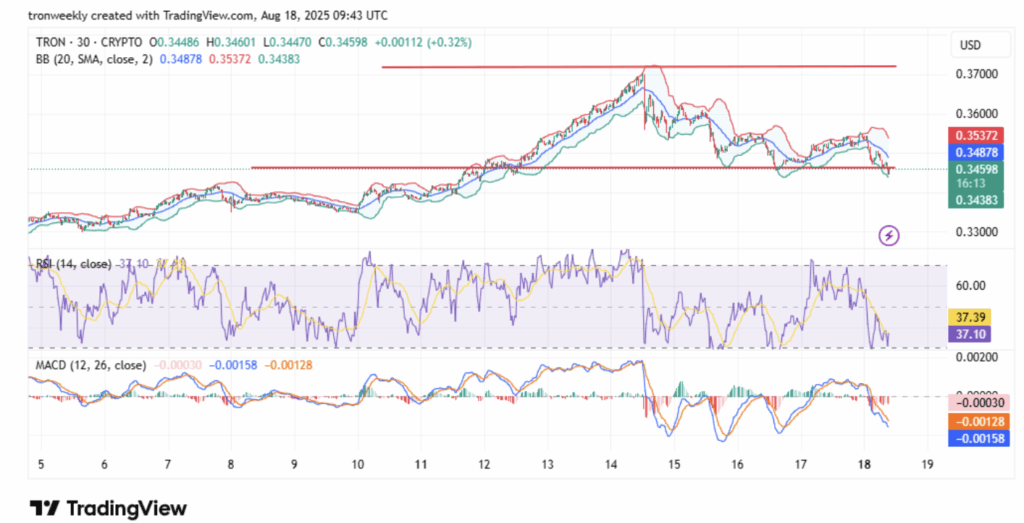

On the charts, TRON is hovering just above its key support at $0.3438. Technical signals paint a mixed picture: RSI is nearing oversold territory at 37, hinting at possible rebound strength, but MACD continues flashing short-term bearish bias. If TRX can hold the line, a push back to $0.357 seems likely, and clearing that level could open the path toward $0.372. On the flip side, losing $0.3438 support could trigger a sharper correction down to $0.33.

Rising Volume Hints at Breakout Potential

Interestingly, trading volume jumped over 11% to $415.6 million even as open interest slipped nearly 4%. This shows traders are rotating positions rather than abandoning the market, with sentiment balanced between cautious optimism and lingering fear. The weighted funding rate remains slightly positive at 0.0049%, reinforcing the idea that a breakout could arrive soon—either above resistance or below support.