- Healthy Rally Signs: ETH’s move past $4.2K looks stronger than past runs, with near-zero funding rates showing it’s spot-driven rather than leverage-fueled.

- $4.7K Resistance Zone: The real test sits at $4.7K, a ceiling that has rejected Ethereum multiple times since 2024—breaking it could confirm a new bullish phase.

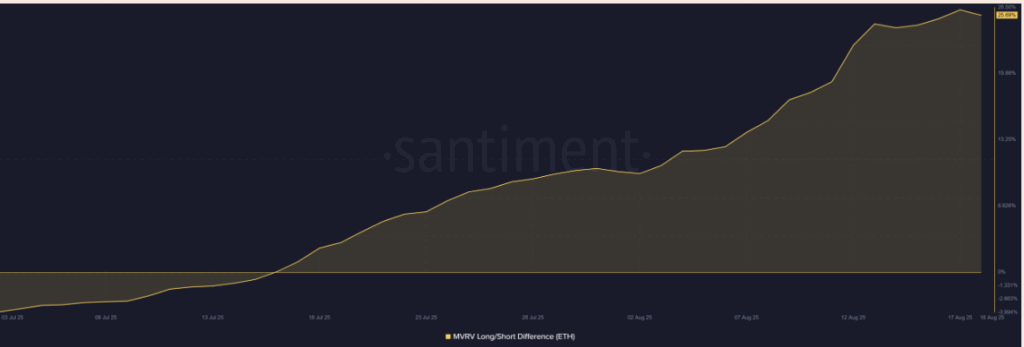

- Volatility Risks: On-chain metrics like Stock-to-Flow and MVRV suggest strong holder confidence, but also rising profit-taking pressure, making this level a pivotal battleground.

Ethereum has powered its way over $4,200, a level that sparks plenty of excitement—but also raises the big question of whether this run has enough fuel left. Unlike the overheated rallies we saw in late 2020 and again in early 2024, this breakout feels… calmer. Funding rates are holding close to zero, showing that the move is mostly spot-driven, not some wild leverage chase. That’s generally healthier—less risk of sudden liquidations slamming the brakes. Still, analysts warn that if funding suddenly climbs above 0.05, the market could flip fast into heavy selling.

Resistance at $4.7K: The Real Test

For now, the elephant in the room is $4.7K. This level has been like a ceiling, rejecting ETH every time it gets too close. Last touched in March 2024, it’s been a recurring pain point across cycles. As Ethereum inches closer again, traders are eyeing whether this zone will spark another rejection—or finally crack. A clean break could set off a new leg up, but rejection might lead to a cooling phase before bulls can try again.

Volatility Brewing Beneath the Surface

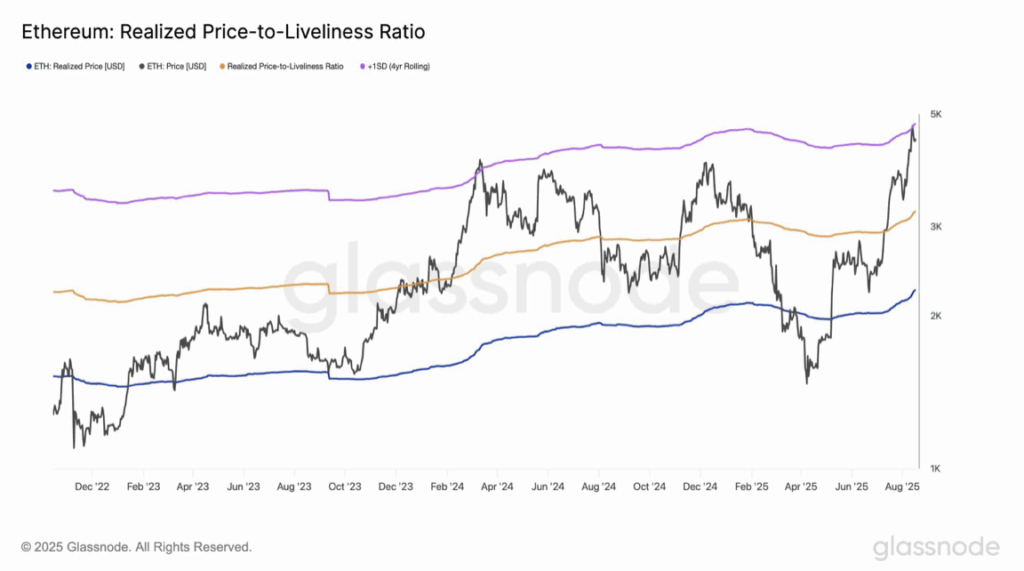

On-chain signals show some interesting contradictions. The Stock-to-Flow ratio has shot up to 47.7, which highlights ETH’s scarcity narrative—but also hints the market might be running a bit hot. Historically, spikes like this bring volatility, either in the form of explosive rallies or sharp corrections. Meanwhile, MVRV shows long-term holders are sitting on fat profits, much higher than short-term players. That confidence is bullish, but it also increases the temptation to sell into strength.

Holding the Line or Breaking Through?

So, here’s the picture. Ethereum’s funding rates suggest the rally is solid, not frothy. But the $4.7K resistance is stubborn, and profit-taking risk is creeping in as older holders see green. If ETH clears that wall with conviction, we could be staring at a new phase of the bull cycle. If not, well, a correction might be the pause that refreshes before the next big attempt. Either way, the battle at $4.7K looks set to define the next chapter in ETH’s story.