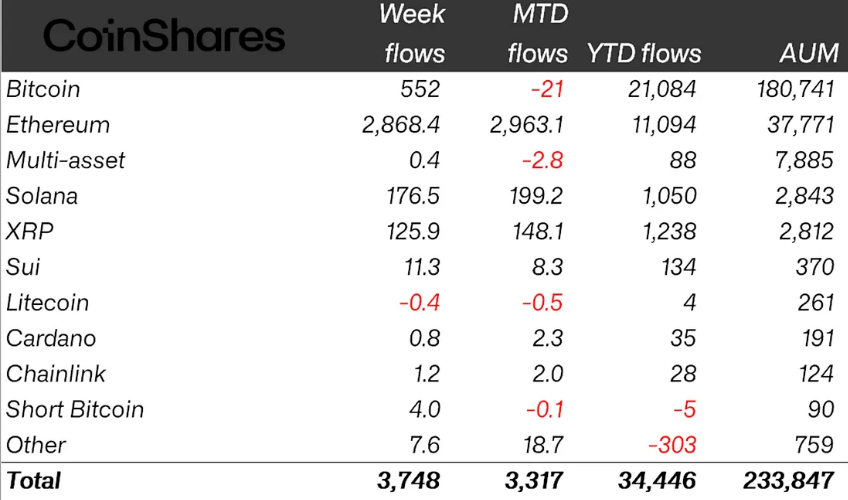

- Ether ETFs dominated last week with $2.9B inflows and a record $17B in trading volume, driving total crypto ETP inflows to $3.75B.

- Bitcoin added $552M in inflows despite hitting new highs above $124K, while Solana and XRP also attracted strong interest.

- Inflow streaks are shorter than earlier in the year, but the scale of capital pouring in is larger than ever, signaling rising institutional demand.

Last week the spotlight shifted hard onto Ethereum, as Ether ETFs pulled in a jaw-dropping $2.9 billion in inflows, the biggest single driver behind a record-breaking $3.75 billion that poured into crypto investment products overall. To add some fireworks, trading volumes went parabolic — Ether ETFs alone hit around $17 billion for the week, with total spot ETF volumes touching $40 billion in just four days. That’s not just busy, that’s mania-level activity.

The surge came right as Ethereum itself flirted with all-time highs near $4,700, stoking both retail hype and institutional FOMO. Investors piled into Ether products, brushing aside the old narrative that “no one cares about ETH compared to Bitcoin.” Well, the numbers now tell a very different story.

Ethereum Leads, Bitcoin Trails (But Still Strong)

Bitcoin wasn’t exactly asleep at the wheel — it pulled in about $552 million in inflows, which still represents 15% of the week’s total. This came even as BTC broke new records above $124,000. Yet the contrast was clear: ETH dominated the flows, and for once, BTC played second fiddle.

The first half of the week was all green candles for ETFs, with four consecutive days of steady inflows across both Bitcoin and Ethereum. But Friday flipped the tone, with investors pulling some chips off the table, sparking outflows. Even so, the week as a whole still ended with some of the biggest inflow numbers in history.

Other altcoins made a splash too: Solana raked in $176.5M and XRP added $125.9M, showing that investors are spreading bets beyond the top two giants. Not every coin got the love, though — Litecoin lost $0.4M and Toncoin shed $1M, breaking the trend.

Record Volumes, “ETHSANITY”

Bloomberg ETF analyst Eric Balchunas didn’t mince words. On X, he called last week pure “ETHSANITY,” pointing out that Ether ETFs “woke up in July” and haven’t looked back since. With $17B in weekly trading volume, ETH products crushed every previous record.

Nate Geraci of NovaDius echoed the sentiment, noting that spot Ether ETFs “absolutely obliterated” historical benchmarks. He also threw shade at critics who had insisted there was “no demand” for Ethereum-based ETFs. Judging by the flood of orders, that narrative seems dead in the water.

Shorter Streaks, Different Market

While the numbers are huge, one interesting quirk is the length of the streaks. Ether’s latest inflow run lasted eight straight days, bringing in $3.7B since August 5. Bitcoin managed a seven-day streak, totaling about $1.3B.

Those are solid, but they’re shorter than earlier monster streaks: ETH saw a 20-day run in July, while BTC pulled off 15 days straight in June. Analysts suggest this reflects a more tactical market, where traders are quicker to lock in profits or reposition, rather than letting inflows run endlessly.

The data from SoSoValue, which tracks crypto investment flows daily, shows that while the streaks may be shorter, the scale of the money is bigger than ever. And that says a lot about where we are: a market that’s growing up, faster, sharper, and more reactive than before.