- Shiba Inu’s explosive 2021 rally was fueled by a huge token burn from Vitalik Buterin and intense retail hype.

- With 589 trillion SHIB tokens still in circulation, repeating that kind of supply-driven surge is nearly impossible.

- Shibarium’s adoption has been slow, and without the same hype, SHIB’s path to reclaiming its peak looks long and uncertain.

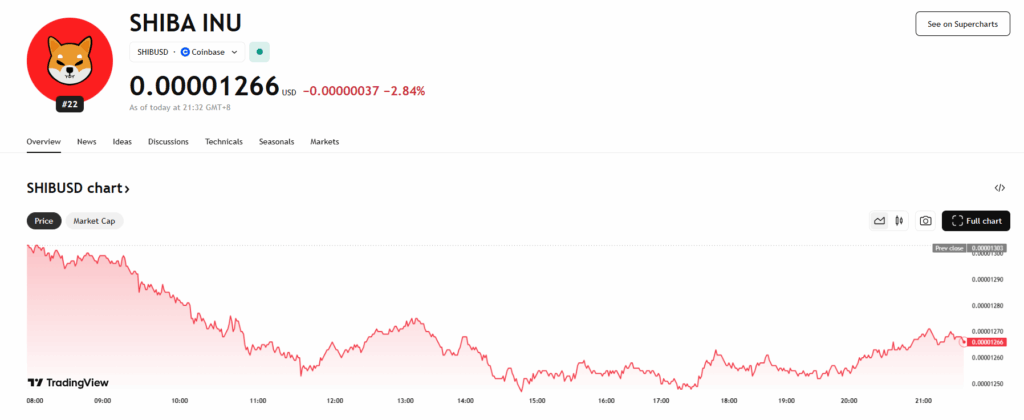

Shiba Inu (SHIB) became a household name in crypto after its mind-bending 2021 rally, where prices exploded millions of percent and turned tiny investments into fortunes. That parabolic run drew in waves of new investors hoping to cash in on the frenzy, though many who bought near the top are still waiting for relief. Today, SHIB supporters remain optimistic about another breakout, but reclaiming that level of momentum looks far harder than before.

Why Repeating the 2021 Rally Is Tough

One of the biggest sparks in 2021 came from Ethereum co-founder Vitalik Buterin, who famously burned 90% of the SHIB tokens he was gifted—slashing supply and sending the price soaring. With roughly 589 trillion tokens still circulating, a burn of that magnitude simply isn’t realistic again. Without a drastic cut in supply, hitting the same astronomical price levels becomes a steep uphill climb.

Another sticking point is adoption. Shibarium, SHIB’s Layer-2 network launched in 2023, was supposed to push the ecosystem forward. While it has attracted apps and smart contracts, activity hasn’t come close to rivaling the bigger networks. For now, Shibarium remains more of a side project than a true game-changer for SHIB’s price.

The Hype Factor Isn’t What It Used to Be

In 2021, SHIB’s rise wasn’t just about supply cuts and network launches—it was pure hype. Memecoins like Shiba Inu and Dogecoin thrive on excitement, social buzz, and retail speculation. But that kind of energy feels muted today. Without the viral, meme-fueled wave that carried SHIB before, sparking a repeat of that parabolic run seems unlikely in the near term.

That doesn’t mean SHIB has no future. It still commands a massive community, strong branding, and steady trading volumes. But the climb back to its all-time high could take far more than retail hype—it may need broader adoption, utility, and some serious long-term patience from holders.