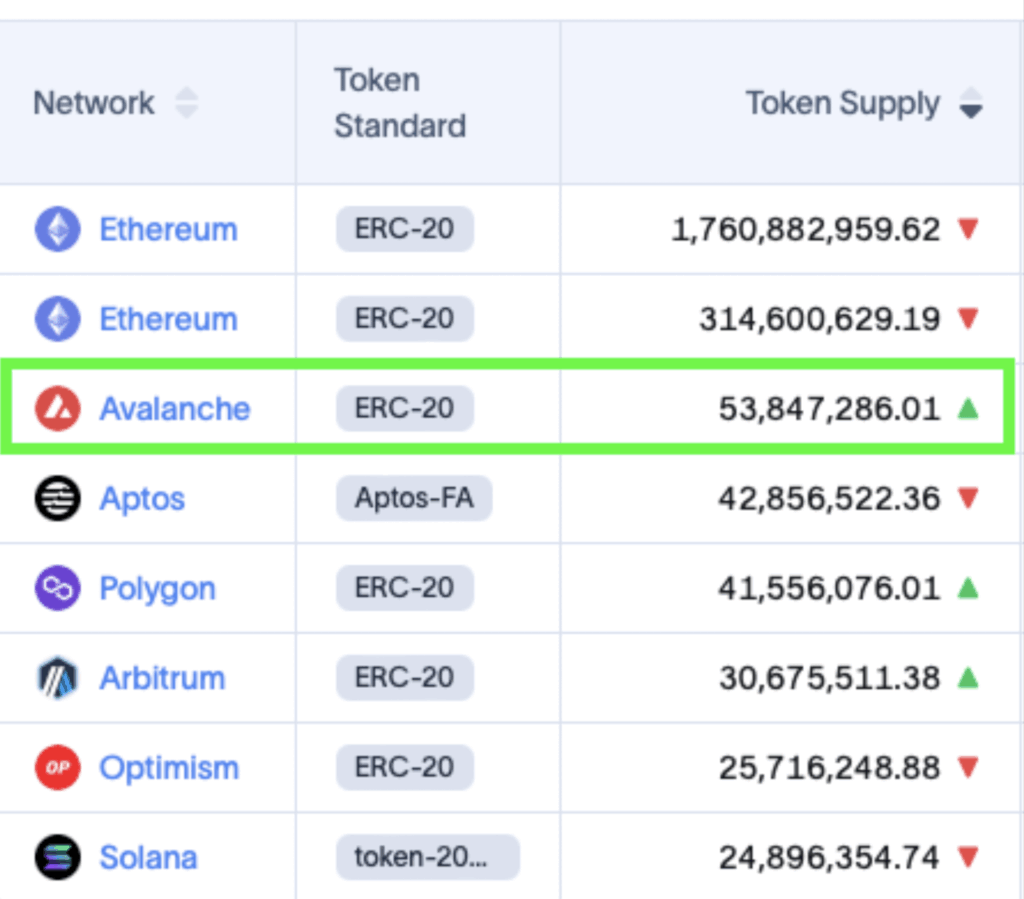

- Institutional spotlight: AVAX ranks second in BlackRock’s BUIDL Fund with $53.8M tokenized, trailing only Ethereum.

- Bullish fractal setup: Price consolidation mirrors past breakout cycles, with $27.40 as the key resistance before $50–$55 targets.

- On-chain boom: 7.3M monthly active addresses in July mark record growth, with sustained user engagement since May.

Avalanche is starting to look less like the “up-and-coming” chain and more like a serious player, as it continues to rack up both institutional attention and raw on-chain activity. With AVAX recently locking in second place on BlackRock’s BUIDL Fund rankings—right behind Ethereum—eyes are shifting to whether the token can finally break out above key resistance levels.

AVAX Catches BlackRock’s Spotlight

The biggest headline for Avalanche right now is its new standing with BlackRock. AVAX has climbed to the second-largest blockchain in the BUIDL Fund with over $53.8 million tokenized on-chain, trailing only Ethereum. For a network that’s been pushing the “real-world asset” narrative, this is a big validation. Analyst mdnhakann noted that institutions are picking Avalanche not just for hype, but for its proven scalability and track record with complex operations.

And here’s the kicker: BlackRock’s BUIDL Fund sits inside a $10 trillion ecosystem. That kind of visibility isn’t just bragging rights—it’s potentially a pipeline for serious institutional inflows.

Price Structure, Fractals, and Altseason Talk

Some traders think Avalanche could be gearing up to lead the next altcoin season rather than just tagging along. Analysts like JRNYcrypto are already leaning bullish, pointing out that AVAX is now firmly tied to real-world asset tokenization while still trading at historically low levels compared to BTC and ETH.

Against Bitcoin and Ethereum, AVAX looks bottomed-out. Bollinger Bands are tightening, price action is consolidating, and repeated support levels have held—classic conditions before a volatility breakout. Crypto analyst Xavier even called this one of the cleanest risk-reward setups in the market right now.

Adding fuel to the fire, AVAX’s chart structure is mirroring a past bullish cycle. Analyst Chris highlighted that consolidation zones are shaping up similarly to the last breakout phase. If the fractal plays out, clearing $27.40 could put $50–$55 firmly on the table.

Avalanche’s On-Chain Activity at Record Highs

It’s not just speculation either—on-chain data is booming. Avalanche recorded 7.3 million monthly active addresses in July, the highest ever. More importantly, activity has held above 6 million since May, showing that this isn’t just a random spike. That consistency hints at expanding adoption and deeper user engagement rather than temporary hype.

When you combine this steady network growth with BlackRock-level validation and bullish technical setups, it’s not hard to see why AVAX is being watched as a top contender for the next market rotation.

Final Take

Avalanche feels like it’s sitting at the intersection of two powerful forces: growing institutional recognition and organic network adoption. If price can finally clear the $27.40 resistance, the $50–$55 zone suddenly looks realistic. Whether altseason arrives this fall or not, Avalanche has lined up the kind of momentum that could make it a standout leader when the next crypto wave kicks off.