- XRP whales have sold 640 million tokens worth $1.91 billion since July 9, raising crash concerns.

- Bearish divergence and declining volume hint at a weakening rally, mirroring previous market tops.

- XRP must hold the $2.65 level or risk a 30% drop to the $2.06 support zone.

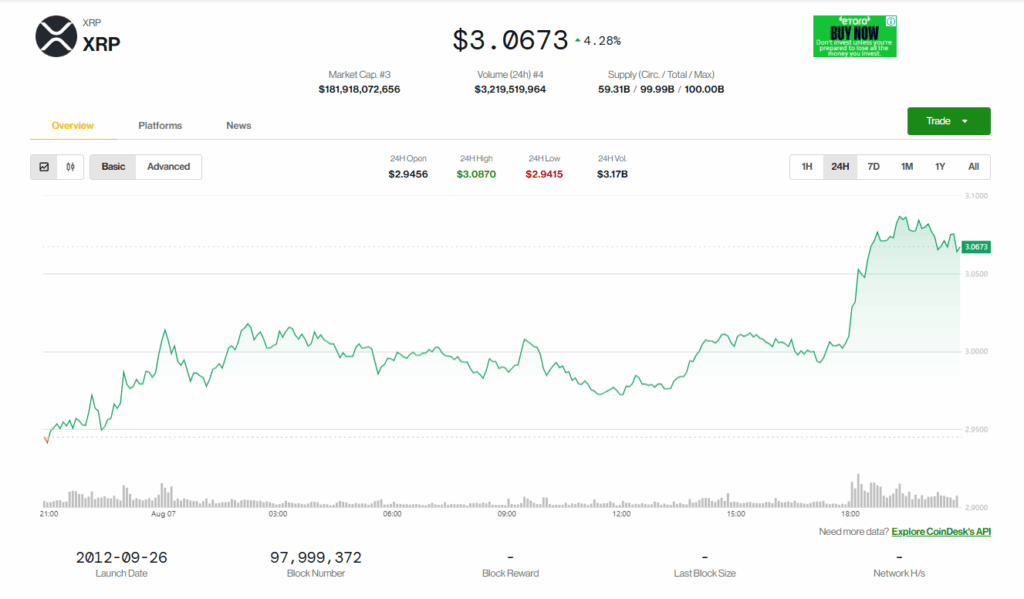

In a significant shift that could spell trouble for XRP’s short-term price outlook, whales have offloaded 640 million tokens in under a month. This $1.91 billion distribution has raised red flags for analysts, many of whom are now warning of a potential 30% drop if key support fails to hold.

Whale Outflows Signal Distribution During Rallies

On-chain data from CryptoQuant confirms that since July 9, XRP’s largest holders—wallets typically categorized as “whales”—have shed 640 million tokens, primarily during a trading range of $2.28 to $3.54. While some of this activity might be internal reshuffling, the pattern is eerily similar to earlier distribution phases, including the November–January rally, where whales sold heavily into rising prices. Historically, XRP tends to rally when whales accumulate—not when they exit.

Momentum Breakdown: Bearish Divergence and Fading Volume

Technicals aren’t offering much relief either. While XRP has made higher highs on the price chart, its Relative Strength Index (RSI) has posted lower highs since January. This bearish divergence typically signals weakening momentum, even during price increases, similar to the setup seen during the April 2021 market top. Compounding the issue is a drop in trading volume during recent price gains, reinforcing that the rally may be losing steam.

Key Levels to Watch: $2.65 and $2.06

The $2.65 support zone is now critical. A breakdown here could trigger a freefall toward the 20-week EMA near $2.55, and possibly even lower toward the 50-week EMA around $2.06. Both these levels serve as mean-reversion targets after the coin’s overheated moves. For XRP to regain bullish structure, analysts say the market needs to see consistent whale accumulation of 5 million tokens or more in the coming days.

Strategic Positioning Ahead

CryptoQuant’s Enigma Trader emphasized that the market is structurally weak right now, lacking large-holder conviction. Without a clear reversal in whale activity, XRP could be staring down a major correction. While the long-term trajectory for Ripple remains linked to regulatory clarity and institutional adoption, the short-term picture is fraught with downside risk unless accumulation resumes.